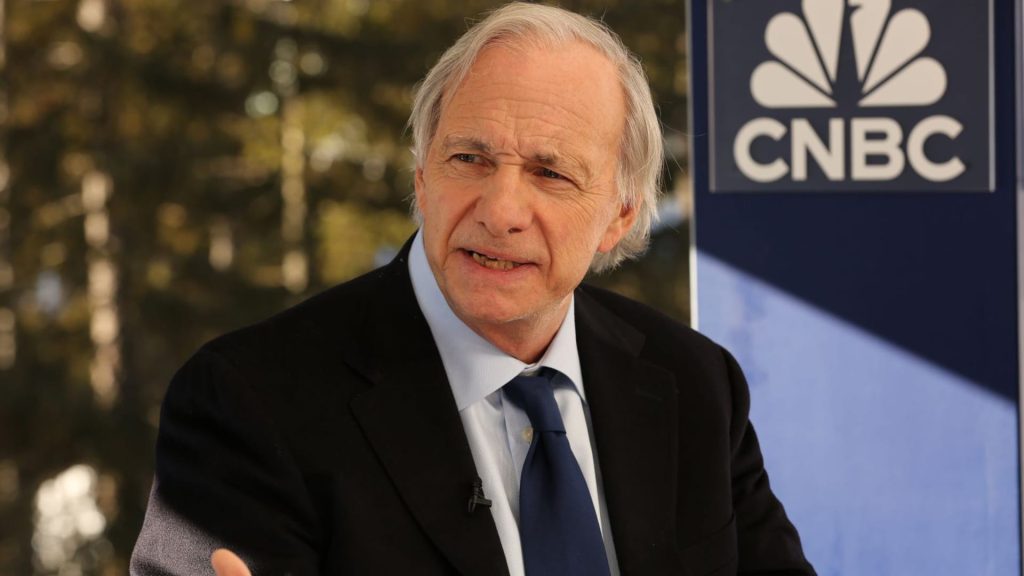

Bridgewater Associates’ Ray Dalio on stage at CNBC’s CONVERGE LIVE in March.

Courtesy of CNBC

Bridgewater Associates founder Ray Dalio said investors should allocate as much as 15% of their portfolios to gold even as the precious metal surged to an all-time high above $4,000 an ounce.

“Gold is a very excellent diversifier in the portfolio,” Dalio said Tuesday at the Greenwich Economic Forum in Greenwich, Connecticut. “If you look at it just from a strategic asset allocation perspective, you would probably have something like 15% of your portfolio in gold … because it is one asset that does very well when the typical parts of the portfolio go down.”

Gold futures year to date

Gold futures were last trading at $4,005.80 per ounce. Prices have skyrocketed more than 50% this year amid a flight to safety on mounting fiscal deficits and rising global tensions.

The billionaire investor compared today’s environment to the early 1970s, when inflation, heavy government spending and high debt loads eroded confidence in paper assets and fiat currencies.

“It’s very much like the early ’70s … where do you put your money in?” he said. “When you are holding money and you put it in a debt instrument, and when there’s such a supply of debt and debt instruments, it’s not an effective storehold of wealth.”

Dalio’s recommendation contrasts with typical portfolio guidance of financial advisors which tells clients to hold mostly stocks and some bonds in a 60-40 split. Alternative assets like gold and other commodities are usually suggested to be a low single-digit percentage of any portfolio because of the lack of income they generate.

DoubleLine Capital CEO Jeffrey Gundlach also recently recommended a high weighting in gold — as much as 25% in the portfolio — as he believes gold will continue to stand out on the back of inflationary pressures and a weaker dollar.

Dalio said gold stands apart as a hedge in times of monetary debasement and geopolitical uncertainty.

“Gold is the only asset that somebody can hold and you don’t have to depend on somebody else to pay you money for,” he said.

Correction: Ray Dalio said, “Gold is the only asset that somebody can hold and you don’t have to depend on somebody else to pay you money for.” An earlier version of this article misstated the quote.