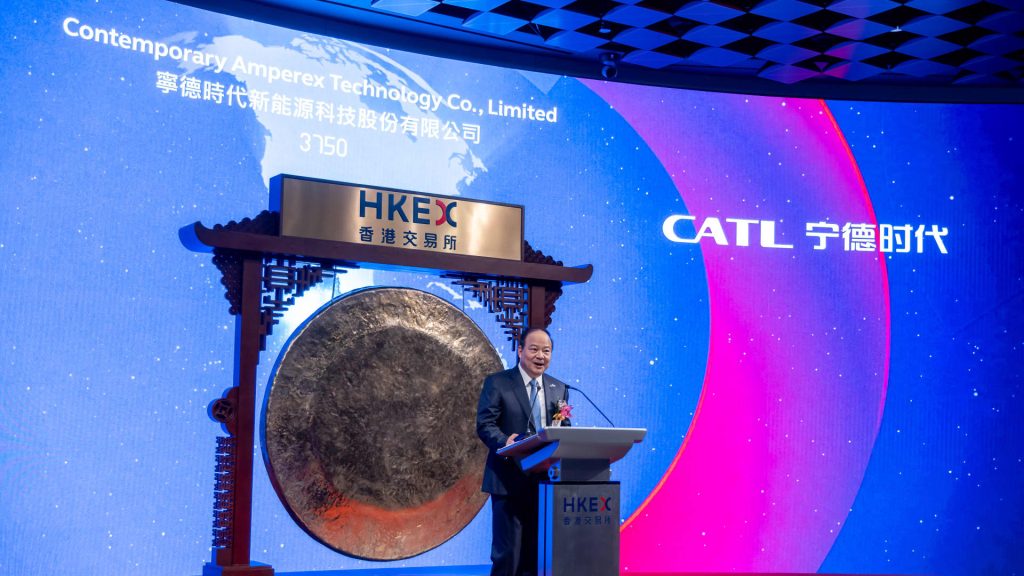

For Tesla supplier Contemporary Amperex Technology , selling battery packs to major electric companies is just the start of its ambitions. “We believe the company is not just a hardware manufacturer, but it will also be a software ecosystem provider,” Morgan Stanley analysts led by Jack Lu said in a report Wednesday. They pointed to CATL’s artificial intelligence-powered tools for monitoring batteries on the road and giving early safety warnings. “As AI develops, the ecosystem will likely further evolve and provide more value added soft services to customers,” the Morgan Stanley analysts said, noting that improved safety will also strengthen CATL’s business partnerships and competitiveness. Morgan Stanley raised its price target on CATL’s Hong Kong-listed shares to 445 Hong Kong dollars ($56.69), up 14% from 390 HKD previously. The new price target is nearly 18% above where CATL closed Friday, after reaching an intraday high of 395 HKD on Thursday. That was the highest since CATL shares listed in Hong Kong on May 20 in the world’s biggest IPO of 2025. The company’s mainland-listed shares have traded at an abnormally large discount to the Hong Kong shares. CATL also looks to be a step closer to generating revenue from licensing. Ford agreement U.S. automaker Ford has planned to open a battery factory through a licensing agreement with CATL. But the deal came under intense U.S. scrutiny , while there were concerns that Ford would lose advanced manufacturing tax credits. But Ford in the last week said it expects its BlueOval Battery Park in Michigan will benefit from such tax credits, and ” remains on track to begin production of lithium iron phosphate (LFP) batteries in 2026.” While the release did not mention CATL, analysts were hopeful. “This recent news is positive in that it appears there is tacit acceptance of the licensing arrangement,” Macquarie analysts Eugene Hsiao and Fergus Kwan said in a report Wednesday, noting the development “helps to remove one key headwind on the shares.” Neither CATL nor Ford immediately responded to a CNBC request for comment. CATL could receive 1.3 billion yuan ($181 million) in annual licensing fees if BlueOval operates near full capacity by 2027, although the battery company’s profits won’t likely benefit until then, the Macquarie analysts said. They have a price target of 360 HKD on CATL shares. U.S. scrutiny But CATL remains under broader scrutiny in the U.S. Earlier this year, the Pentagon added CATL to a “Chinese military” list that prohibits the U.S. Department of Defense from buying the company’s products starting in 2026. CATL at the time said the designation was “a mistake” and that it “is not engaged in any military-related activities.” “We believe geopolitical risk between China and the U.S. is already priced into the shares,” the Macquarie analysts said. “Strong earnings fundamentals from market share gains in Europe, coinciding with increased shareholder returns, should lead to a valuation re-rating.” CATL has pledged 90% of the funds raised by going public would support its expansion into Europe , especially a factory in Hungary that’s nearing completion. The company last month also said a subsidiary has reached a deal in Indonesia for a $6 billion project that aims to cover nickel mining and processing, battery production and battery recycling. “We maintain our Buy rating for CATL,” Bank of America analysts led by Ming Hsun Lee said in a July 2 report, “given its industry-leading battery technology and new product strategy to protect its market share, as well as its edge in technology and scale to drive more room for cost savings and sustained high” gross profit margins. The analysts have a 400 HKD price target on the stock. They highlighted that, in CATL’s main line of business, Xiaomi will use the CATL’s battery in its popular YU7 SUV, “which should be positive to CATL’s [market] share in China.” CATL has also built business partnerships in new technologies around battery swapping and packs designed specifically for hybrid-powered cars . Geely -backed electric car company Zeekr on Wednesday announced its hybrid driving system is based on CATL’s “Freevoy Super Hybrid Battery.” The technology will be used in Zeekr’s first hybrid vehicle, the 9X SUV, which has a range of 380 kilometers on a single charge and is set to begin deliveries in China by the end of September, a statement said. — CNBC’s Michael Bloom contributed to this report.

Tesla supplier CATL has potential beyond just batteries, analysts say

No Comments4 Mins Read

Previous ArticleTrump tariff surprise delivery fees

Next Article What is a fiduciary bond?

Related Posts

Add A Comment