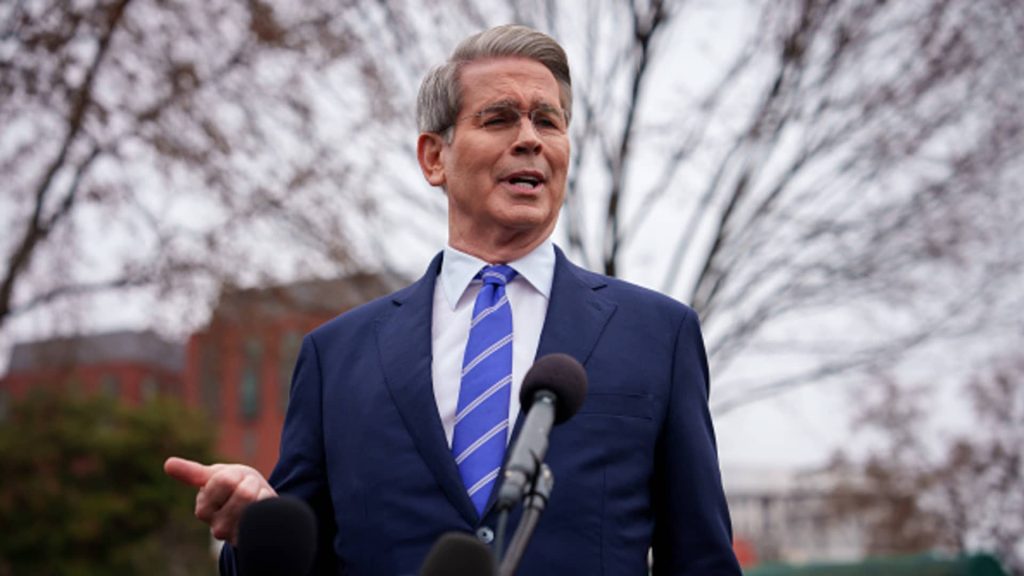

Treasury Secretary Scott Bessent speaks to reporters outside the West Wing after doing a television interview on the North Lawn of the White House on March 13, 2025 in Washington, DC.

Andrew Harnik | Getty Images

Treasury Secretary Scott Bessent said Wednesday the sell-off in the stock market is due more to a sharp pullback in the biggest technology stocks instead of the protectionist policies coming from the Trump administration.

“I’m trying to be Secretary of Treasury, not a market commentator. What I would point out is that especially the Nasdaq peaked on DeepSeek day so that’s a Mag 7 problem, not a MAGA problem,” Bessent said on Bloomberg TV Wednesday evening.

Bessent was referring to Chinese AI startup DeepSeek, whose new language models sparked a rout in U.S. technology stocks in late January. The emergence of DeepSeek’s highly competitive and potentially much cheaper models stoked doubts about the billions that the big U.S. tech companies are spending on AI.

The so-called Magnificent 7 stocks — Apple, Amazon, Tesla, Alphabet, Microsoft, Meta and Nvidia — started selling off drastically, pulling the tech-heavy Nasdaq Composite into correction territory. The tech-heavy benchmark is down about 13% from its record high reached on December 16.

However, the secretary downplayed the impact from President Donald Trump’s steep tariffs, which caught many investors off guard and fueled fears of a re-acceleration in inflation, slower economic growth and even a recession. Many investors have blamed the tariff rollout for driving the S&P 500 briefly into correction territory from its record reached in late February. Wall Street defines a correction as a drop of 10% from a recent high.

S&P 500, YTD

Trump signed an aggressive “reciprocal tariff” policy at the White House Wednesday evening, slapping duties of at least 10% and even higher for some countries. The actions sparked a huge sell-off in the stock market overnight, with the S&P 500 futures declining nearly 4% and the blue-chip Dow Jones Industrial Average shedding 1,100 points. The losses will likely but the S&P 500 back into correction territory in Thursday’s session.

“It’s going to be fine if we put the best economic conditions in place,” Bessent said in a separate interview on Fox Wednesday evening. “If you go back and look, the stock market actually peaked on the [DeepSeek] Chinese AI announcement. So a lot of what we have seen has been just an idiosyncratic tech sell-off.”