![]()

![]()

Kamal Khurana

6th Sep 2025

Reading Time: 10 minutes

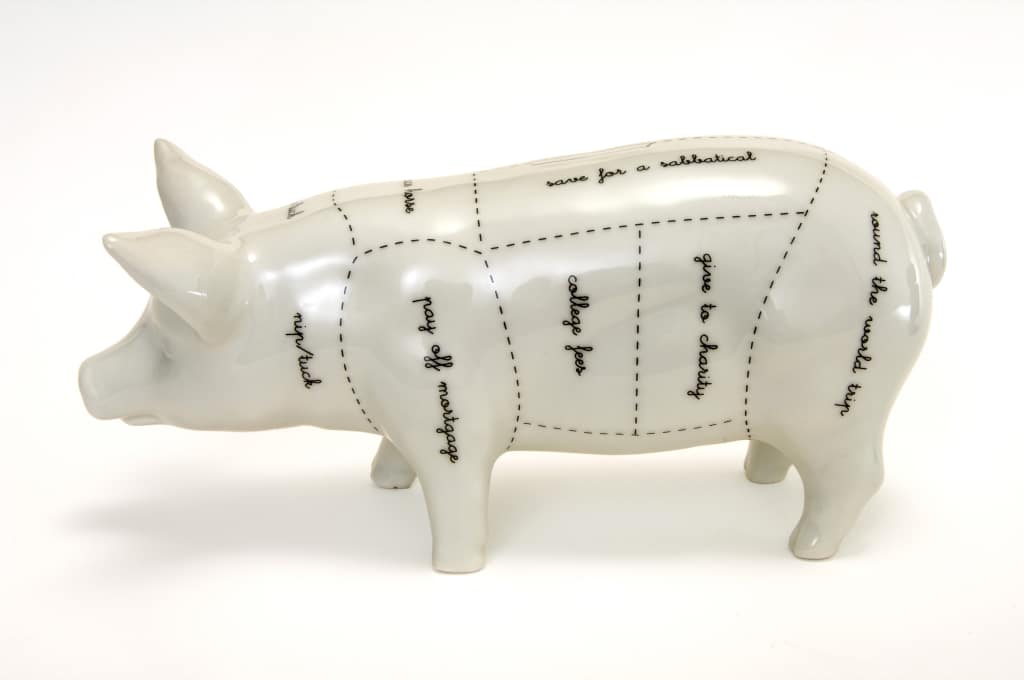

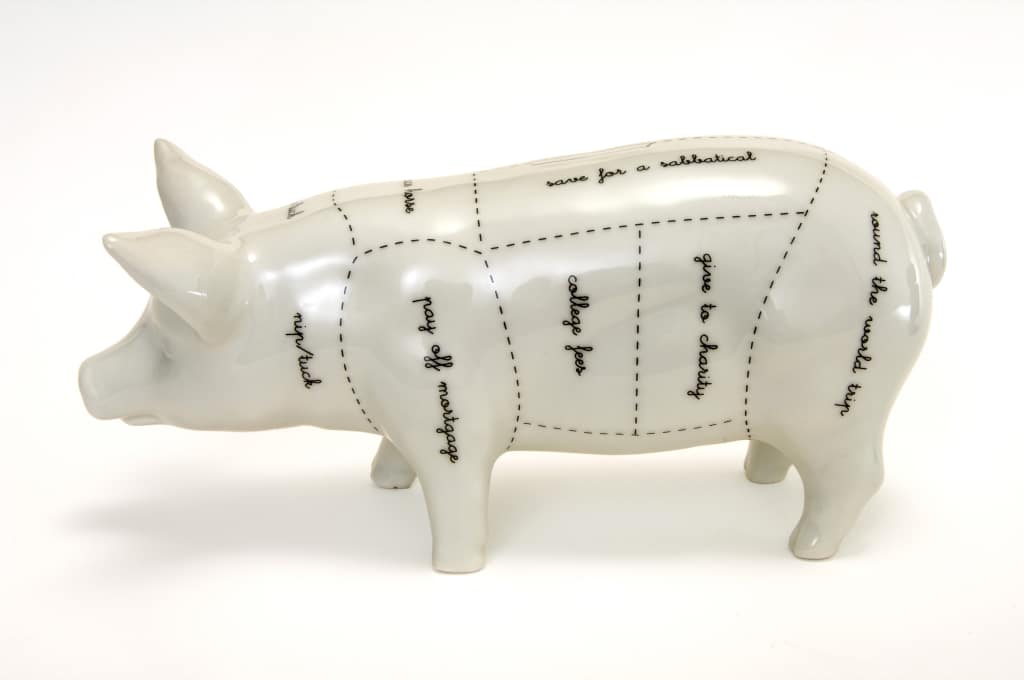

When it comes to saving money it’s all about cutting costs and finding the right discounts, offers, vouchers and sometimes even freebies. From saving on the cost of your gym membership and kids entertainment to paying attention to your spending habits and saving money with travel, insurance and bills, we have 26 ways for you to save money and enjoy the benefits along the way.

Take a look at our A-Z guide to saving money below.

A – is for Avoiding debt

It may seem like an obvious one to start with but far too many people in the UK have to worry about debt on a daily basis.

It may seem like an obvious one to start with but far too many people in the UK have to worry about debt on a daily basis.

Take a look at our tips on avoiding debt overwhelm – the first step to tackling the debt spiral.

B – is for Bulk Buying

There’s big money to be saved from group discounts, free extras and simply buying in bulk.

The MoneyMagpies are strong advocates of buying in bulk to save money. Also, you can get great discounts by joining group-buying sites like Groupon. These sites offer great discounts and can send them straight to your inbox because a large amount of people are committing to the sale.

C – is for Cut Your Cost

It’s quite simple really; the less you spend, the more you’ll save. And, more importantly, the more you’ll be able to put into investments for your future.

It’s quite simple really; the less you spend, the more you’ll save. And, more importantly, the more you’ll be able to put into investments for your future.

See our tips for cutting your heating costs here, how to cut your driving costs and check the weekly deals page for free food and big discounts.

D – is for Designer Deals

Designer clothes, shoes and handbags are more often than not worth the money – especially if you’re trying to save money.

Designer clothes, shoes and handbags are more often than not worth the money – especially if you’re trying to save money.

But if you can’t live without your designer fashion you must search around for the best deals to make your money go further.

You can shop on sites like Brand Alley and The OutNet where you can get between 30% and 70% off loads of designer labels.

E – is for Entertainment for Kids

Take the kids out for a cheap or free meal to keep them entertained – check out our full list of places where kids eat free.

