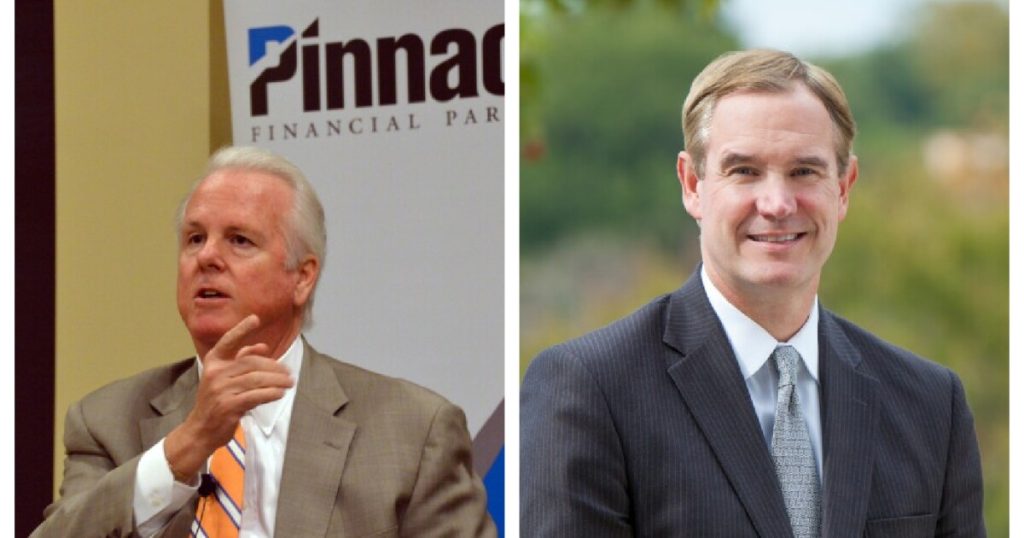

- Key Insight: Investors have balked at the merger of Pinnacle Financial Partners with Synovus Financial, but incoming CEO Kevin Blair is confident it will prove more successful than other mergers of equals.

- Supporting Data: Post-merger, Pinnacle now has $117.2 billion of assets and more than 400 branches across nine states.

- Expert Quote: “Empty rhetoric will not change people’s opinion,” Blair said. “I think people are starting to believe the story, but believability comes with consistency in execution.”

Processing Content

In the banking world, mergers of equals have a reputation for underperforming. But as Pinnacle Financial Partners unites with

Kevin Blair, formerly CEO of the Georgia-based

Blair says the two men have become “students of other MOEs,” determined to learn from others’ mistakes.

“Every decision Terry and I made was not about who got what. It was about what is best for the shareholder,” Blair told American Banker in an exclusive interview. “I think we’ve done this as well as anyone, and now it all comes down to execution.”

The merger of Pinnacle and

And yet many investors, at least so far, remain unconvinced that the merger is a good idea. After news of the deal first leaked, both companies saw their

“The initial reaction, both prior to the deal officially being announced, and then subsequent to, was pretty negative,” said Timur Braziler, an analyst at Wells Fargo. “I don’t think that necessarily means this was a terrible idea. I think it just means that that’s pricing in a level of surprise that both of these companies would get involved in this transaction.”

The concerns span multiple fronts. First and foremost, mergers of equals — as opposed to deals in which a larger bank acquires a smaller one — have a checkered history. The largest example, the 2019 deal that created Truist, resulted in years of

In addition, the merger with

Blair knows these concerns well, and he’s done his best to explain how Pinnacle will overcome them. But at the end of the day, he knows actions will speak louder than words.

“Empty rhetoric will not change people’s opinion,” Blair said. “I think people are starting to believe the story, but believability comes with consistency in execution.”

As 2026 begins, Blair and the new Pinnacle will have their chance to turn more investors into believers.

“The initial phase of talking is now over,” Braziler said. “Now comes the phase of doing.”

Pinnacle Financial Partners

MOE problems

For Pinnacle, the merger-of-equals stigma has been hard to shake. But Blair has analyzed the reasons other MOEs disappointed investors, and he believes his bank has avoided those pitfalls.

The first reason has to do with leadership. In other MOEs, the newly combined banks have appointed or kept the top executive only for a transitional period, with the stated intention of passing the baton within a few years. Truist’s first CEO, for example, was only in charge for about two years.

“You know what happens when that occurs? The leaders below them change,” Blair said. “And when you’re having constant change in leadership, it’s hard to know what your culture is, or what your go-to-market strategy is.”

In Pinnacle’s case, Blair has made it clear he’s in it for the long haul. And he’s been upfront about why he, not Pinnacle’s founding CEO, will be leading the bank: At 54 years old, he’s about a decade and a half younger than Turner, who is 70.

“Terry … recognized that for us to be successful, we had to have a new CEO on day one that was entrenched and was going to be the future leader,” Blair said. “There wasn’t a big debate there in terms of longevity. And so he said, ‘You’ve got to run it.'”

Another factor is geography. In other MOEs, the two banks involved had significantly overlapping markets, forcing leaders to decide which branches would stay and which ones would go. In Blair’s view, that dynamic creates a natural “animosity” between employees.

But for Pinnacle and

“We really felt like we fit together like two puzzle pieces, given the fact that our markets generally are contiguous,” Blair said. “Having less overlapping markets — significantly less — I think bodes well for success in this merger.”

Pinnacle Financial Partners

A less tangible but no less important factor is culture: Are the two lenders’ business practices compatible, or will they clash?

Both

“If you look at the

The $100 billion question

As Pinnacle grows beyond $100 billion of assets, some investors are concerned — and not just about the resulting regulatory burdens. There’s also the question of whether Pinnacle, which before the merger had about $56 billion of assets, will be able to maintain its identity after it’s doubled in size.

“This is hard to put your finger on, but Pinnacle, historically, has just made it feel like it’s not a bank,” said John McDonald, an analyst at Truist Securities. “That’s going to be harder when they’re bigger.”

That unique corporate culture, McDonald said, includes Pinnacle’s aggressive growth mindset, its streamlined loan approval process and its chummy office traditions, like maintaining a book-of-the-week club.

And it’s not just Pinnacle’s new size that threatens that atmosphere, McDonald said. It’s also the change in leadership — from the co-founder of Pinnacle in 2000 to the executive who spent nearly a decade as chief financial officer, chief operating officer and finally president and CEO of

“As you get bigger, and you merge with a company that has been more of a traditional bank, there’s a risk of deserting that culture,” McDonald said.

For his part, Blair says he’s fully committed to Pinnacle’s red tape-slashing style. In a survey of leaders at both

“No two banks are identical,” Blair said. “So anybody that says we have the same culture, the same models — that’s a farce. What I would suggest to you is that our companies are built on the same foundational elements.”

In McDonald’s eyes, Turner chose Blair as his successor for more reasons than just his age.

“He didn’t just look for any 54-year-old,” McDonald said. “He looked for one that would identify with and commit to preserving this culture.”

Pinnacle Financial Partners

For Pinnacle, 2026 is the last full year when some of its branches will still bear the name “

On this point, he and Blair agree: 2026 will be a crucial period.

“I think ’26 will be a pivotal year for us,” Blair said. “It’s going to put the final icing on the cake, to show that this thing can come together and create a really powerful franchise that will be very difficult to compete with.”