- Key insight: After acquiring Credit Suisse in 2023, Switzerland-based UBS has become embroiled in a dispute with an American lawyer who’s been overseeing World War II-era research inside the Credit Suisse archives.

- Why it matters: The dispute is relevant to the question of whether a landmark settlement between Swiss banks and Jewish community organizations should be reopened.

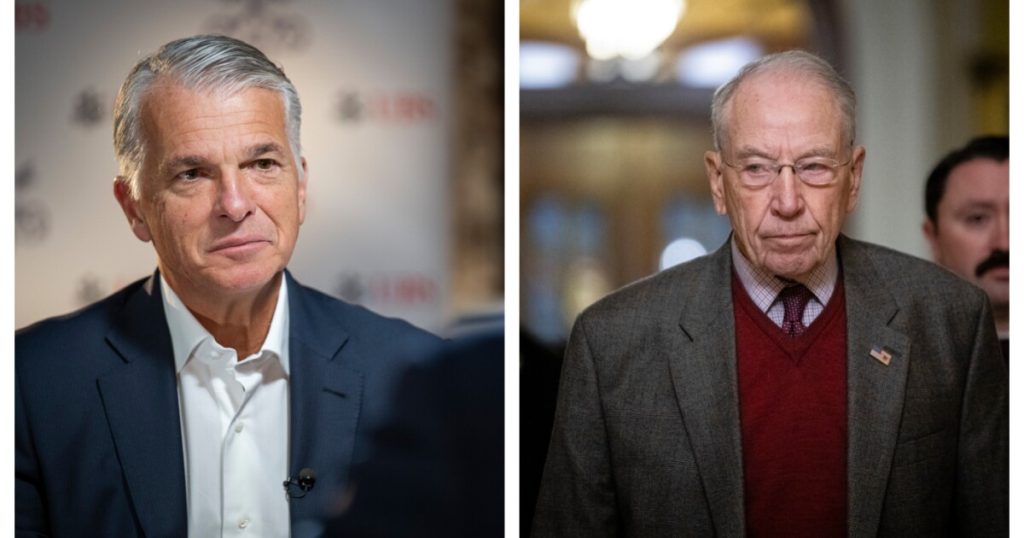

- Forward look: Two high-level UBS executives are expected to face tough questions Tuesday at a Senate Judiciary Committee hearing.

A U.S. Senate hearing Tuesday is expected to explore the controversial question of whether to reopen a landmark 1999 settlement involving

Processing Content

Swiss banking giant UBS, which acquired rival Credit Suisse three years ago, revealed Monday that it’s locked in a dispute with an American lawyer who’s been overseeing World War II-era research inside the Credit Suisse archives. The lawyer, independent ombudsperson Neil Barofsky, is scheduled to testify at Tuesday’s Senate Judiciary Committee hearing, as are two high-level UBS executives.

The conflict involves whether UBS should turn over certain 1990s-era communications between Credit Suisse and its attorneys, which are relevant to the question of whether the $1.25 billion settlement should be reopened, according to the written testimony of a top UBS executive.

“Materials from the 1990s are not within the scope of the ombudsperson’s oversight, which is

meant to be focused on Credit Suisse’s history and World War II-era conduct. This investigation was never meant to be focused on whether and how to reopen the 1999 settlement agreement. And yet, that is the subject on which the documents the ombudsperson is seeking is most relevant,” Robert Karofsky, UBS’ co-president of global wealth management and president of UBS Americas, said in his written testimony.

Barofsky’s testimony was not made available on Monday. He has declined to comment in advance of the hearing.

Also scheduled to testify Tuesday is Rabbi Abraham Cooper, director of global social action at the Simon Wiesenthal Center, which fights antisemitism. The Simon Wiesenthal Center made an investigative breakthrough on Nazi-related bank accounts in 2020, which led to the ongoing examination of Credit Suisse’s archives. Cooper has also declined to comment in advance of the Senate hearing.

In Karofsky’s written testimony, which UBS provided to American Banker, he said that the dispute concerns fewer than 150 Credit Suisse documents.

“These communications have not been provided because the Simon Wiesenthal Center and others have threatened litigation over this matter, which makes it of paramount importance to protect those specific attorney communications,” Karofsky states.

UBS will likely face tough questions on Tuesday from senators who have been pushing for a full excavation of the historical record with regard to Nazi-related bank accounts.

