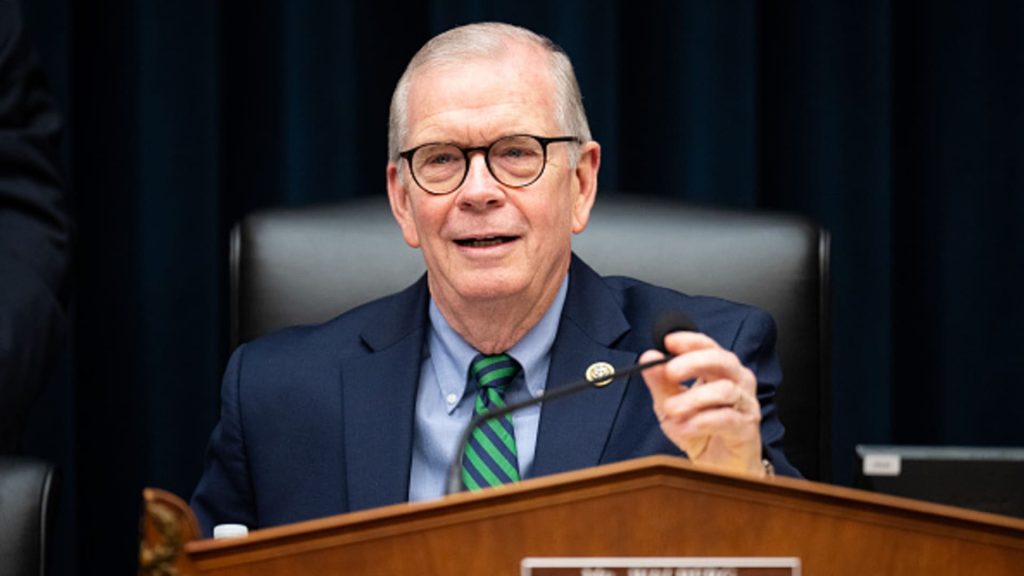

Chairman Tim Walberg, R-Mich., attends the House Education and Workforce Committee hearing on “The State of American Education” in the Ryaburn House Office Building on Wednesday, February 5, 2025.

Bill Clark | Cq-roll Call, Inc. | Getty Images

House Education and Workforce Committee Republicans have released their plan to overhaul the country’s student loan and financial aid system, calling for limits on student borrowing and a reduction to the repayment options for borrowers.

The GOP measure, known as the Student Success and Taxpayer Savings Plan, is aimed at helping Republicans pass President Donald Trump’s tax cuts.

“For decades Congress has responded to the student loan crisis by throwing more and more taxpayer dollars at the problem — never addressing the root causes of skyrocketing college costs,” committee Chairman Tim Walberg, R-Mich., said in a statement.

More from Personal Finance:

Is college still worth it? It is for most, but not all

How to maximize your college financial aid offer

What student loan forgiveness opportunities remain under Trump

The proposal immediately triggered warnings from consumer advocates, who said the measures would deepen the affordability crisis families already face in paying for college.

“The committee’s current proposal would severely restrict college access by slashing financial aid programs, eliminating basic consumer protections and making it harder to repay student loan debt,” said Sameer Gadkaree, president and CEO of The Institute for College Access & Success.

Here are some of the proposals in the Republicans’ legislation.

Caps on federal student loans

Under the proposal, undergraduate students would face a borrowing cap of $50,000 in federal student loans starting July 1, 2026, while graduate students couldn’t take out more than $100,000.

Current limits vary by factors including student status and year of schooling, but for many people, the caps will mean they can borrow less.

Those limits “will shift some borrowing to private student loans,” said higher education expert Mark Kantrowitz.

That’s a concern for Kantrowitz and other consumer advocates, who point out that private student loans come with far fewer borrower protections than federal student loans.

Fewer repayment plans, hardship protections

The GOP proposal would reduce the number of existing income-driven repayment plans for new federal student loan borrowers to just one. IDR plans aim to make monthly payments affordable for borrowers by capping the bills at a portion of their discretionary income.

More than 12 million people were enrolled in IDR plans as of September 2024, according to Kantrowitz.

It would also eliminate the unemployment deferment and economic hardship deferment for federal student loan borrowers, on debt taken out during or after July 2025.

More requirements to receive a Pell Grant

Full eligibility for Pell Grants would also require students to be enrolled at a minimum of 30 hours each academic year, up from the current requirement of 12 hours per semester.

The federal Pell Grant program, signed into law in 1965, is one of the largest sources of financial aid available to college students. More than 6 million undergraduate students received the grants in 2020. The maximum Pell Grant award is $7,395 for the 2025-26 award year.

Meanwhile, the grants would be expanded for short-term workforce training programs.