In the midst of becoming a meme stock, iBuying company Opendoor has launched a new feature.

It seems to be curious timing given the stock’s meteoric rise of nearly 300% over the past month.

But we’ll just assume it’s all one big coincidence, and that the stars just seemed to align.

So what is the new feature? It’s called Cash Plus, and as the name implies, home sellers can sell for cash plus potentially earn more if their fixed-up property eventually sells at a premium.

Whether it’s enough to save Opendoor and/or prove that the iBuying model is viable is another question.

How iBuyer Opendoor Became the Next Meme Stock

Prior to the past month’s historic stock rally, Opendoor (NASDAQ: OPEN) was struggling mightily and most importantly, had slipped below $1 per share.

It did so for 30 consecutive days, which meant it no longer met the minimum bid price required for continued listing on the Nasdaq Global Select Market Composite.

That led to the company exploring a possible reverse stock split to increase their stock price back above that minimum $1 requirement.

But then something miraculous happened. A hedge fund manager got behind the company, and then the Reddit crowd joined in.

Before long, the stock was back above $1 per share and even north of $3 per share for a brief moment in time before settling in above $2.

If it can hold there, it’ll be enough to stay on the Nasdaq without any financial maneuvering required.

And perhaps that’s why the company decided to strike while the iron was hot and roll out a new feature.

Opendoor Rolls Out New Cash Plus Option for Home Sellers

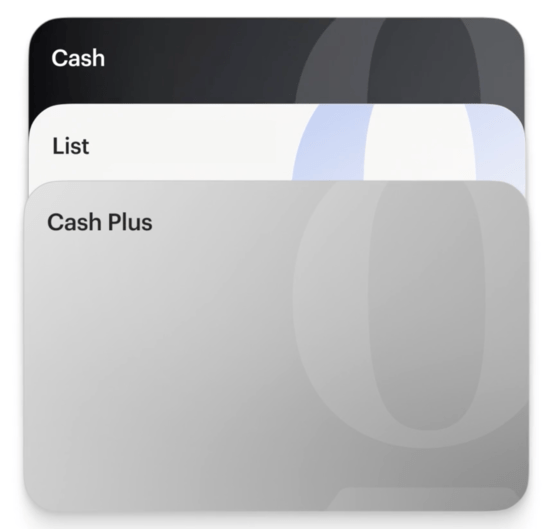

Opendoor has just added a third selling option to complement its existing options, the Cash offer and the standard List option.

The new product in question is known as “Cash Plus” and allows home sellers to get paid twice, potentially benefitting from any remodeling or repairs performed by Opendoor.

First, they’ll offer you a cash price, with no need to hire a real estate agent, repair the property, stage it, or show it.

Then a local Opendoor Key Agent and Opendoor pro team will carry out necessary repairs and improvements to make the home more marketable.

Once the home is sold to a third-party, any additional sales proceeds minus fees and expenses are passed along to the seller.

This means the seller can effectively get paid twice, and could capture some of the upside realized from repairs and renovations they didn’t want to undertake themselves.

The big question though is how much upside could there be? And how much does it cost in fees and repairs before you begin to see some of that upside?

One also has to wonder what the initial cash offer is relative to simply listing the home on the open market.

If that cash offer is pretty low in comparison, even some upside later might still fall short of just listing it yourself, even without making any repairs.

That’s kind of the thing with these companies, and perhaps why many of the others have already failed.

Is the iBuyer Model Even Viable?

I’ve struggled to determine if the iBuyer model is viable. I’ve long argued that real estate is slow by design.

It’s a feature, not a bug. Or something like that. But the main takeaway is that its very illiquidity is what makes it work so well.

Real estate isn’t a stock and can’t be day traded. It can’t change hands in days, let alone seconds.

And that’s what makes it a winner for most people. The more chances you have to buy and sell, the more chances you have to make bad decisions.

Real estate is pretty boring when it comes down to it, and most importantly, it’s slow.

The iBuyers came along over the past decade with the aim to speed things up. Like other tech companies, they wanted to disrupt the status quo.

Opendoor’s original pitch was getting an offer in 24 hours.

However, real estate proved difficult to disrupt, and many of these companies, or divisions of companies, failed.

For example, Zillow Offers shut its doors because it couldn’t forecast future home prices (pretty important detail, especially for a company that invented the Zestimate).

And Redfin’s iBuying venture known as RedfinNow was also paused back in 2021 and later shut down in late 2022 as the housing market began to slow.

Opendoor has kept on trucking, though it did shut down its Opendoor Home Loans venture along the way, leading to 500+ layoffs.

But as mentioned, the shares have struggled for quite some time before becoming the latest meme stock.

I suppose I applaud Opendoor for rolling out new ideas when there’s a spotlight on the company. You can’t blame them for trying.

The question is will it be enough to right the ship, or is the iBuyer model simply not workable at scale, at least for now?