Natalia Bratslavsky – stock.adob

Princeton Bancorp in New Jersey will likely swing to a second-quarter loss after disclosing a $6 million after-tax impairment charge connected to a pair of office loans.

The $2.3 billion-asset bank had previously reported first-quarter net income totaling $5.4 million, or $0.77 per diluted share. As a result of the impairment charge, the company will post a second-quarter loss of $0.06 per share, predicted Hovde analyst Feddie Strickland.

Strickland wrote in a research note that he expects the bank “to remain at a discount to peers while this relationship is unresolved.”

Princeton Bancorp, the corporate parent of the 18-year-old Bank of Princeton, first reported the problem credits — which involve participation loans totaling $25.4 million — as part of its fourth-quarter earnings report in January. At that time, the company stated it was evaluating options with the bank that led the loan participation, including selling both of the loans.

In a disclosure late Wednesday to the Securities and Exchange Commission, Princeton stated that it concluded an impairment charge would be necessary after reviewing bids for the loans. The total pre-tax charge would amount to $9.9 million, according to the bank, which added that it has already reserved $2.4 million.

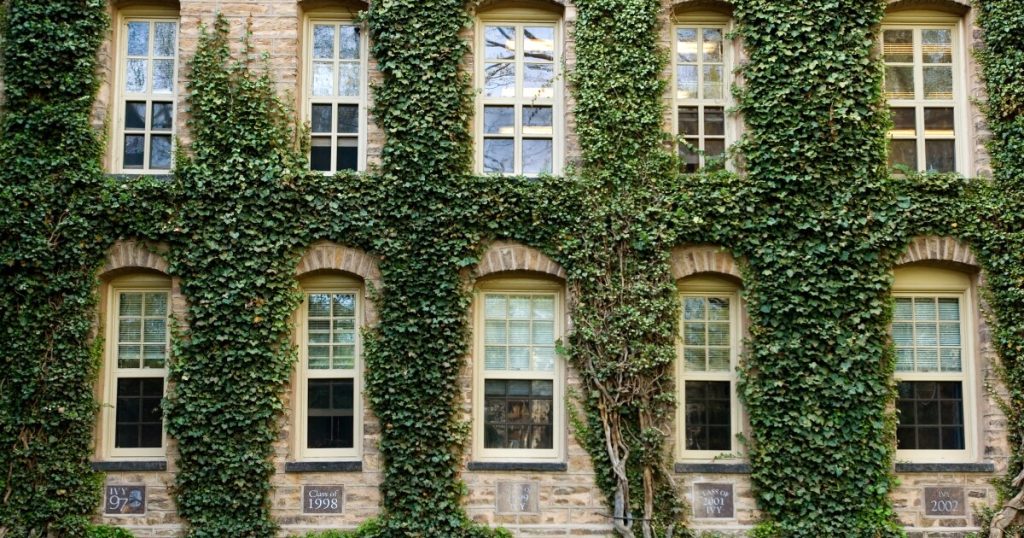

In an email Thursday to American Banker, Princeton Chief Financial Officer George Rapp said the nonperforming loans are secured by office buildings. That asset class has come under

Loan participations totaled $125 million, or about 7%, of Princeton’s $1.9 billion loan portfolio on March 31, according to Strickland. The Princeton, New Jersey-based bank’s management has reported no new loan participations in recent years, Rapp stated in the email.

Princeton sought to sell itself nearly a decade ago, but it has since been a buyer.

After the bank’s May 2016 agreement to merge with Investors Bancorp was terminated in March 2017, Princeton

Investors, which was based in Short Hills, New Jersey, so

While banks have always bought and sold loan participations, they’re a small part of the balance sheet at most institutions. According to the 2024 Conference of State Bank Supervisors Annual Survey of Community Banks, 70% of responding institutions reported that participations amounted to no more than 5% of their total loans.

Credit-quality issues resulting from participation loans have also been regular, if not frequent occurrences. In 2023, the $60 billion-asset Synovus Financial

Beyond the problem participation loans, Princeton’s asset quality appears pristine, even within its approximately $1.4 billion commercial real estate portfolio. Indeed, Princeton’s nonperforming loans totaled $26.5 million at the end of the first quarter, an amount that included the nonperforming participation loans.

“There are relatively few issues outside of the participations,” Strickland wrote.