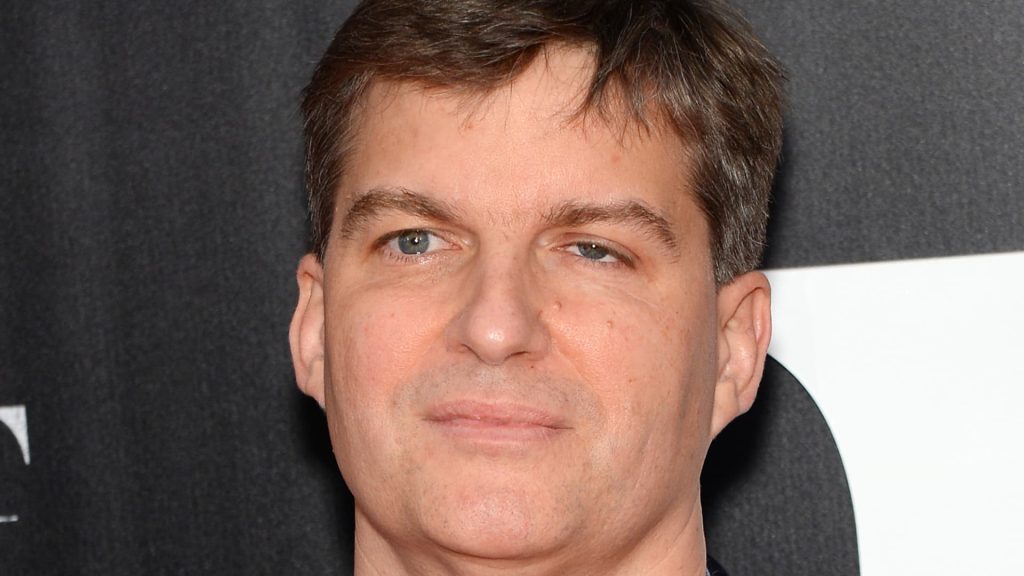

The fight between Nvidia and one of its loudest naysayers, investor Michael Burry, is escalating.

Following the “Big Short” investor’s series of social media posts arguing that the artificial intelligence investment boom is replaying the dotcom bubble from the 1990s, with Nvidia at the center of it, the chipmaker quietly circulated a private memo to analysts that explicitly name-checked Burry to push back on many of his claims.

The Nvidia seven-page response to “questions and claims we’ve received,” began by citing “Michael Burry on Twitter / X” as its first collection of source documents the company sought to refute.

For his part, Burry answered in a post on Substack that, “Nvidia emailed a memo to Wall Street sell side analysts to push back on my arguments on [stock-based compensation] and Depreciation … I stand by my analysis. I am not claiming Nvidia is Enron. It is clearly Cisco.”

Burry has repeatedly warned that today’s AI infrastructure frenzy mirrors the late-1990s telecom buildout far more than the dot-com wipeouts investors remember. He pointed to massive capex plans, extended depreciation schedules and soaring valuations as evidence that markets are again mistaking a supply boom for durable demand.

The Nvidia memo, first reported by Barron’s, responded to Burry’s criticism of Nvidia’s stock-based compensation dilution and stock buybacks.

“NVIDIA repurchased $91B shares since 2018, not $112.5B; Mr. Burry appears to have incorrectly included RSU taxes,” the memo said, referring to Restricted Stock Units. “Employee equity grants should not be conflated with the performance of the repurchase program. NVIDIA’s employee compensation is consistent with that of peers. Employees benefitting from a rising share price does not indicate the original equity grants were excessive at the time of issuance.”

The memo also disputed Burry’s claims around depreciation life. To Burry’s charge that customers are overstating the useful lives of Nvidia’s graphics processing units in order to justify runaway capital expenditures, Nvidia counters that its customers depreciate GPUs over four to six years based on real-world longevity and utilization patterns.

Nvidia added that older GPUs such as A100s, released in 2020, continue to run at high utilization rates and retain meaningful economic value well beyond the two to three years claimed by critics.

The memo also rejects Burry’s suggestion of “circular financing,” saying Nvidia’s strategic investments represent a small fraction of revenue and that AI startups raise capital predominantly from outside investors.

Today’s Cisco

Burry said he believes Nvidia now occupies the same position that Cisco — the key hardware supplier that powered a massive capital investment cycle — held in 1999-2000.

Just as telecommunication companies spent tens of billions of dollars laying fiber optic cable and buying Cisco gear based on forecasts that “internet traffic doubles every 100 days,” today’s hyperscalers are promising nearly $3 trillion in AI infrastructure spending over the next three years, Burry said in a Substack newsletter.

The heart of his Cisco analogy is overbuilt supply meeting far less demand than expected. In the early 2000s, less than 5% of U.S. fiber capacity was operational, Burry said. Today, he believes the industry’s belief in boundless AI demand rests on similarly optimistic assumptions about data center power and GPU longevity, he said.

“And once again there is a Cisco at the center of it all, with the picks and shovels for all and the expansive vision to go with it. Its name is Nvidia,” Burry wrote.

— CNBC’s Michael Bloom contributed reporting.