It was yet another W for mortgage rates this morning after a cool CPI report was released by the Bureau of Labor Statistics.

Mortgage rates have rallied all week, despite a hotter-than-expected jobs report on Wednesday.

And after elevated jobless claims yesterday, they got another push in the right direction thanks to the latest inflation report.

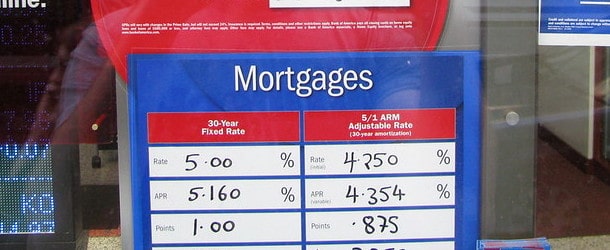

That has the 30-year fixed testing 2026 lows and inching ever closer to the big 5% threshold.

Keeping the rate momentum is crucial to the housing market, which got off to a sluggish start in January.

CPI Beat Pushes Mortgage Rates Closer to 5% Range

The elusive 5% mortgage rates everyone wants are becoming a little less elusive.

This week had the potential to make or break mortgage rates and fortunately for existing homeowners and prospective home buyers, it went well.

As noted, the delayed January jobs report was actually hotter than expected, but still couldn’t derail mortgage rates.

Then we got elevated jobless claims, which pushed 30-year fixed mortgage rates to around 6.10%.

And to cap off the week, we got a CPI report that came in better than expected, with consumer prices rising just 2.4% year-over-year versus the 2.5% forecast.

Prices also only increased 0.2% month-to-month versus the 0.3% forecast, while core CPI was in line with expectations both on a monthly and annual basis.

Long story short, it was generally a clean report and not another setback for mortgage rates.

For the past several years, mortgage rates have been falling, but experienced many ups and downs along the way.

There have been constant worries of inflation reigniting, but it seems like it’s finally on the right track, despite ongoing tariff threats.

Together with relatively stable labor, we’ve seen mortgage rates drop from 8% in late 2023 to nearly the 5s today.

But there’s the thought that sub-6% rates could boost home buyer sentiment and also get home sellers off the fence.

So it’s pretty critical that rates keep falling from here and stay low throughout spring if we’re to have a good buying and selling season in 2026.

Some have already written it off thanks to a weak existing home sales print for January released by NAR yesterday.

However, that was likely for contracts in November and December, before mortgage rates and sentiment improved.

The 30-year fixed was closer to 6.50% back then versus 6% today. We’ll see what kind of difference it makes soon.

Mortgage Rates Still Above 2026 Lows Despite Lowest Bond Yields of the Year

What’s interesting though is mortgage rates remain above their 2026 lows despite the lowest bond yields of the year.

In case you’re unaware, mortgage rates follow 10-year bond yields, so with those at their lows, you’d expect 30-year fixed mortgage rates to be at their best as well.

However, there’s the issue of mortgage spreads, which climbed in recent weeks after sinking to their best levels in years thanks to that MBS buying news.

They fell to around 180 basis points in early January before reversing course and climbing back to around 200 bps today.

Historically, the spread between the 10-year bond yield and 30-year fixed has been around 170 bps.

This means if the 10-year bond yield is 4.06%, which is it currently, a 30-year fixed would price around 5.75%.

Instead, the 30-year fixed is still slightly above 6%. If and when spreads AND bond yields can cooperate, we might see those elusive 5% mortgage rates!

We’re closer than we’ve been for a long, long time though. And you can almost sense it’s going to happen.

Mortgage Rates Need to Get to the 5s and Stay in the 5s

The key though will be getting to the 5s and staying in the 5s. That will give prospective home buyers confidence to move forward with a purchase.

It will also free up more available inventory as sellers feel more comfortable listing their homes and moving on, perhaps to purchase a replacement property.

So a lot is at stake for mortgage rates and this week may prove pivotal for the 2026 housing market.

Rates certainly navigated it well and hopefully it’s a sign of more good things to come. Ultimately, housing affordability remains poor and the quickest lever to fix that is mortgage rates.

I do get the sense that mortgage lenders and MBS investors have grown more comfortable with rates at these new lower levels.

That may allow us to test even better as the data continues to support a lower interest rate environment.