The standard deduction is a fixed dollar amount that individuals can subtract from their adjusted gross income (AGI) in order to reduce taxable income. The standard deduction was created in 1944 and simplified the tax filing process for many individuals by offering an alternative to tracking and documenting any expenses that could be included as part of itemized deductions. From 1944 until 1963, individuals could take a standard deduction of 10 percent of AGI, limited to $1,000. The standard deduction changed to a flat $1,000 dollar amount in 1964 and was adjusted periodically by Congress until the Tax Reform Act of 1986 when Congress passed into law annual inflation adjustments based on filing status, beginning in 1988.

The Tax Cuts and Jobs Act (TCJA) of 2017 doubled the existing standard deduction amounts for the various filing statuses (single, head of household, married filing jointly, married filing separately). The TCJA was scheduled to sunset at the end of 2025, at which time the standard deduction amounts would revert back to 50 percent of the 2025 amount effective January 1, 2026. However, the passage of the One Big Beautiful Act (OBBBA) in 2025 instituted several changes to the standard deduction, starting with making the doubling of the standard deduction amount permanent.

This column presents the changes to the standard deductions resulting from the OBBBA passage and planning opportunities for individuals and in particular senior citizens.

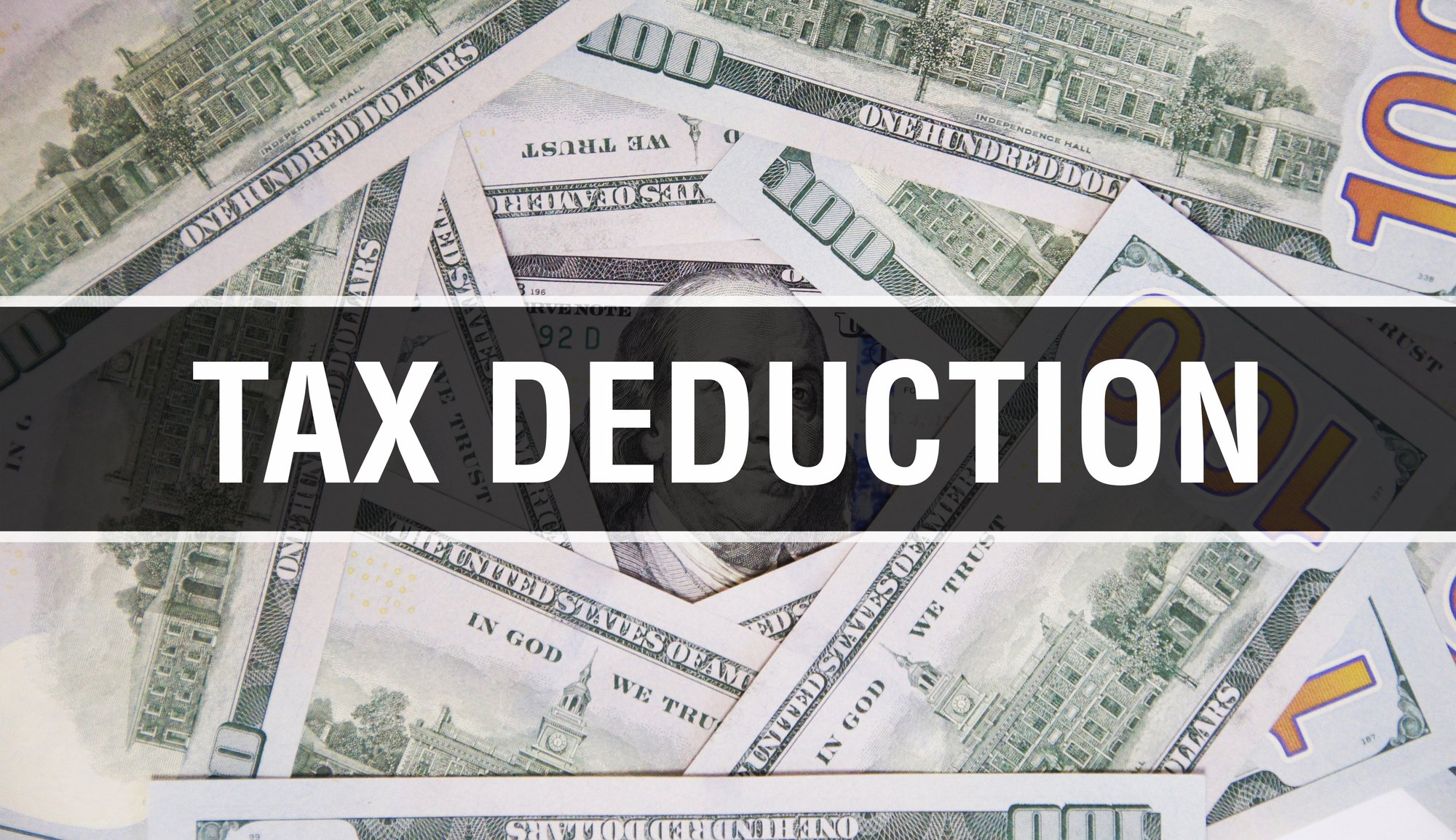

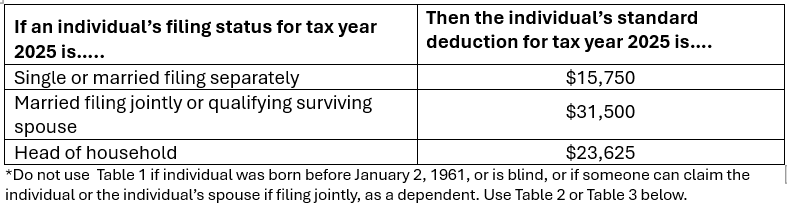

The following tables summarize the standard deduction amounts by tax filing status for 2025:

Table 1. Standard Deduction Chart for Most Individuals*

Table 2. Standard Deduction Chart for Individuals Born Before January 2,1961 or Who Are Blind1

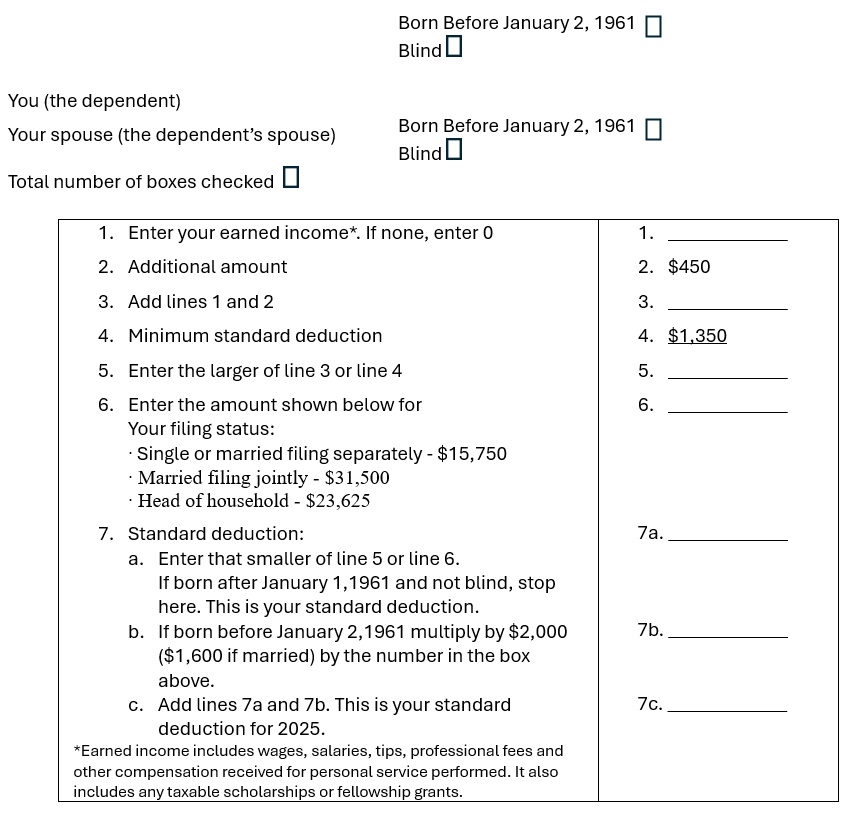

Table 3. Standard deduction worksheet for dependents. This worksheet is used for an individual who can be claimed as a dependent by another individual.

The following examples illustrate the amount of the standard deduction.

Example 1. Jim and Laura are a married couple. Both Jim and Laura were under age 65 during 2025 and neither can be claimed as a dependent by another individual. They decide not to itemize their deductions. They go to Table 1 to determine the amount of their 2025 standard deduction: $31,500.

Example 2. Ted and Heather are a married couple. Ted is age 66 and Heather is age 62 during 2025. Neither Ted nor Heather are blind. They decide not to itemize their deductions on their 2025 federal income tax returns. They go to Table 2 and determine the amount of their 2025 standard deduction – $33,100.

