“Oops, I did it again”

– Britney Spears

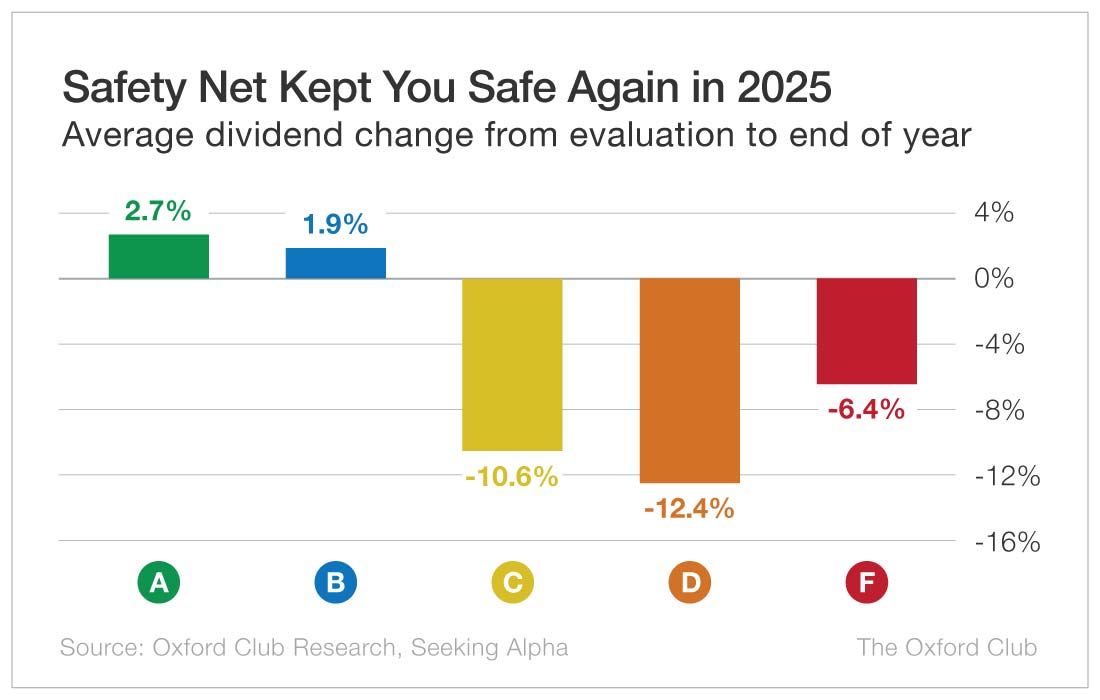

In 2025, Safety Net was once again an excellent resource for evaluating the safety of a company’s dividend.

During the year, 10 stocks were rated “A” for dividend safety. None of them cut their dividends. In fact, since 2023, not one of the 29 “A”-rated stocks has lowered its payout within a year after we evaluated it.

Even more impressive, 50% of 2025’s “A”-rated stocks boosted their dividends during the year, including Iron Mountain (NYSE: IRM), which raised its dividend by 10% six months after my “A” rating was released, Delek Logistics Partners (NYSE: DKL), which raised its distribution each quarter, and MPLX (NYSE: MPLX), which hiked its payout by 12% less than a week after I gave it an “A” rating.

I only gave four stocks a “B” for dividend safety in 2025, but two of them boosted their dividends, while the other two kept them the same. There were no cuts.

Energy Transfer (NYSE: ET) was rated “B” in April and raised its distribution every quarter in 2025.

There were seven stocks whose dividends were considered to have a moderate risk of being cut, receiving a “C” rating. Two raised their dividends; two cut them. The average change to the dividend of those seven stocks was -10.6%.

There were a handful of cuts among the “D” and “F”-rated stocks as well. We gave 12 stocks a “D” grade, and 17 others were rated “F.” Two out of the 12 “D”s lowered their dividends, while three out of the 17 “F”s did so.

“D”-rated stocks had the biggest average drop at 12.4%. “F”-rated stocks only saw a 6.4% average decline, but that number is skewed a bit by one variable dividend that saw a sizable – yet likely temporary – increase.

Back in February, Stellantis (NYSE: STLA) slashed its dividend by more than 50% a week after I issued a “D” rating on the stock.

Advanced Flower Capital’s (Nasdaq: AFCG) dividend wilted in 2025. After I gave it a “D” rating, management proved me right by cutting the dividend twice and then skipping it altogether in the fourth quarter.

In June, Research Analyst John Oravec said there was a strong likelihood that OFS Capital (Nasdaq: OFS) would “have a repeat of 2020 with a cut coming down the line” before slapping the stock with an “F” rating. The dividend was cut in half in December.

All in all, it was another terrific year for Safety Net.

Thanks to all of you who submitted requests for stocks to be evaluated in the Safety Net column. Keep them coming! Leave the ticker symbols in the comments section below.

You can also check to see if I’ve rated your favorite dividend payer recently. Just type the company name in the search box in the upper-right corner of this page, and hit “enter.”