Take the kids out for a cheap or free meal to keep them entertained – check out our full list of places where kids eat free.

The cinema is a great way to keep the kids occupied for a few hours (bonus points if you have lunch or dinner from one of the places in the link above to make a whole afternoon of it). Check out our cinema deals page to find out how you can take the family to the cinema for as little as £1.

F – is for Fuel Bills

Cut your heating costs now by making a few simple changes to your home before the really cold weather comes. With energy prices higher than ever, making your home as energy efficient as possible can save you serious money and ensure you stay warm for less. Click here for advice on easy ways to cut your bills.

Cut your heating costs now by making a few simple changes to your home before the really cold weather comes. With energy prices higher than ever, making your home as energy efficient as possible can save you serious money and ensure you stay warm for less. Click here for advice on easy ways to cut your bills.

G – is for Gym Membership

If you find that you don’t work out as often as you intend to and you’re paying over the odds for your membership, now’s the time to do something about it.

If you find that you don’t work out as often as you intend to and you’re paying over the odds for your membership, now’s the time to do something about it.

Gyms are often open to negotiating the prices of contracts – but they’re more likely to cut you a deal at times when they aren’t selling so many memberships. Here are our 12 top tips to finding cheaper fitness fees.

Check out our editor Vicky Parry’s advice in the Mirror about working out and keeping fit for free at home for more ideas on how to save money without sacrificing your exercise regimen.

H – is for Save in your Home

Trimming the fat off wasteful habits can really add up to savings of £100s. We could all do with cutting down our household expenditure by making small changes to everyday life.

Trimming the fat off wasteful habits can really add up to savings of £100s. We could all do with cutting down our household expenditure by making small changes to everyday life.

We’ve come up with 50 ways your can reduce your spending and start saving at home – take a look here. Start having a go at just half of them and you’re bound to save a packet.

I – is for Interest Free

If you have an ongoing debt on a credit card that’s currently charging you interest… then a 0% interest balance transfer card could really help you to clear the debt.

