Years ago, I was hooked on technical analysis. Even though many on Wall Street laugh at it, I found value in reading price and volume like a map.

I built a tool – one of many I’ve created over the years – that used volatility to spot quick trades in options, typically holding for no more than a week or two.

That tool worked quite well. In fact, one of my biggest wins was from the very company we’re looking at today. (It gave me a nice 100% option win in less than 24 hours.)

But today, we’re not chasing short-term spikes. We’re looking at the company’s financials.

Samsara (Nasdaq: IOT) helps companies run their physical operations more efficiently. Its software tracks trucks, trailers, equipment, and more, using data and AI to cut waste and improve safety.

Let me give you the facts…

In the first quarter of fiscal 2026, which ended on May 3, Samsara brought in $367 million in revenue, up 31% from the same time last year. The company’s net loss shrank to $22.1 million, a big improvement from $56.3 million a year ago. It also turned in $45.7 million in free cash flow, compared with $18.6 million last year.

Margins are moving the right way, too. Gross margin hit 79%, up from 77%. Adjusted operating margin was 14%, also up year over year. Management now expects full-year revenue of $1.547 billion to $1.555 billion, with adjusted free cash flow margin set to beat last year’s figure by about 1 percentage point.

The business is growing across the board. Samsara now has 2,638 customers spending over $100,000 per year. That’s up 35% from last year. It added 154 new large customers in the last quarter alone. Wins include names like 7-Eleven, Dallas Fort Worth International Airport, and Knife River, a construction firm that was spun off from MDU Resources.

But what do the numbers say?

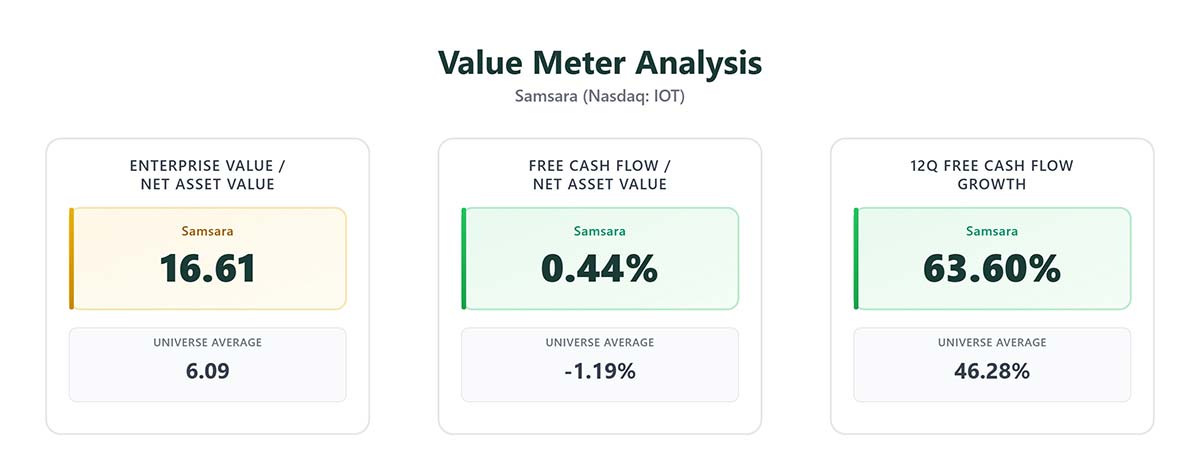

Samsara’s EV/NAV is 16.61, compared with a universe average of 6.09. That tells us investors are paying a premium – likely for future growth and high retention.

Its FCF/NAV ratio is 0.44%. That may not sound like much, but it beats the universe average of -1.19%. The company’s free cash flow has grown quarter over quarter 63.6% of the time, compared with 46.3% for the typical stock.

Put simply: Samsara is still scaling, but it’s doing so with better cash discipline than most.

Now, the stock isn’t cheap. But it’s also not riding a hype wave. It’s actually down this year.

That can be a good sign: The market isn’t overreacting even as the business keeps improving.

If you want exposure to AI – especially through a company tied to more concrete things like trucks, warehouses, and field work – Samsara is worth a close look. It’s not a screaming bargain, but it’s building something durable.

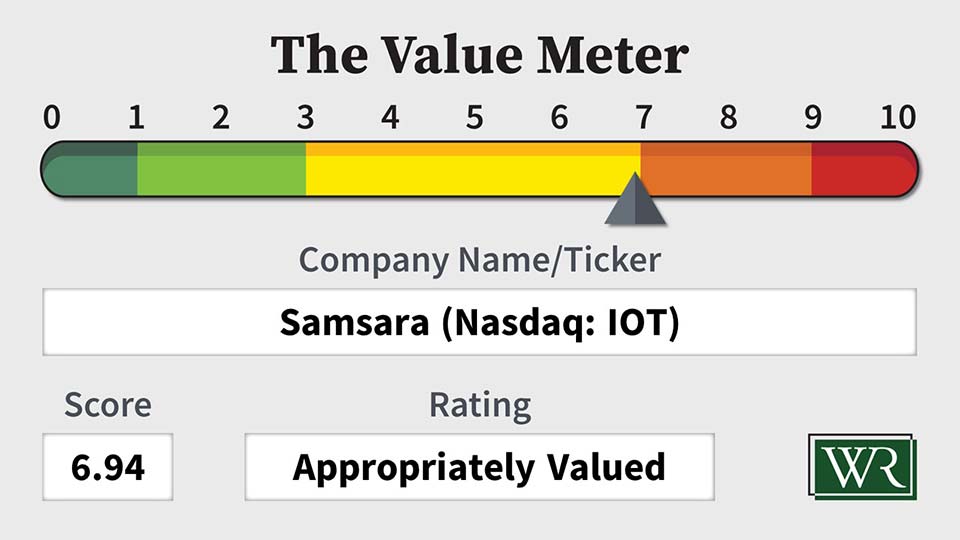

The Value Meter rates Samsara as “Appropriately Valued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.