Editor’s Note: Monument Traders Alliance’s Karim Rahemtulla is one of the experts I trust the most when it comes to the oil and gas sector.

Below, he explains how the current trends in the sector are creating some massive opportunities for investors.

– James Ogletree, Managing Editor

The oil sector has been back in vogue lately.

Our politicians have been hanging out with the Saudis. Donald Trump just accepted a $400 million plane from Qatar. Everything is peachy cool with the Middle East right now.

But going past the surface-level headlines – I’m asking myself…

“How does this impact the oil sector as a whole?”

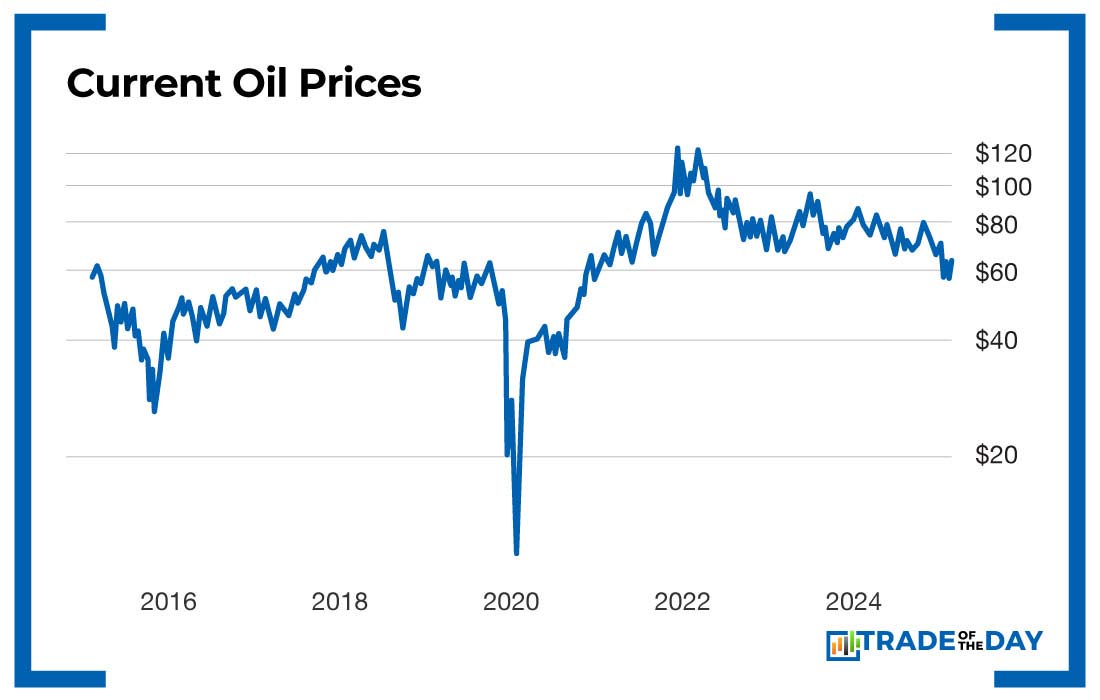

If you recall in 2020 when COVID-19 brought the world to a standstill, energy demand was crushed.

Oil dropped to $12 a barrel, and by January of 2021, over 100 oil and gas companies had declared bankruptcy.

Now in 2025, I’m seeing a similar trend play out that started in April of 2024.

You might recall during the inflation spike in 2022, oil screamed higher to $120 a barrel. Since April of 2024, it’s been on a steady decline back to $63. Which is right around the level many drillers require to make money.

Plus, with the new volatility surrounding Trump’s trade war in 2025, oil companies are starting to cry the blues again as they struggle to determine how tariffs will affect prices.

Energy service companies like Halliburton and Schlumberger reported lower earnings in Q1 2025, and they’re bracing for what could be the first price strain in several years. Overall, it would be just the second time in the past decade that US production fell.

What falling oil prices mean for the markets

When it comes to declining oil prices, a familiar cycle often plays out.

- Reduction in capital expenditure: Low prices stall production and projects get postponed.

- Cheaper oil increases demand: Less oil supply means prices increase again.

What it means for you as a trader?

I say if the oil companies start to really struggle, then let some of them go bankrupt.

It’s good for the industry as a whole. The major players will survive and gobble up the smaller players. Which is what happened in 2020.

It’s also a good opportunity to find hidden value energy companies nobody’s talking about that could weather the storm.

When it comes to finding valuable oil plays flying under the radar, I always tell traders to focus on companies with hidden assets.

The truth is… companies in the oil and gas sector have tremendous assets. But many of them are already well-known.

![]()

YOUR ACTION PLAN

There’s one company with assets that I believe is tremendously undervalued right now.

It’s currently boosting American energy production by working with the best-performing AI company of 2024.

The only reason it’s cheap is because few people know it exists.