If you have an ongoing debt on a credit card that’s currently charging you interest… then a 0% interest balance transfer card could really help you to clear the debt.

Learn more about balance transfer cards and other credit cards here.

J – is for Jasmine’s Money Saving Emails

Sign up to our newsletter and every week you’ll get money saving (and money making) tips, offers and deals. It’s free so you don’t have to pay a Casadefinance Reader, and you’ll hear about exclusive offers such as MoneyMagpie’s cash giveaways.

Sign up to our newsletter and every week you’ll get money saving (and money making) tips, offers and deals. It’s free so you don’t have to pay a Casadefinance Reader, and you’ll hear about exclusive offers such as MoneyMagpie’s cash giveaways.

K – is for Keeping a Spending Diary

When it comes to savvy saving, the reason why most people fail is because they have no idea what is going into their bank account each month, and even less about what’s flowing out. The easiest way to keep track of what your spending is to write it down. Seems simple? That’s because it is.

When it comes to savvy saving, the reason why most people fail is because they have no idea what is going into their bank account each month, and even less about what’s flowing out. The easiest way to keep track of what your spending is to write it down. Seems simple? That’s because it is.

Keeping a spending diary is just one of our favourite old school budgeting tips to get ahead on our finances.

L – is for Lunch Savings

Did you know that the average worker spends about £10 per day on lunch, adding up to around £50 each week? By the end of your career you could have spent over £50,000 just on buying lunch! Save money by making your own to take in.

Did you know that the average worker spends about £10 per day on lunch, adding up to around £50 each week? By the end of your career you could have spent over £50,000 just on buying lunch! Save money by making your own to take in.

Remember to check our deals page for free food and supermarket deals to keep your groceries costs down, too.

M – is for Mobile Comparison

There are loads of mobile networks out there and they are all fighting over your business. That means you’ve got the upper hand. The average mobile bill spend is £40-50 but you don’t need to spend anywhere near that much.

There are loads of mobile networks out there and they are all fighting over your business. That means you’ve got the upper hand. The average mobile bill spend is £40-50 but you don’t need to spend anywhere near that much.

Talk to your provider when your contract nears its end to get a better deal. Keep your handset – you don’t need to upgrade every couple of years – and you could nab brilliant SIM-only deals from just £5 a month from providers like SMARTY and iDMobile, too.

N – is for NO to Expensive Food

Food prices have rocketed. It’s tough for everyone to buy nutritious food on a budget.

Food prices have rocketed. It’s tough for everyone to buy nutritious food on a budget.

You can always find free food and good deals, if you know where to look. Make the most of yellow stickered reduced items (which some Tesco stores offer FREE after 9pm!), use loyalty schemes to gain points and access cheaper prices, and ditch the takeaways for homemade dinners.

O – is for Organise a House Swap Holiday

House swapping is a fantastic way to have a holiday for less. This is probably one of the best money-saving tips, because as well as economising big-style you will also get a much more authentic experience of the place that you are visiting.

House swapping is a fantastic way to have a holiday for less. This is probably one of the best money-saving tips, because as well as economising big-style you will also get a much more authentic experience of the place that you are visiting.

If you organize your swap through a reputable company NO money should pass between you and the person you’re swapping with. For more house swapping tips and advice read our article here.

P – is for Prepaid Cards

Why pay more for your travel money at the airport or paying sky high rates using your debit card overseas? Make your spending money go further with prepaid cards.

Why pay more for your travel money at the airport or paying sky high rates using your debit card overseas? Make your spending money go further with prepaid cards.

They also help protect your money if your wallet is stolen or your card details are lifted in a scam. Be aware of other common holiday scams to avoid losing money abroad.

Q – is for Quit Smoking

There are many reasons why your should quit smoking; for your health, for your social life and for your wallet. We know it’s not an easy thing to do, but quitting smoking can save you around £3,000 a year. Think what you could buy with that!

There are many reasons why your should quit smoking; for your health, for your social life and for your wallet. We know it’s not an easy thing to do, but quitting smoking can save you around £3,000 a year. Think what you could buy with that!

Boots also have a great quit smoking scheme and a range of useful products to help you too – click here to see their full range.

