Visualization created with AI assistance based on original reporting.

Processing Content

- Key Insight: Tokenized money market funds, or TMMFs, are gearing up to have an even deeper impact on the evolution of payments and money than stablecoins.

- Expert Quote: “it looks like we are heading into a mind-bending expansion of what can be considered money.” —Neolle Acheson

- Forward Look: If the rules restricting the issuance and transfer of TMMFs relax, we could start to see an actual security become more money-like.

Since the passage of the GENIUS Act last July,

While stablecoins dominate headlines and mainstream attention, tokenized money market funds, or TMMFs, are quietly powering yield,

How they could do that is only part of the story; just as interesting is why they are taking a back seat to stablecoins for now, and what that says about the deeper transformation ahead.

Let’s start with a look at today’s rapidly evolving TMMF market. Year-on-year growth in assets under management of over 160% as of mid-February has pushed the market capitalization of issued tokens to more than $7 billion. The largest TMMF is BlackRock’s BUIDL, with more than $1.7 billion in issued AUM. Other market leaders include Circle’s USYC, with over $1.6 billion; Superstate’s USTB, with almost $800 million; and WisdomTree’s WTGXX, with over $700 million.

Although all are based on commoditized products, there is diversity among the tokens. Some trade on one public blockchain, others on many. Some funds distribute interest in the form of new tokens; others accrue yield to the token value. And the degree to which each is embedded in decentralized finance varies.

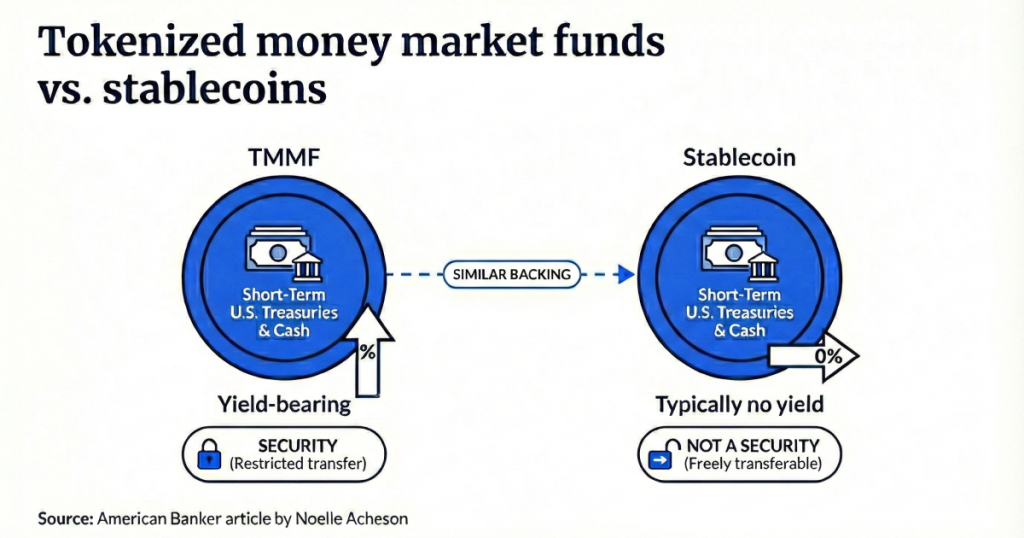

So, here you have on-chain tokens backed by short-term U.S. Treasuries and other cashlike instruments that can be transferred on-chain and interact with third-party applications. Unlike stablecoins, which have essentially the same backing, these reward holders with a yield.

That should, all else equal, make them even more attractive than stablecoins — and yet their total market size is tiny in comparison. They didn’t get a dedicated piece of legislation through Congress with bipartisan support. They are not hotly debated in White House meeting rooms, nor do they alarm monetary authorities around the world. Why not?

The reason is a key difference that goes well beyond the ability to pay yield: Tokenized money market funds are securities. Stablecoins, with the same backing, are not. Here is where things get even more interesting.

Because stablecoins are not securities, they are freely transferrable which makes them an on-chain substitute for money.

Tokenized money market funds are securities, however, which means transfer is heavily restricted.

The two assets are

Let’s step back and look at the regulatory framework, with the caveat that I’m not a lawyer and so will do my best to simplify. Today’s set of TMMFs are issued under exemptions from full public securities registration, largely to avoid the extensive disclosures, reviews and up-front costs, not to mention a lengthy back-and-forth with the SEC. These exemptions require issuers to restrict distribution to accredited investors, which anyway makes sense from a strategic perspective: lower operating costs relative to order size, less risk of know-your-customer and secondary trading issues, and a closer relationship with key clients for the beneficial feedback loop.

But the exemptions also limit utility by allowing transfer of the tokens only to whitelisted addresses. These could be other onboarded clients or approved decentralized finance applications. For instance, Superstate’s USTB money market token is accepted as collateral on Aave’s Horizon, a decentralized lending protocol for accredited investors that allows holders to earn additional yield. BlackRock’s BUIDL token is accepted as collateral in Euler Finance’s lending protocol on Avalanche, as well as for trading on Binance. And last week, it

If you squint, you can see that tokenized money market funds — essentially, restricted securities — are starting to pick up some movement. In hopping between approved addresses to improve returns and liquidity, they’re gaining utility beyond that of their traditional counterparts, whose transfers usually have to go through an intermediary during office hours.

And if you look a little closer, you see that the additional utility of tokenized money market funds makes them, well, more money-like. They cannot yet be directly used as a settlement asset for a transaction; but one day they could, with some tweaks to arguably outdated regulation.

After all, TMMFs and stablecoins are essentially the same asset, just with different legal classifications and limitations. Yet the movement of TMMFs is restricted because of securities laws that treat publicly listed money market funds — not exactly risky investments — the same as technology ETFs or a basket of Malaysian equities. Just how much disclosure and regulatory consideration does a money market fund need? How many of the layers of complexity are actually justified by the nature of the asset?

If the rules for tokenized money market funds can be relaxed so holders can take better advantage of blockchain efficiencies, we could start to see TMMFs act more like yield-bearing money.

Intriguingly, the U.S. Treasury seems to know this. In the second quarter of last year, it charged the Treasury Borrowing Advisory Committee, or TBAC, with

It asked:

“Further, do tokenized money funds present a risk should they be allowed to compete with other payment or settlement instruments?”

In sum, it looks like we are heading into a mind-bending expansion of what can be considered money. I’ve