By Paula Sambo

(Bloomberg) — Vancity, one of Canada’s largest credit unions, and an Indigenous-owned private credit firm launched a $100 million partnership to finance housing projects.

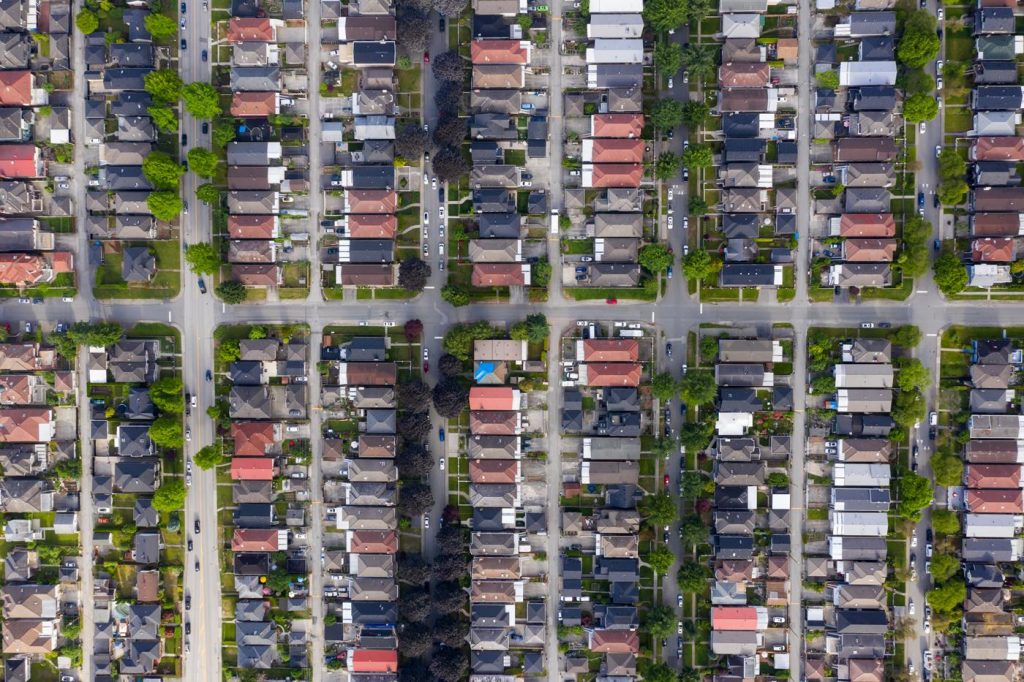

Indigenous communities face some of Canada’s most severe housing shortages and more limited access to conventional mortgage financing, according to federal housing and census data.

The partnership between Vancity and Keewaywin Capital is designed to address a long-standing gap in construction financing on Indigenous lands, where major banks have largely avoided lending, according to Tracee Smith, Keewaywin’s chief executive officer and founder.

“This is a company I didn’t really want to have to start,” said Smith, a member of Missanabie Cree First Nation in northern Ontario who spent more than a decade working in banking.

“First Nations get government transfers just like any municipality in the country,” she said. “So if anything, they should be considered strong credit, but that’s not how it works.” For example, federal law prevents Indigenous land from being used as collateral, pushing communities toward government programs or alternative lenders.

In 2011, Vancity began recognizing First Nations as governments for lending purposes, the first financial institution in Canada to do so, according to a statement. It has since worked with several First Nations to co-develop banking solutions.

Under the Keewaywin arrangement, Vancity’s investment bank subsidiary will provide as much as $100 million in credit facilities, covering up to 90% of individual project costs. Keewaywin will provide short-term construction financing, typically for 18 to 24 months, before Vancity steps in with long-term mortgage financing once projects are completed.

The model allows Keewaywin to focus on the riskiest phase of housing development, while recycling capital into new projects once permanent financing is in place.

Keewaywin is targeting returns of about 7%, Smith said, while charging borrowers roughly 9% interest during construction. Vancity’s long-term loans are expected to price at about 6% to 6.5% over 20 years, lowering the blended cost of capital once projects are completed.

Smith said the fund aims to finance between 300 and 500 housing units over five years. Keewaywin’s investors include the federal government’s Canada Mortgage & Housing Corp., Vancity, Addenda Capital and several family offices, Smith said.

Her longer-term goal is to prove the model’s viability and attract larger pools of institutional capital, including from pension funds, and ultimately force major banks to rethink their approach, Smith said.

“We’re going to show you how to do it,” she said. “More money should flow into this, and everyone can make money too. No one’s asking for free money here.”

©2026 Bloomberg L.P.

Visited 170 times, 15 visit(s) today

bloomberg credit unions Editor’s pick First Nations Keewaywin Capital Tracee Smith Vancity

Last modified: January 21, 2026