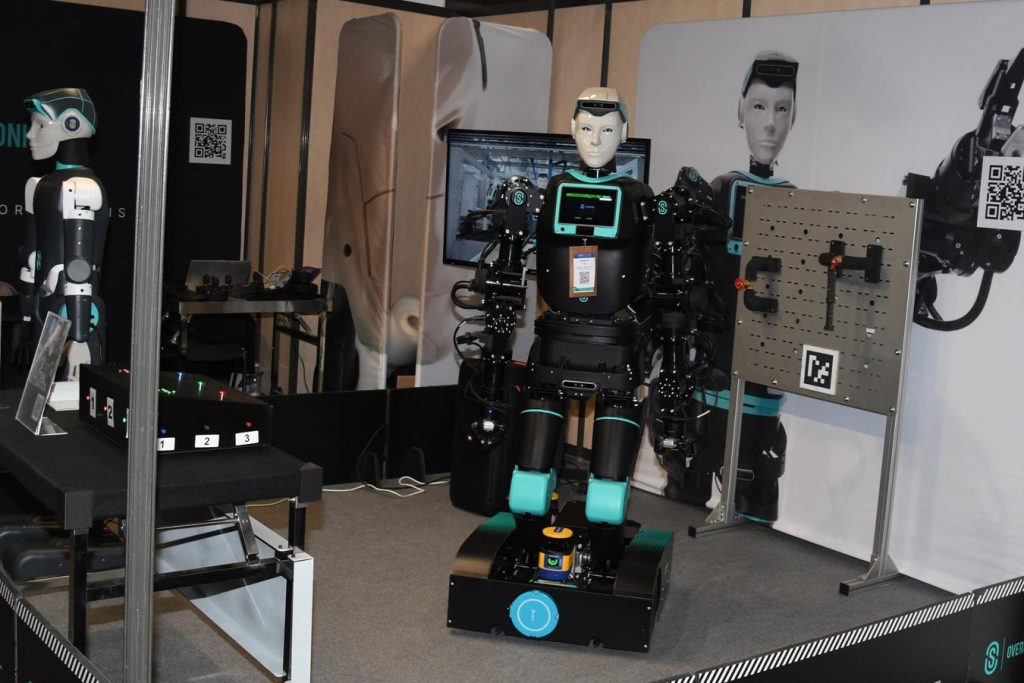

CANNES, FRANCE – 2025/02/13: The Human Side Of Industrial Automation robot seen displayed during the … [+]

Last November, I was a guest on Labor Relations Radio, speaking with Peter List about artificial intelligence and what it might mean for working people.

The discussion touched on many areas: automation of higher-paying, white-collar jobs; median household income growth badly trailing the cost of living; differences between individual and corporate income tax levels; how the number of new jobs won’t match the jobs lost to the latest technology; and so forth.

Something List mentioned how new forms of taxation, including the need to “tax the machines,” as he put it. Looking ahead, this may become a critical need given the impact that the latest versions of AI is already starting to have on the nature of work.

I’ve written before how AI companies are becoming monopsonies — that is the purchasing equivalent of a monopoly. Instead of being a near-sole source of a product or service that people might want, a monopsony is the near-sole purchaser of goods or services, including labor.

An example is when a major retailer moves into a suburban or rural area, pushes prices down, drives small competing sellers out of business, and then becomes the dominant employer. The retailer gains control over the local economy and pushes overall wages down.

In 2005, as an article from the end of 2024 in The Atlantic related, economist Jason Furman argued that Walmart might pay relatively low wages but the savings workers saw in buying groceries from the company more than made up the loss. However, new research in two studies suggests that cheaper food prices aren’t benefit enough to make up for the lower incomes.

One study from the I Z A Institute of Labor Economics found that “the opening of a Supercenter leads to a 2 percentage point (16%) increase in poverty” and also led to a $200, or 16%, increase in government assistance and a $920, or 5%, per household annual decrease in tax revenues.

The second paper, out of the University of Victoria Department of Economics, examined whether there was a bias from where Walmart located its Supercenters. Researcher Justin Wiltshire compared the locations with stores and those where locals successfully blocked the company from opening a new store. The results were that a new Supercenter resulted in declines in local employment and earnings.

The point isn’t that AI would be identical to Walmart, but that monopsony power is likely to have a similar effect. The more AI is used, the more jobs become unnecessary — because even if the systems only enable greater efficiency, that means companies need less help.

That creates a double squeeze on the federal government as the first paper indicates. Workers get poorer and need more financial help, and they have less money to be taxed.

Taxing the AI vendors, the users, or both would provide important benefits. First, by properly adjusting the degree of tax, one could balance the benefits the software provided to companies and the economic impact it had on individuals and society. Complete elimination of any benefit might be too much, but higher levels of taxation could reduce the complete social impact.

Second, it makes it economically more difficult for companies to casually replace workers with technology.