Mortgage lender Paramount Residential Mortgage Group (PRMG) has launched a co-branded credit card with fintech company Mesa.

The Mesa Homeowners Card is noteworthy because it allows cardholders to earn points on their monthly mortgage payments.

No other credit card companies allow you to make a mortgage payment, let alone earn points for doing so.

That’s the biggest draw of this new card, but the way it works is rather unorthodox so pay attention.

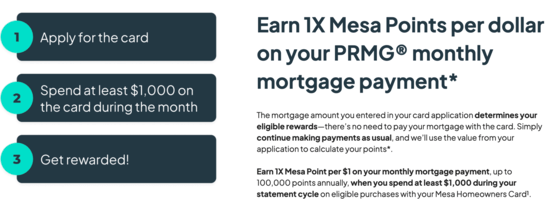

In addition, you need to spend at least $1,000 on the card outside the mortgage each month to actually earn the points.

PRMG’s Mesa Homeowners Card Rewards You for Paying the Mortgage

From what I can see, this new PRMG co-branded Mesa Homeowners Card is no different than the default version.

The press release simply states “PRMG clients will have access to an exclusive, customized version of the Mesa Homeowners Card.”

Perhaps that just means having the PRMG logo on the front of the card?

Other than that, it says it features all the same benefits of Mesa’s flagship card, and upon reading through the terms and conditions I couldn’t find anything unique here.

That aside, this card works like the standard version in that it rewards you for making mortgage payments each month.

But instead of actually paying the mortgage with a credit card, you link your bank account with the Mesa app to verify the existence of your mortgage account.

And most importantly, the mortgage amount you enter during the card application process determines your eligible rewards.

So be sure to enter the highest mortgage payment you make (only one mortgage is eligible assuming you have multiple mortgages).

From there, there’s no need to pay your mortgage with the Mesa Homeowners Card. And for that matter, you can’t anyway!

PRMG Credit Card Perks for Homeowners

But as long as you spend $1,000 elsewhere each month using the card, you’ll earn one Mesa Point per $1 on your monthly mortgage payment, up to 100,000 points annually.

For example, if you have a monthly mortgage payment of $3,000 and enter it into the application, then spend at least $1,000 via the card, you’ll earn 3,000 Mesa points.

Do this for all 12 months of the year and you’ll earn 36,000 points just for the mortgage, plus the points for the other spending.

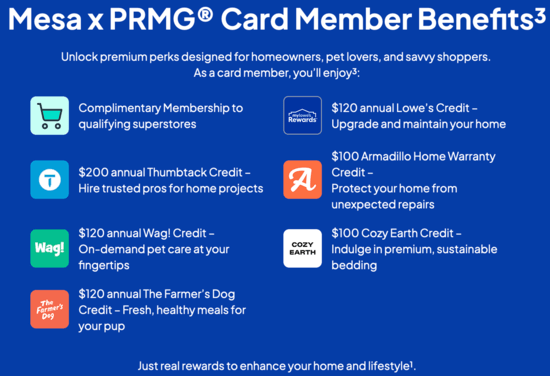

Speaking of, the card earns 3X Mesa Points on home improvement, decor, maintenance, utilities, and daycare.

And 2X on everyday purchases, including groceries, gas, EV charging, etc., along with one point on other spend. So it’s a decent card earnings category-wise, all with no annual fee.

However, they have limited redemption options right now, so other cards might still be a better fit.

Wait to Apply After Your Mortgage Closes!

The PRMG co-branded version of the Mesa Homeowners Card is now available to all qualified PRMG clients.

But one funny thing in the press release is they do tell prospective customers to wait to apply for the card after closing on their home purchase when working with a PRMG loan officer.

Why? Because it’s a no-no to apply for new credit during the home loan process as it can jeopardize your application.

The last thing you’d want is to get denied a mortgage because you tried to open a credit card before your loan funded.

This is good advice from PRMG and really applies to any other credit card or new line of credit during the mortgage process. Just wait to avoid any unwanted surprises!

For the record, PRMG is a mid-sized mortgage lender that does most of its business in the states of California and Oregon.

Perhaps other mortgage lenders will also open co-branded Mesa credit cards in the future as well?