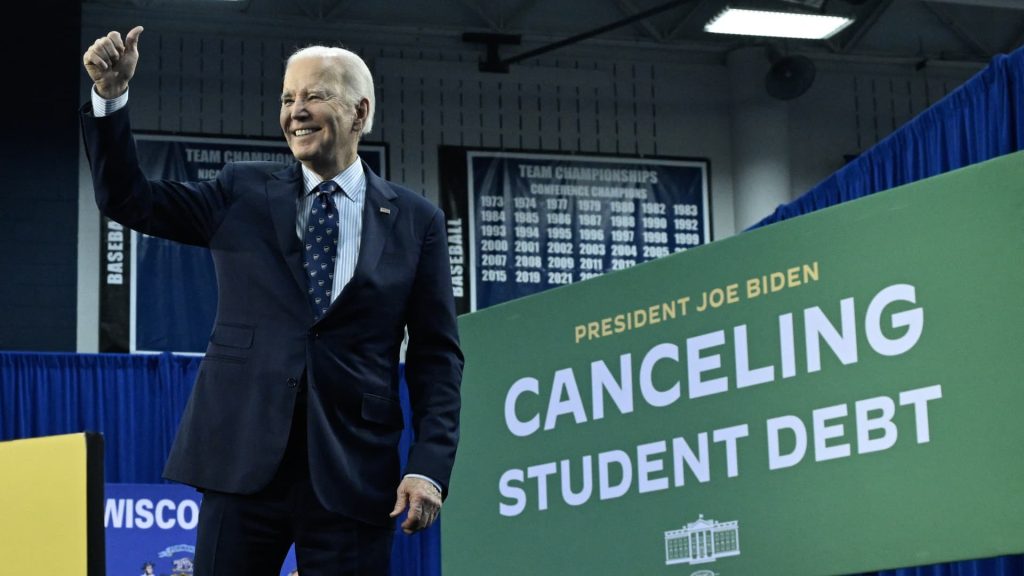

US President Joe Biden gestures after speaking about student loan debt relief at Madison Area Technical College in Madison, Wisconsin, April 8, 2024.

Andrew Caballero-Reynolds | AFP | Getty Images

Former President Joe Biden forgave more student debt than any other president. However, the country’s education debt tab still grew during his presidency.

Outstanding federal student debt stood at roughly $1.64 trillion toward the end of 2024, according to U.S. Department of Education data analyzed by higher education expert Mark Kantrowitz. That compares to around $1.59 trillion at the start of 2021.

“Total student loan debt went up while President Biden was in office, despite all of the student loan forgiveness,” Kantrowitz said.

While Biden was in the White House, he canceled student debt for 5.3 million borrowers, for a total of $188.8 billion in relief.

While these numbers don’t account for inflation, they still show how difficult it is to make a meaningful debt in the country’s student loan balance, experts said.

There were roughly the same number of people with student debt — 42 million — both when Biden entered and exited office, according to Kantrowitz’s calculations.

Root cause of the crisis is ‘the cost of higher education’

Betsy Mayotte, president of The Institute of Student Loan Advisors, a nonprofit that helps borrowers navigate the repayment of their debt, said it didn’t surprise her that the country’s loan balance still climbed.

“We’re going to continue to see that until we solve the root cause of the student loan crisis,” Mayotte said. “And the root cause is the cost of higher education.”

Before financial aid, the sticker price at some four-year colleges and universities — after factoring in tuition, fees, room and board, books and other expenses — is now nearing $100,000 per year.

For undergraduate students in the 2024-25 academic year, the estimated expenses for tuition, fees, housing and food at a public four-year in-state college is $24,920, and $58,600 at a private, nonprofit four-year college, according to CollegeBoard.

“New borrowing outpaces repayment,” Kantrowitz said. Indeed, over $300 billion in new federal loans were taken out while Biden was president, Kantrowitz calculated.

Another reason student debt didn’t drop under Biden was the Covid-era pause on federal student loan payments, which spanned from March 2020 to Sept. 2023, Mayotte said.

“We went three and half years where the vast majority of borrowers weren’t paying,” she said.