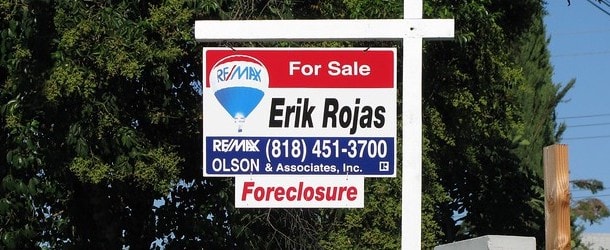

After the Veterans Affairs Servicing Purchase (VASP) program was abruptly wound down earlier this year, scores of veteran homeowners were left at risk of foreclosure.

The Biden-Harris era program allowed the VA to purchase defaulted VA loans from mortgage loan servicers, modify them, and then place them in the VA-owned portfolio as direct loans.

A key feature of VASP was monthly payment relief, with borrowers receiving 2.5% fixed mortgage rates for the remainder of the loan term.

While seemingly an effective tool to prevent foreclosure, there were concerns that the program would put undue stress on taxpayers, and lead to strategic default (by those with higher rates) to obtain a lower interest rate.

That led to the end of VASP without a replacement, putting thousands of veterans at risk of losing their homes. Now they’ve got some relief in the form of a partial claim.

VA Home Loan Program Reform Act Restores the Partial Claim

While VASP is gone, VA loan borrowers will now have a new loss mitigation solution to potentially stave off foreclosure.

The VA Home Loan Program Reform Act makes the partial claim a permanent solution for veteran and active duty mortgage holders going forward.

The partial claim is a fairly straightforward tool. It allows delinquent borrowers to put any missed payments on the back of their loan in order to bring the loan current.

These arrearages are then held as a second lien set at 0% interest and only repaid once the first mortgage is paid off via home sale or refinance.

This allows the borrower to get back on track, resume their old monthly payment, and ideally avoid foreclosure in the process.

Of course, they still need to make future monthly payments, so the solution isn’t foolproof. But it’s a start.

The partial claim was a COVID-era option for VA loan borrowers from 2021-2022, but once the program was closed, a viable replacement wasn’t put in place.

Around that same time, mortgage rates surged higher, making it difficult to modify VA loans that were already set at or near record low rates.

The temporary solution was a foreclosure moratorium while VASP was put in place.

The foreclosure freeze was initially set to go until June 2024, but later extended to December 31st, 2024.

Shortly after, the VA stopped accepting VASP submissions on May 1st, leaving even more veterans facing economic hardship with no place to turn.

This newly-signed bill at least restores the partial claim, but might not go far enough to keep veterans in their homes.

Payment Relief Still a Big Question Mark for VA Loan Borrowers

While a partial claim allows homeowners to set aside missed payments, it doesn’t address future payments.

Any quality loss mitigation program has to address how a homeowner can continue making payments as well.

If VA loan holders are unable to make payments moving forward, the partial claim merely acts as a band-aid.

Before long, they’ll be back in arrears on the loan and facing foreclosure yet again. For this reason, the VA must also develop a loan modification program that provides actual payment relief.

This is tricky because chances are a lot of these borrowers already have rock-bottom mortgage rates obtained in the 2020-2021 era when interest rates hit record lows.

Perhaps they already have a 30-year fixed set at 2-3%. So what then?

Fortunately a solution already exists. The FHA has a payment supplement solution that temporarily reduces the principal portion of the borrower’s monthly mortgage payment for a period of three years.

And it does this without modifying the mortgage, so the low mortgage rate stays in place.

Similar to the partial claim, the Payment Supplement is only repaid when the homeowner sells the property or refinances the mortgage, or the loan is otherwise extinguished.

This could provide a viable solution to help those who serve(d) this country remain in their homes.