Enjoy complimentary access to top ideas and insights — selected by our editors.

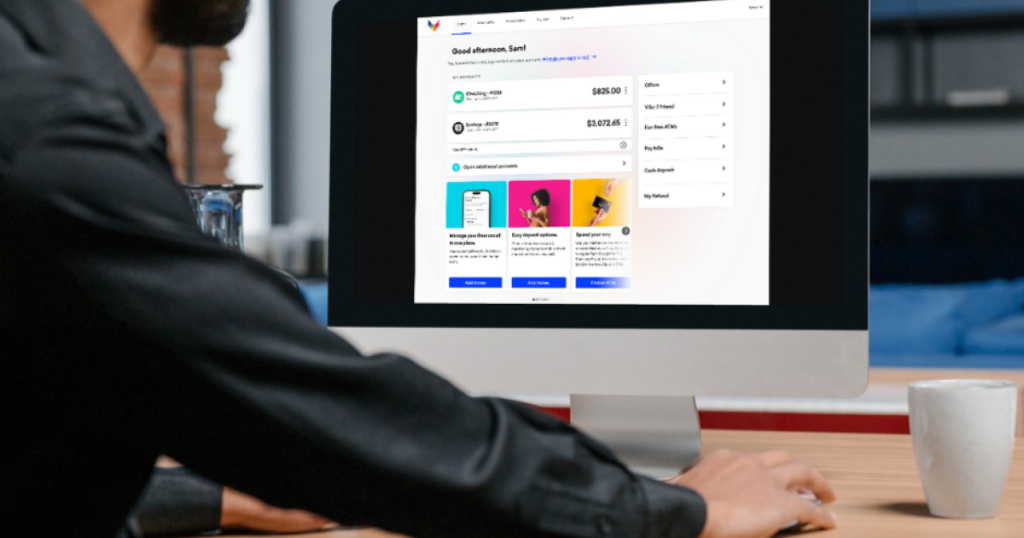

BM Technologies

First Carolina Bank has completed a

The two companies initially formed a

Sona Photography

“We’ve been partners for almost two years now,” BM Technologies’s outgoing CEO Luvleen Sidhu told American Banker. “We’ve always worked in a bank partnership model, and First Carolina Bank was a unique bank that came onto our radar when we were looking for a bank partnership.”

“By integrating BMTX’s digital banking platform with our robust regional banking infrastructure, we’re not just acquiring a company—we’re accelerating our digital banking growth strategy and establishing a differentiated market position in higher education financial services,” Ron Day, chief executive officer of First Carolina Bank, said in a statement.

Sidhu believes that the acquisition of BM Technologies will help First Carolina Bank differentiate itself.

“Community banks really struggle to differentiate themselves,” Sidhu said. “Quite frankly, I think a lot of them won’t survive unless they create a niche strategy for deposit acquisition at low cost. We’re really looking forward to First Carolina Bank being able to help our colleges and universities. We have about 700 campuses across the country that we do business with at BMTX. First Carolina Bank is well positioned to be able to serve their banking needs in a much more comprehensive way, something that we couldn’t do as a fintech, but they can do as a bank.”

Sidhu also noted that recent regulatory shifts, at least as of the end of last year, were a major factor in the decision to sell BM Technologies.

“There’s been a huge push now towards banks taking much more ownership in fintech-bank partnerships,” Sidhu said. “We were just going with the trend in the direction that the regulatory environment was shifting, because we wanted to make sure that we had the best outcome for our company.”

BM Technologies did attempt to acquire Seattle-based First Sound Bank in 2022, but the $23 million sale was

Speaking of the decision to sell BMTX, Sidhu acknowledges she might have “made a different decision” in the current macro environment.

“I think that this is an exciting time for innovation to continue to be able to flourish,” she said. “During our time, it really was a tough time for fintechs, and I think this [acquisition] was a great outcome for us. It created significant shareholder value and significant premium to market, so we thought it was a huge win.”

Under the terms of the agreement, BM Technologies stockholders will receive

Sidhu highlighted that though BM Technologies operated as an independent fintech company before the acquisition, it has a history of working within bank infrastructures.

“If you follow our history, we started out as a bank, and we then spun off from a bank, and now we have joined a bank again,” she said.

BM Technologies, formerly known as

BankMobile previously became part of a special-purpose acquisition company, or blank-check company, called Megalith Financial Acquisition Corp. BankMobile then

Now that the deal is closed, Sidhu is looking to pursue ventures separate from her family’s businesses.

“I would likely do something on my own,” Sidhu said. “I’ve been doing something on my own for years now, leading a publicly traded fintech company. It’s been a wonderful journey, sharing the beginning moments of BankMobile with my father, and I’m very proud of the book that we wrote and the vision that we held. But I think that there’s still demographics that I can relate to, whether that’s minorities or women, that continue to not have the same type of access to basic financial services. I would love to spearhead something in that realm and obviously utilize technologies that weren’t available to me back in 2015 that are now available today.”

Sidhu is now taking some time off and exploring other opportunities.

“I’m very open to what’s next, but I think in the meantime I’ll be focusing a little bit on my own family,” Sidhu said. “I’ll also be very open to helping advise any fintechs that have the same passion and mission that they’re combining to serve this industry.”