Share Price Calculation

The value of your TSP account is determined each business day based on the daily share price and the number of shares you hold in each fund.

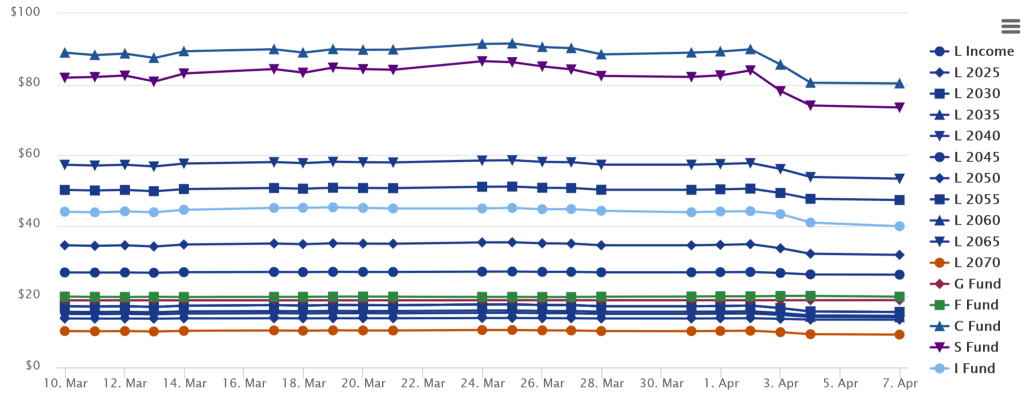

At the end of each business day, after the stock and bond markets have closed, the total value of the funds’ holdings (net of accrued administrative expenses) is divided by the total number of shares outstanding to determine the share price for that day.

SEE ALSO:

Source: Thrift Savings Plan website: https://www.tsp.gov/share-price-history/

Dividends & Capital Gains

Your earnings (that is, the increase or decrease in the value of a fund) in the TSP and other similar defined contributions plans (e.g., 401(k) plans) are not considered taxable income (but rather, tax deferred) under the Internal Revenue Code. Interest, dividends, capital gains, and/or tax deferred contributions are not taxed until you withdraw money from your plan. There is no need for you to report dividends and capital gains separately for your tax-deferred accounts.

BlackRock Institutional Trust Company, N.A., and State Street Global Advisors Trust Company manage the index funds in which the F, C, S, and I Funds are invested, and credits interest and dividend income each business day. This income is then reflected in your TSP’s share prices.

The daily change in your TSP’s share prices reflects all investment income (interest on short-term investments, dividends, capital gains or losses, and securities lending income) net of TSP administrative expenses.

Share Purchases

Your employee contributions, Agency/Service Automatic (1%) Contributions, and Agency/Service Matching Contributions, as well as loan payments and transfers from other eligible retirement plans, are all used to purchase shares in each TSP fund based on your contribution allocation.

For example, if your employee contribution each pay period is $100 and you have elected to invest in one TSP fund, $100 will be used to purchase shares in that fund. The calculation is done the same way if you’re eligible for Agency/Service Automatic (1%) Contributions and Agency/Service Matching Contributions.

The number of shares purchased by each contribution source is calculated by dividing the contribution ($100 in the above example) by the applicable share price. The number of shares purchased is then rounded to four decimal places.

Share Sales

When you borrow or withdraw from your TSP account, the shares are sold from your account at the applicable share price. The number of shares sold is calculated by dividing the amount required from each fund/source combination by the share price for that fund. The result is rounded to four decimal places.