- Key insight: A new survey of consumer credit companies revealed deteriorating business conditions in the third quarter, and signs of increasing stress among some consumer segments.

- What’s at stake: The results provide more evidence of a K-shaped economy, the chief economist at the American Financial Services Association, which conducted the survey, told American Banker.

- Forward look: While the six-month outlook was optimistic, consumers with lower credit scores may experience more difficulty accessing credit.

Business conditions for consumer credit firms deteriorated during the third quarter of this year, as borrowers wrestled with higher prices, a largely static labor market and general uncertainty about the direction of the U.S. economy, according to a recent survey of finance providers.

While the overall six-month outlook on

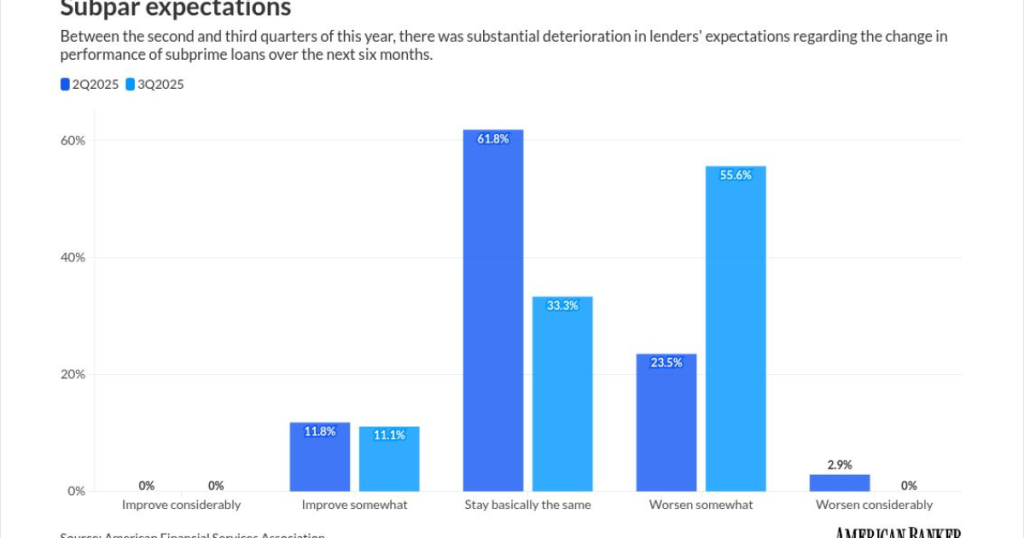

Lenders who participated in the survey reported worsening loan performance during the third quarter, especially among borrowers with lower credit scores. In fact, the outlook for loan performance among subprime consumers fell sharply from the second quarter.

The results provide more evidence of a

“There is a cohort that is absolutely struggling,” Gill told American Banker. “The subprime performance has certainly deteriorated … especially with respect to auto financing.”

AFSA, a trade group for consumer credit companies, has surveyed its members about credit conditions on a quarterly basis since early 2024. Its members include banks, mortgage providers, credit card companies, auto lenders, student loan financers and installment loan providers.

The survey questions are designed to capture lenders’ perspectives about how certain conditions have changed from the prior quarter, and how the situation may evolve in the coming months. They focus on loan demand, the cost of funds and the performance of outstanding loans.

Third-quarter results, which were collected from 34 respondents in October, revealed a “net improving index” that measured -5.9%. A negative result means there are more respondents who report worsened conditions than there are who report improvement.

The index stood at 12.8% during the second quarter and 15.6% during the first quarter. It peaked at 21.4% during the fourth quarter of 2024, following the presidential election.

“I think the complex economic situation has almost everything to do” with the dip into negative territory during the third quarter, Gill said. Demand for loans was down, and loan performance soured, according to the survey results. Meanwhile, respondents said that their cost of funds improved, likely a result of the Federal Reserve’s resumption of interest-rate reductions.

Overall loan performance results showed a quarter-over-quarter decline, with 29.4% of respondents saying that loan performance “worsened somewhat” during the third quarter. That compared with 15.4% of respondents who gave the same answer in the second quarter.

Regarding the loan performance of subprime borrowers, 32.1% of lenders reported worsened performance between July and September. During the second quarter, that figure was 17.6%.

The outlook for loan performance among borrowers with lower credit scores was particularly grim, with 55.6% of lenders saying they expected conditions to “worsen somewhat” in the coming months, compared with 23.5% of lenders who felt the same way in the second quarter.

Still, the overall six-month outlook was rosier, in part because of

Broadly speaking, “more people feel like it’s harder to get credit now versus a year ago, and they expect that in a year from now, it will be harder still,” said Stephen Kates, a financial analyst at Bankrate who focuses on financial planning and financial literacy.

He pointed to the

In November, 33.5% of respondents to the New York Fed’s survey thought it would be “somewhat harder” to obtain credit one year later. That was up from 24.1% from the same month last year.

Subprime borrowers are feeling the sharpest credit-access stings, Kates said.

“They’re seeing larger rejection rates for things like home refinancing and auto loans,” he said.

Still, the overall picture is brighter than it was a few years ago, when inflation was rampant, Kates said. “Expectations today in the last quarter or so are better than they were a few years ago … when we were seeing 6% or 7% or 8% inflation, where it was really going bananas.”