With markets near all-time highs, I’ve had numerous conversations with friends telling me they’re going to hold off on investing until the market comes back down. “I’ll wait until things turn around,” they often say.

However, when the market falls, very few brave investors will put money to work.

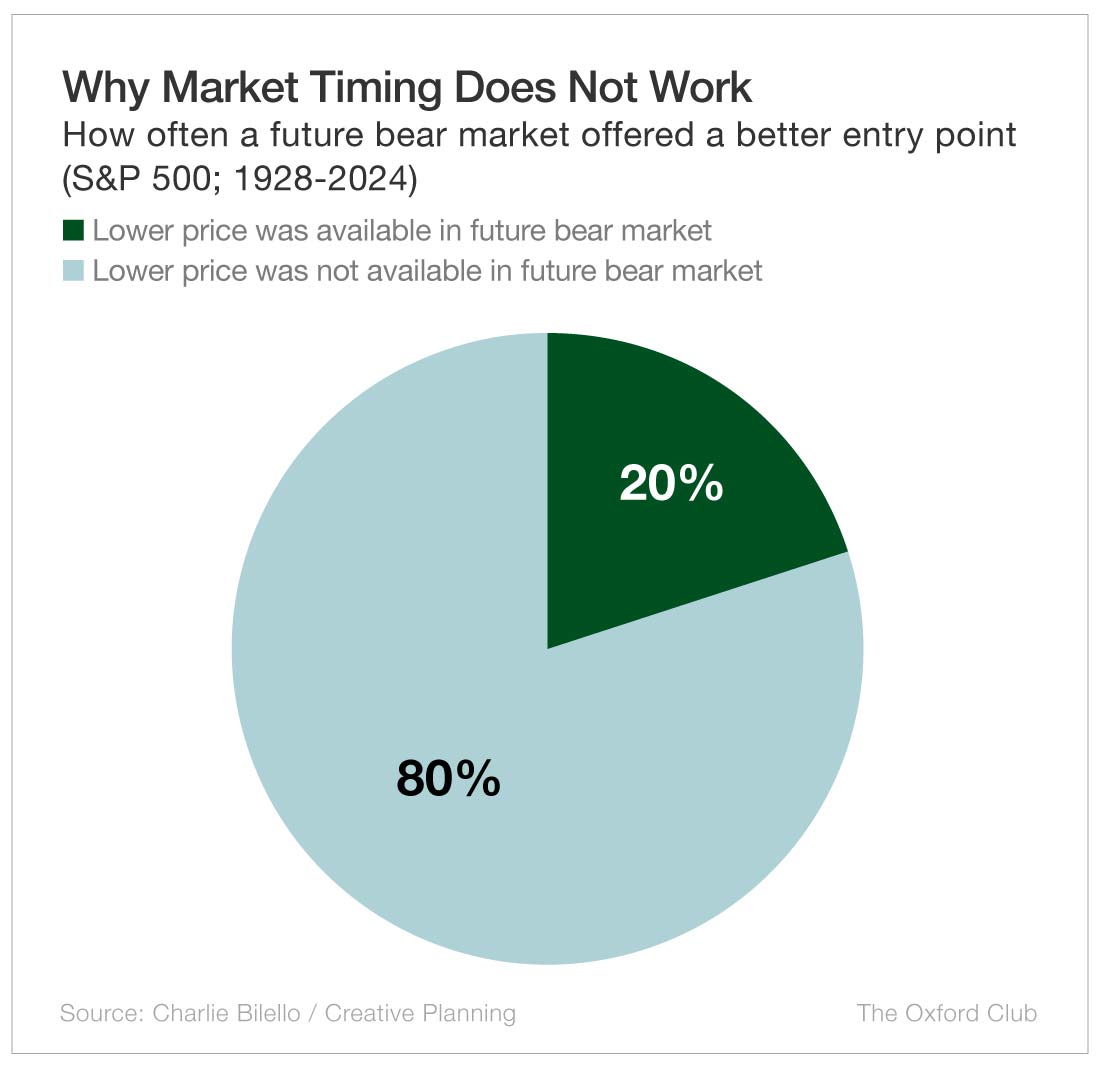

Additionally, the odds of getting a better price than what you’d receive currently – regardless of when you’re reading this – are actually quite low. In fact, going back to 1928, if you wait for a bear market (a drop of 20% or more), you only have a 1-in-5 chance of obtaining a better entry point than the current price – no matter where that price level is.

This is an amazing statistic, because most people naturally think a bear market will provide a better opportunity.

Sometimes it does. The brief bear market during the early days of the pandemic provided a decent time to buy. At the very bottom in March 2020, prices were at their lowest point since December 2016 – nearly eight years after the bull market had started.

But how many people were buying stocks as the market was plummeting and the economy was shut down? Almost no one had the guts to buy at that time.

The most recent bear market ended in October 2022. At the low, you could have gotten a better price in the S&P than at any time after December 2020.

However, even if you possessed the nonexistent skill of market timing and waited to buy at the 2022 bear market low, that was still higher than the peak before the COVID crash and was roughly three times higher than where the S&P was in 2010.

Furthermore, even investors with the best intentions of buying low and selling high have a very hard time buying when stocks are falling. It’s too emotionally difficult. Sure, some folks are buy-the-dippers, but I’m not talking about a dip. I’m talking about a real correction or bear market. That’s a scary time to buy, and most people won’t do it until they believe things have stabilized.

At that point, the market is usually in raging bull mode.

Again, think back to the pandemic or the global financial crisis. Do you know anyone who was buying stocks in 2009? At that time, the economy was still a disaster. We were nowhere close to a recovery. Yet stocks bottomed and started their move higher. I know people who still have the emotional scars from the crisis and the terrible bear market that followed. As a result, they’re still scared to invest in stocks and have missed one of the great bull markets of all time.

Waiting for a better time to buy that may never come – or being scared to answer the door when opportunity knocks – could mean tens or even hundreds of thousands of dollars of missed gains over time.

Invest at regular intervals regardless of what’s happening in the market – whether it’s a raging bull, growling bear, or anything in between. It may feel uncomfortable, but your future self will thank you for having discipline and not letting emotion get in the way of the most important element of investing success: the amount of time you are invested.

Remember, there’s an 80% chance you won’t get a better price in the future than what you see today.