R – is for Remember to Book Early

It cannot be said too many times; if you want cheaper flights with the major airlines, especially long-haul, then you should try and get in as early as possible. Over a matter of weeks or sometimes days, prices can change immensely. Planes, trains and buses all have a quota of seats they will sell for the lowest price and then prices just increase. Make sure you don’t fall foul of holiday booking scams too. If you can’t book early for whatever reason, take a look at Lastminute.com who have a range of cheap last minute travel deals.

S – is for Switch Today

Pour yourself a nice cuppa and settle down with your computer to switch everything. Get the best deal on your gas and electricity, all your insurances, your phone and broadband providers and even your bank. Over the next year you should be able to save thousands of pounds with some savvy searching and price-matching. Remember to check providers direct too – they might be able to offer a better deal than through a comparison site.

T – is for Tax

While most of us have to pay tax in some form, there’s no need to pay any more than you need to. Britons waste billions of pounds every year paying too much tax. Remember, we’re not talking about tax evasion, which is illegal, but tax avoidance – big difference. For the self-employed, we’ve got a full guide to saving on your tax bill.

U – is for Use Cashback Sites

Cashback sites like Topcashback and Quidco are brilliant for giving you small discounts on your everyday online buying. They even have some in-store offers these days, too!

Cashback sites like Topcashback and Quidco are brilliant for giving you small discounts on your everyday online buying. They even have some in-store offers these days, too!

It’s not an excuse to shop MORE – but if you need to buy something (or change your broadband, energy supplier, mobile phone or insurance policies) make sure you do it through a cashback site for some extra savings.

V – is for Voucher Codes

Voucher codes are everywhere. If you Google a website plus ‘discount code’ you’re bound to find a few to try. If none of them work, you can try signing up to the website’s newsletter – it usually comes with a welcome discount.

Voucher codes are everywhere. If you Google a website plus ‘discount code’ you’re bound to find a few to try. If none of them work, you can try signing up to the website’s newsletter – it usually comes with a welcome discount.

Or, try websites like Wowcher to buy a discount code to save money overall. We’ve got 10% off your Wowcher purchases too – click here and use the code SAVE10 at checkout.

W – is for Write a Will

Now admittedly this might not save you money right now but it will certainly save your kids, friends, charities etc later on. If you write a will and keep it updated then there’s less for them to pay in solicitor’s fees, tax and all sorts of other expenses. You should have a will NOW if you have any sort of assets (car, bit of money, clothes, jewellery, pension) and any family or friends you want to give it to.

Now admittedly this might not save you money right now but it will certainly save your kids, friends, charities etc later on. If you write a will and keep it updated then there’s less for them to pay in solicitor’s fees, tax and all sorts of other expenses. You should have a will NOW if you have any sort of assets (car, bit of money, clothes, jewellery, pension) and any family or friends you want to give it to.

Free Wills Month runs in March and October every year and mean you could get your basic will written up for free.

X – is for Xmas Savings

The earlier you can save for Christmas, the better! Putting aside ten pounds a week from the summer could leave you with a nice festive pot to spend.

The earlier you can save for Christmas, the better! Putting aside ten pounds a week from the summer could leave you with a nice festive pot to spend.

But it’s also worth considering what Christmas means to you and whether you need to spend all the money you usually do. Are the kids grown? Do you prefer a single big social occassion instead of lots of nights out in December? Would you prefer to give handmade gifts this year? Talk to friends and family about doing a Secret Santa instead of everyone buying lots of gifts, or set a price limit for them.

Y – is for Saying YES to Freebies

The best way to save money is to spend nothing at all. Here at MoneyMagpie we’re always on the lookout for a good freebie. See our article on 50 ways to live for free here and this article on how to get the best freebies, deals and vouchers.

The best way to save money is to spend nothing at all. Here at MoneyMagpie we’re always on the lookout for a good freebie. See our article on 50 ways to live for free here and this article on how to get the best freebies, deals and vouchers.

We’ve also got a freebies newsletter to take all the effort out of finding freebies.

Sign up to our freebies newsletter to get freebies delivered to your inbox every week.

Don’t want emails? Check out our new Whatsapp group instead!

Z – is for Zero Spend Days

Once a week try having a zero spend day. Use your local library for books, magazines, music and film. Use your points to buy things such as Boots or Superdrug cards for toiletries, Tesco Clubcard for dinners in restaurants and Avios for a trip to a theme park. Use food you have already in the kitchen to make a picnic and have a family outing in the park for free. Find out how to live for free with loyalty and rewards cards to help you.