A consortium of mortgage and banking trade groups is voicing support for changes to a capital risk framework governing depository institutions, which if enacted could expand their participation in home lending.

Processing Content

In a letter addressed to federal officials, the groups called for further reexamination and a reproposal of the Basel III rule that sets appropriate capital-risk levels for banking activities. The letter comes days after remarks made by Federal Reserve Gov. Michelle Bowman this week which pushed for

Listed among the addressees was Bowman, alongside the leaders of banking regulators Office of the Comptroller of the Currency and Federal Deposit Insurance Corp.

“Adequate capital reduces the likelihood of bank failures that threaten broader financial stability, which can prove costly for households, financial institutions and taxpayers. However, excessive capital requirements that are misaligned with empirically derived risk assessments can negatively affect the cost of and access to credit,” the letter said.

It was signed by eight trade groups, including the Mortgage Bankers Association and Housing Policy Council. Also included among the signatories were U.S. Mortgage Insurers and groups representing the banking industry.

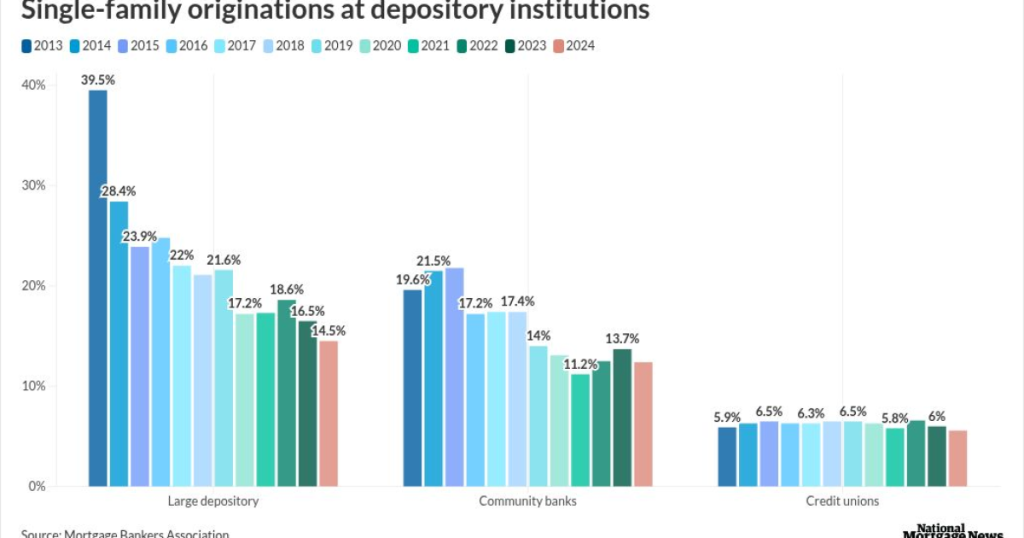

According to MBA data, the share of mortgages originated by depository institutions shrank from 65% in 2013 immediately following the Great Recession to 32.5% in 2024, with many citing regulatory overreach as a driver of bank exits in recent years. At the same time, the nonbank lender share has expanded from 35% to 67.5% over the same time period.

Throughout the letter, the groups asked for more granular consideration of various criteria that would encourage banking activity ultimately benefiting all types of lenders at minimal risk, they claimed. Their suggestions covered policy topics ranging from risk weighting of

- Risk weights need to “accurately reflect real-world credit performance.” The letter asked for adoption of granular risk levels by loan-to-value ratio that takes into account private mortgage insurance commensurate with its protection of the loan. “All banking organizations should be able to elect the more granular credit risk framework,” it said.

- Capital risk weight assigned to mortgage servicing rights should be slashed from a “punitive” 250% to 100% for all banks. The groups also recommended recalibration of limits or deductions tied to MSR-related assets when considering what counts as core capital in determining risk levels. Alternatively, the current common equity tier cap could be significantly raised, they proposed.

- The group recommended reducing depository warehouse lending risk weights from its current levels of 100% to 50%, freeing up liquidity available to independent mortgage bankers. It said warehouse lending business lines brought “extremely low-risk credit exposure” for banks.

The letter also called for more granular treatment of mortgage credit risk exposure, recognizing the value of private mortgage insurance, and coordination across federal banking regulators.