Example 3. Frank and Margaret are filing a joint tax return for 2025. Both are over age 65. They decide to use the standard deduction on their 2025 federal income tax return. They use Table 2 and determine that the amount of their 2025 standard deduction is $34,700.

Example 4. Lucy is 16 years old and single. Lucy’s parents can claim her as a dependent on their 2025 federal income tax return. During 2025, Lucy had interest income of $780 and wages of $150. She has no itemized deductions and uses Table 3 to find her 2025 standard deduction. Lucy enters $150 (earned income) on line 1, $600 ($150 plus $450) on line 3, $1,350 (the larger of $600 and $1,350) on line 5, and $15,750 on line 6. Lucy’s 2025 standard deduction, on line 7a is $1,350 (the smaller of $1,350 and $15,750).

Discussion and Tax-Planning Opportunities

With the enhanced standard deduction coming out of OBBBA, it will become more difficult for individuals to accumulate a sufficient number of itemized deductions in order to make itemizing more financially beneficial than taking the standard deduction. Itemized deductions include medical deductions, state and local taxes, mortgage interest and charitable contributions. Both the medical deduction and the charitable deduction are limited to percentages above AGI thresholds. .

The medical deduction is limited to the amount that exceeds 7.5 percent of an individual’s AGI. If an individual had a lower AGI in 2025 compared to prior years and the individual’s family has much in out-of-pocket medical and dental expenses, then itemizing rather than taking the standard deduction may be more beneficial. Similarly, additional charitable deductions make itemizing more attractive and beneficial. Together with the mortgage interest deduction and a higher ceiling in state and local income taxes, property taxes and personal property taxes (up to $40,000 during 2025-2028, increased from a ceiling of $10,000 during the years 2018-2024 ), can result in additional tax savings.

Additional Senior Tax Deduction

OBBBA also added a new temporary senior tax deduction for the years 2025 through 2028. The new deduction is up to $6,000 for an individual age 65 and older by the end of the tax year. This is $12,000 on a joint return in which both spouses are aged 65 and older. The $6,000/$12,000 deduction is in addition to the existing standard deduction for individuals age 65 and over. No change was made to the normal age 65 and over standard deductions or the additional deduction if blind. An individual or married couple can claim the new deduction regardless of whether they itemize or claim the standard deduction.

The $6,000 amount is reduced (but not below $0) by 6 percent of an individual’s modified adjusted gross income (MAGI) to the extent MAGI exceeds $75,000, or $150,000 on a married filing joint return. On a married filing joint return with both spouses over age 65, each $6,000 amount is phased out separately.

The phase-out of the senior deduction is phased out when a single filer reaches $150,000 of MAGI and $250,000 MAGI when both married filers reach $250,000 of AGI. MAGI is an individual’s AGI plus amounts excluded under Internal Revenue Code Sections 911,931, or 933.

An individual must file a married filing joint return in order to claim the $6,000/$12,000 deduction if the individual is married. The exception is when the individual is considered unmarried under the same rules applicable to head of household filing status.

The following example illustrates:

Example 5. At the end of 2025, Kevin age 68 and Margaret age 64 will file their 2025 federal income tax return as married filing jointly. Only Kevin, who is age 68 is entitled to the senior deduction of $6,000 for 2025. Their 2025 MAGI is $175,000. Kevin’s senior deduction is therefore reduced to $4,500. This is because 6 percent of $25,000 (the amount of MAGI which exceeds $150,000) is equal to $1,500,. $6,000 less $1,500 equals $4,500.

The new senior tax deduction is temporary for the years 2025 through 2028 and does not make Social Security benefits non-taxable. The senior deduction is also not tied to the receipt of Social Security benefits.

Individuals older than age 65 should also note that the additional senior tax deduction is available to all individuals 65 and older whether they itemize (file Schedule A on their federal income tax return) or whether they take the standard deduction. However, the additional senior tax deduction is subtracted from taxable income (and not from an individual’s AGI) in determining an individual’s federal income tax liability.

There are several “stealth taxes;” for example, the net investment income tax and Medicare Part B and Medicare Part D premium IRMAA surcharges , which kick in if an individual’s AGI exceeds certain AGI limits. Individuals who are age 65 and older and who may be affected by any of these “stealth taxes” are advised to consult with a tax professional in order to find out what they can do to lower their AGI for the purpose of minimizing exposure to any of these “stealth taxes.”