- Key insight: Mobile wallets are becoming more popular among consumers.

- What’s at stake: Banks generally undervalue the influence of social media and video streaming platforms, which are influential in consumers’ decisions, according to Lauren Taylor, global leader for BCG’s Center for Customer Insight.

- Forward look: Cryptocurrency is increasingly becoming a way for consumers to engage with mobile wallets.

Move over physical cards, mobile wallets continue to gain traction, upping the ante for banks to remain competitive.

“With volumes of non-cash transactions expected to rise from 1,685 billion in 2024 to 3,540 billion by 2029, digital wallets and Account-to-Account (A2A) transfers are steadily replacing traditional card payments,” according to Capgemini’s

Processing Content

Here’s what banks need to know about the changing landscape for mobile payments in 2026 and beyond.

Consumers are getting comfortable using mobile wallets

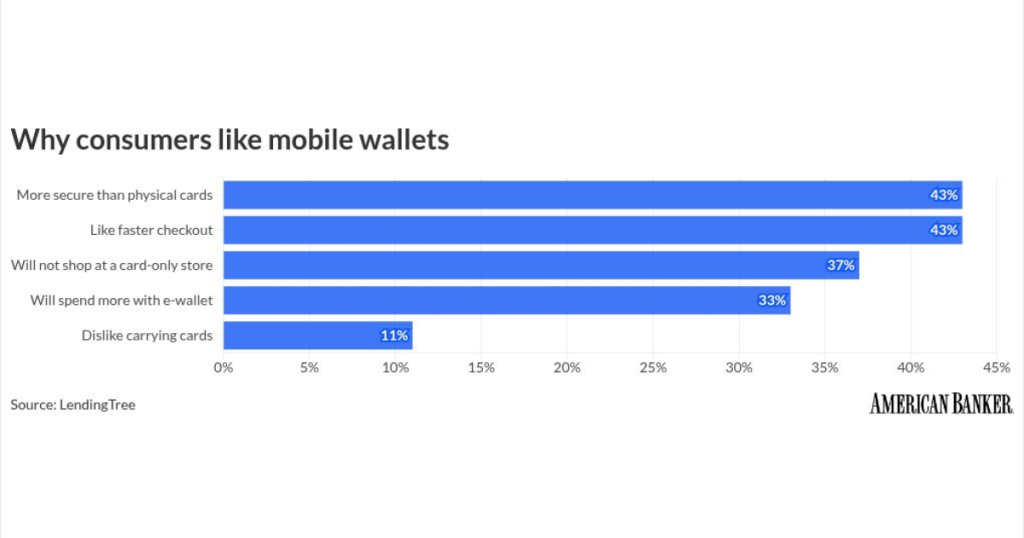

Nearly two-thirds of Americans have used a mobile wallet, with about a third, 33%, saying they spend more with it than with a physical card, according to a recent LendingTree

Of course, there’s still a generational divide when it comes to mobile wallet usage, but that’s poised to diminish over time. LendingTree found that 84% of Gen Zers ages 18 to 28 and 81% of millennials ages 29 to 44 have used mobile wallets. That compares with 60% of Gen Xers ages 45 to 60 and just 30% of baby boomers ages 61 to 79.

Digital wallets set to dominate global payments

November

“Changing user behavior, such as card usage, particularly when it is long-established, means providing incentives,” said Thomas Wilson, analyst at Juniper Research, in a press release. “As the digital wallets space becomes increasingly saturated, differentiation using rewards and other capabilities, such as gamification or superapp features, will be vital to success.”

How consumers choose credit cards is changing

Banks generally undervalue the influence of social media and video streaming platforms, which are influential in consumers’ decisions, Lauren Taylor, global leader for BCG’s Center for Customer Insight, told American Banker. That’s a big risk, she adds.

Banks should put more effort into understanding what influences consumers to determine where they should be focusing their advertising dollars. This means figuring out “the mismatches” and what is most influential to their clients and redirecting their efforts to those places, Taylor said. “It’s not a one-size-fits-all solution. There are different customer influence pathways.”

Seemingly similar customers “may have different needs and motivations in what they’re looking for and therefore different influence pathways,” Taylor told American Banker.

Will physical cards phase out?

Nearly 2 in 3 mobile wallet users (64%) say they expect to carry a physical wallet or card in five years, LendingTree data shows. That compares with 18% who said they don’t expect to carry a physical card and 18% who said they aren’t sure. Gen Z consumers are the least likely to use physical cards in the future, with 25% saying they don’t expect to carry them five years from now.

Credit cards aren’t the only option within digital wallets

Digital wallets accounted for 53% of e-commerce transaction value in 2024. That’s projected to reach 65% by 2030, according to Capgemini. Wallets now account for 32% of in-store transactions. That’s predicted to climb to 45% by 2030. However, banks need to be mindful that customers have multiple other ways to pay besides traditional cards. Other options, including buy now/pay later, are growing, with BCG research showing that 30% of U.S. consumers use some kind of BNPL solutions. Usage is even higher among younger consumers, with 55% of Gen Zers and 40% of millennials using BNPL, BCG’s research shows.

The ability to pay with cryptocurrency could also influence consumer behavior and shift usage away from cards within mobile wallets. World, the biometric ID verification project co-founded by OpenAI Chief Executive Sam Altman, recently announced an expanded digital payment system that allows app users to send and receive cryptocurrency, TechCrunch

Stripe, meanwhile, allows U.S. businesses to accept stablecoins from customers globally. Customers can pay with their preferred crypto wallet, token and payment network, while completed stablecoin payments settle in U.S. dollars, according to Stripe’s website.