Credit Suisse terminated Barofsky in 2022, after which the Judiciary Committee’s chairman and ranking member — Sens. Chuck Grassley, R-Iowa, and Sheldon Whitehouse, D-R.I. — issued a subpoena to obtain an interim report that Barofsky had written.

Barofsky was subsequently reinstated to his position. Grassley has accused Credit Suisse, which was acquired by UBS in the period between when Barofsky was terminated and when he was brought back, of trying to conceal information from congressional investigators.

In a call with reporters on Monday, Grassley said the review of Credit Suisse’s archives, which includes Credit Suisse’s predecessor banks, has so far identified 890 hits for accounts with potential Nazi links. Among them: accounts for the German War Office, a German arms manufacturer and the German Red Cross.

“Credit Suisse’s connection to all three of these entities was previously unknown or only partially known,” Grassley said. “These accounts were all once used by individuals or entities who participated in or assisted Nazi war efforts.”

Grassley also said that newly uncovered records show Credit Suisse’s relationship with the Nazi SS were more extensive than previously known, and that progress is being made in uncovering the Swiss bank’s role helping Nazis flee to Argentina at the end of World War II, through activities known as “ratlines.”

“Credit Suisse leased out a building in Switzerland that the Argentine government worked out of to conduct ratline operations,” Grassley said Monday during the call with reporters.

At Tuesday’s hearing, Grassley is expected to call for the creation of a central repository for historical materials about Nazi-related accounts, so that researchers can access the extensive materials in the coming decades and build a fuller historical record.

Senate Judiciary Committee aides said Monday that the scope of the investigation has expanded since 2023, when a consulting firm hired by Credit Suisse filed a 113-page report that explored certain topics and questions that the Simon Wiesenthal Center had raised in connection with World War II-era events.

Since then, the investigation has widened to include accounts in additional countries, as well as an extended time period, according to the Senate Judiciary Committee aides.

Those aides expect both Barofsky and Cooper to testify that the question of whether the investigation should be expanded further, to include accounts at UBS as it existed before its 2023 acquisition of Credit Suisse, is a legitimate one.

In Karofsky’s written testimony, the UBS executive said that the bank’s voluntary investigation has involved the production of more than 16.5 million documents consisting of more than 44 million pages and four terabytes of data, with roughly 85 people working on the project full-time, and spanning 18 public archives in seven countries.

“To support these efforts and to demonstrate our unflinching commitment to finding the truth, we have spent hundreds of millions on this investigation,” Karofsky said.

The 1999 settlement between Swiss banks and Jewish community groups followed litigation and — in an effort to reach a mutually acceptable outcome — the establishment of two separate commissions.

For the next 21 years, the issue of Swiss banks’ support of the Nazis was widely thought to be concluded. But that changed in 2020, when the Simon Wiesenthal Center revealed new information about Nazis in Argentina who had contributed to bank accounts at a Credit Suisse predecessor.

Advocates for reopening the1999 settlement have noted that the agreement was signed by Jewish community organizations, not the actual victims and their families. They’ve also argued the Swiss banks failed to live up to certain obligations, and that the 1990s-era litigation was about accounts held by victims, not the accounts of the Nazis who stole Jews’ assets.

UBS’ Karofsky sought to rebut some of those arguments in his written testimony at Tuesday’s hearing.

“The settlement was intended by all parties and the presiding U.S. District Judge, Edward R. Korman, to achieve global resolution through a conclusive end to the controversy that went beyond legal and financial closure. It was not limited to the facts known at the time,” Karofsky said.

“Accordingly, the scope of the settlement is extremely broad and involves release of all claims whether known or unknown in any way associated with Nazi Germany and all individuals and entities associated or affiliated with it, the Holocaust, World War II, and its prelude and aftermath. As part of its comprehensive scope, the settlement explicitly included ‘Nazi assets’ — those belonging to Nazi companies and individuals.”

In connection with the dispute over the production of the 1990s-era communications between Credit Suisse and its lawyers, Karosky said that UBS has asked Judge Korman to issue an order to clarify and reaffirm the scope of the 1999 settlement.

The renewed fight over Nazi-era bank accounts comes at a delicate time for UBS, which last year applied to U.S. regulators for a national bank charter. That charter would allow it to expand its already-sizable stateside wealth-management business. UBS said last month that its application has received conditional approval from the Office of the Comptroller of the Currency.