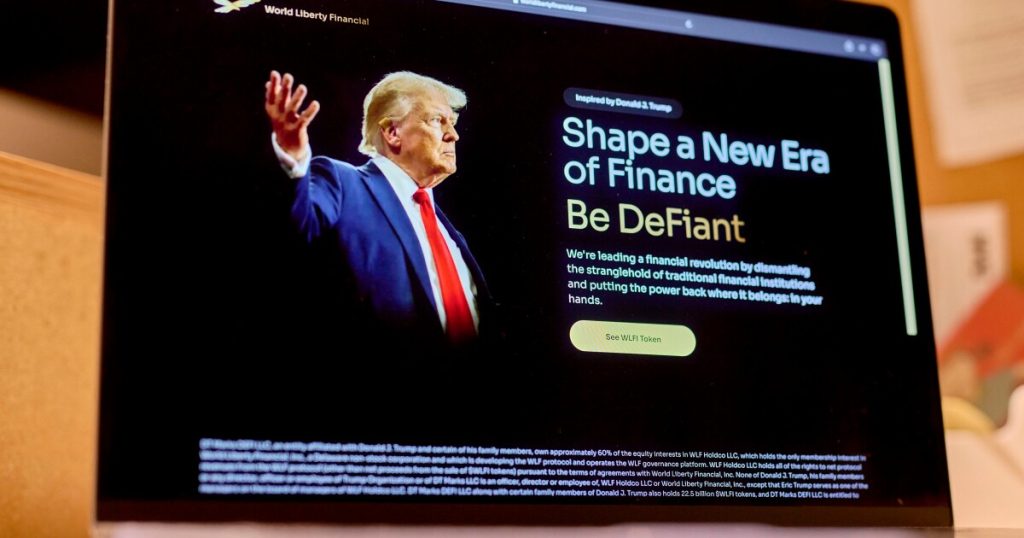

President Donald Trump-backed World Liberty Financial announced it launched a U.S. dollar-pegged stablecoin.

The stablecoin known as USD1 will be on the Ethereum and Binance Smart Chain blockchain networks. World Liberty Financial said USD1 will be backed by short-term U.S. government treasuries, U.S. dollar deposits and “other cash equivalents.”

“We view stablecoins as an integral part of not only crypto but the entire financial ecosystem,” said Zach Witkoff, co-founder of World Liberty Financial, at the DC Blockchain Summit in Washington, D.C. on Wednesday. “It’s currently a $250 million total market cap business. We think it’s going to be worth many trillions of dollars in the next few years and we’re excited for the world to experience our stablecoin USB1.”

BitGo, the world’s

“Our clients demand both security and efficiency and this partnership with World Liberty Financial delivers both,” Belshe said, “combining deep liquidity with the assurance the reserves are securely held and managed within regulated, qualified custody.”

The Trump administration’s push for

Total transfers reached $27.6 trillion in 2024, according to a report by CEX.IO that found the

Trump ran on a promise to make the United States the “crypto capital of the planet” and signed an executive order days after taking office that

White House Crypto Czar

“I look forward to working with each of you in creating a golden age in digital assets,” Sacks said, noting

World Liberty Financial launched in October as a decentralized finance project. The president’s official title is “chief crypto advocate” and his sons are all involved: Barron Trump, his youngest, is listed on the company’s website as the “DeFi visionary” and Eric and Donald Trump Jr are both “Web3 ambassadors.” Co-founder Zach Witkoff is the son of Steve Witkoff, Trump’s Special Envoy to the Middle East. He participated in the White House’s Crypto Summit earlier this month.

The company has raised more than $550 million through its two rounds of sales of its token WLFI, which includes $250 million raised in the most recent sale announced last Monday, according to the company. World Liberty Financial said the money has come from more than 85,000 investors, both American and international. The largest investor is Justin Sun, the founder of Tron.

The president and first lady additionally launched a

Binance, which hosts one of two blockchains USD1 will be held on, is the largest cryptocurrency exchange in the world. Its

The company ran afoul of U.S. regulatory agencies and was banned in the U.S. in 2019. The company paid a $4.3 billion fine to U.S. prosecutors after pleading guilty to violating U.S. anti-money laundering laws, allegedly failing to report more than 100,000 suspicious transactions. With backing from other investors, Binance launched the separate exchange Binance.US later that year to comply with U.S. laws.