Most investors chase exciting stories. They want fireworks, breakneck innovation, or CEOs who tweet more than they work.

I’ve always been content with the opposite: companies that keep their heads down, cash their checks, and quietly make shareholders richer over time.

That’s why T. Rowe Price (Nasdaq: TROW) is on my radar this week. It’s the kind of business that rarely lands on the front page, but its work helps people sleep well at night.

T. Rowe Price is a global asset manager with $1.8 trillion in assets under management (AUM). About two-thirds of those assets are tied to retirement investors – one of the most durable customer bases on Earth.

The company makes money the old-fashioned way: It manages other people’s money and collects fees. It focuses heavily on long-term investing, research-driven portfolio management, and a culture that, frankly, is more buttoned-up than most of Wall Street.

That’s not exciting. But if you’re managing retirement accounts, excitement is overrated.

Stability is the point.

In the third quarter, net revenues rose 6% year over year to $1.9 billion, while diluted earnings per share hit $2.87, up 8.7% from a year ago. AUM gained $89 billion of market appreciation despite $7.9 billion in net outflows.

Management emphasized improving investment performance, particularly across fixed income and long-term equity mandates, and highlighted its new strategic collaboration with Goldman Sachs to expand model portfolios, alternatives access, and advisor-managed accounts.

There were also significant cost moves, as expense discipline remains a priority. The company reduced headcount by roughly 4% since year-end and recorded a $28.5 million restructuring charge tied to layoffs.

It also returned $442 million to shareholders last quarter through dividends and buybacks.

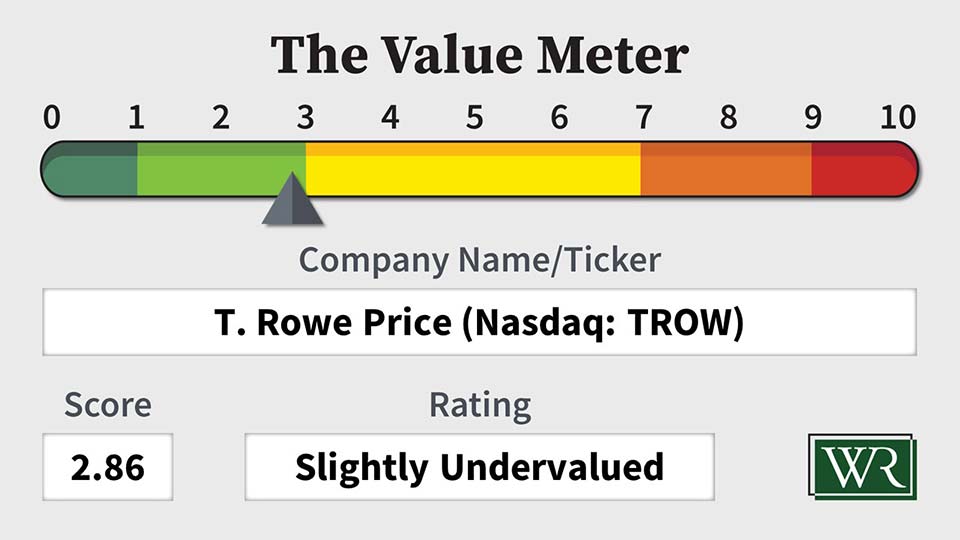

With all that said, let’s now run this sure and steady asset manager through The Value Meter.

T. Rowe’s EV/NAV ratio is 1.75, far below the peer average of 3.80. That means investors are paying less than half of what they typically would for every dollar of net assets.

This is a clear sign of undervaluation compared with the broader universe.

Free cash flow efficiency paints an even better picture. The firm’s FCF/NAV ratio is 2.48%, more than double the peer average of 1.13%.

The company also grew its free cash flow 45.50% of the time across the last 12 quarters – roughly in line with the peer average of 46.76%. Given the nature of the business, this isn’t a bad thing. Rather, it shows the company’s cash growth profile is solid rather than spectacular.

Still, consistency counts. And T. Rowe delivers plenty of it.

Over the past year, its stock has traded in wide swings – from highs near $118 to lows in the high $70s before rebounding to around $98 today. The chart shows a stock that’s been pushed around by sentiment far more than by fundamentals.

That usually spells opportunity.

T. Rowe Price is not a high-octane growth engine, nor does it pretend to be. It’s a resilient, cash-generating machine with a loyal client base, improving investment performance, and a growing lineup of advisory and retirement solutions.

Add in a nice 5% dividend yield, a disciplined expense strategy, and undervalued fundamentals, and you start to see why patient investors might want to take notice.

It’s no wonder the company is buying back its own stock.

The Value Meter rates T. Rowe Price as “Slightly Undervalued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.