With additional Bank of Canada rate cuts expected, variable-rate mortgages are becoming an increasingly attractive option.

But choosing flexibility comes with its challenges—borrowers must weigh potential savings against heightened market volatility and the growing uncertainty surrounding a possible trade war with the U.S.

Ron Butler of Butler Mortgages told Canadian Mortgage Trends that this is the most volatile time he’s seen in the bond market “in forever.”

“It’s literally like 2008, during the Global Financial Crisis, it’s so wild,” he said.

Butler notes that the Canadian 5-year bond yield, which typically leads fixed-mortgage rate pricing, fell from a high of 3.85% in April to 2.64% last week, a significant change in such a short period of time. As a result, following six consecutive Bank of Canada rate cuts, 5-year variable rates are now nearly on par with fixed equivalents for the first time since November.

Clients opting for variable rates in droves

Look past the volatility—and the threat of devastating U.S. tariffs —and variable rates present a compelling case.

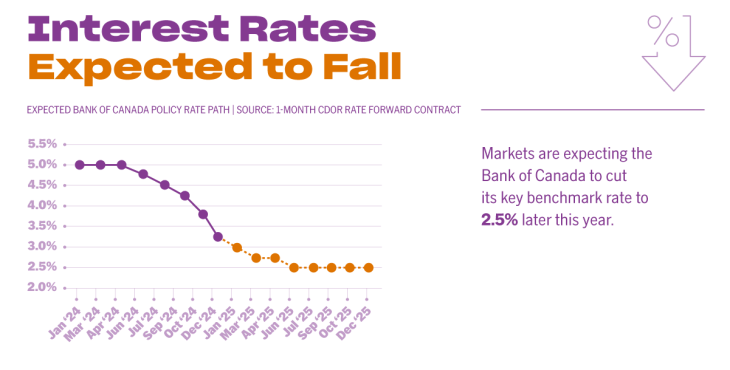

Markets are still pricing in at least two more quarter-point Bank of Canada cuts this year, which could push variable mortgage rates down at least another 50 basis points.

Some forecast even more aggressive rate-cut action will be required to counter the ecnoomic shock of a trade war with the U.S.

“I don’t think it’s a stretch to believe that the Bank will reduce its policy rate from its current level of 3.00% down to at least 2% during the current rate cycle,” David Larock of Integrated Mortgage Planners in a recent blog.

However, he cautions that there is also the risk that rate hikes come back into play should inflationary pressures re-emerge.

“While I expect variable rates to outperform today’s fixed-rate options, I caution anyone choosing a 5-year variable rate today to do so only if they are prepared for a rate rise at some point over their term,” Larock added. “Five years is long enough for the next rate cycle to begin, and for variable rates to rise from wherever they bottom out over the near term.”

Still, it’s a risk more and more borrowers are willing to take. Data from the Bank of Canada shows that as of November, nearly a quarter of new mortgages were variable-rate, up from less than 10% earlier in the year.

Butler says this trend has only accelerated in recent months, noting that the share of variable mortgages he’s originating has surged from 7% last year to 40% now.

“We advise clients to take variable because we now have actual reporting from marketplace analysts that it will go down,” he says. “The fee benefit of variable is a guaranteed penalty amount; you just don’t know what penalty you’re really going to get with fixed.”

Unlike fixed-rate mortgages, which often come with interest rate differential (IRD) penalties that can amount to tens of thousands of dollars, variable-rate mortgages typically carry a much smaller penalty—just three months’ interest—making them a more flexible option for borrowers who may need to break their mortgage early.

Butler argues that if tariffs are imposed, their impact on the mortgage market won’t be immediate, as inflation would primarily rise due to retaliatory counter-tariffs. This lag, he says, could give variable-rate borrowers a window to switch to a fixed rate before higher inflation forces the Bank of Canada to reverse course and hike rates.

“This kind of trade war means that in the beginning, the economy deteriorates, and interest rates go down; it takes nine months or a year for the inflation to really lock into a point where the Bank has to raise rates,” he says. “The inflation spiral takes time. The Bank of Canada will cut long before costs start to increase.”

Tracy Valko of Valko Financial, however, suggests that in such a trade war inflation becomes secondary to more immediate economic indicators, like unemployment. That, she warns, could skyrocket following a tariff announcement as companies brace for impact.

“‘Inflation’ was the word last year; this year I think it will be ‘employment,’ because tariffs will drive unemployment, and people won’t be able to afford housing, which will put a lot of pressure on the government infrastructure,” she says. “I don’t think it will be like inflation, which is a lagging indicator, because businesses will have to adjust quite quickly, and we could see massive unemployment in certain sectors.”

Even Trump’s latest tariff threat on aluminum and steel imports could have devastating impacts on Canadians workers in those industries within days.

Valko adds that high unemployment would potentially drive interest rates down faster—potentially even triggering an emergency rate cut, as National Bank had suggested—to blunt the effects of high tariffs. That potential scenario, Valko says, adds to the variable rate argument, but also adds to the widespread feeling of uncertainty in the market.

“A lot of people are really pessimistic right now on the future; we’ve had clients and homeowners that have had a lot of shocks in the mortgage market and the real estate market, and are not interested in having any more instability,” she says. “People are more educated than they’ve ever been before, so they are really looking at their financing — which is great to see — but people are very cautious, so to take variable, it has to be a very risk-tolerant client.”

Rate options for the more risk-averse borrowers

Valko notes that borrowers wary of economic uncertainty are increasingly choosing shorter-term fixed rates, offering stability without locking in for the long haul.

“Three-year fixed has been probably the most popular because it’s not taking that higher rate for the traditional five-year fixed rate term,” she says. “They’re hoping in three years we’ll see a more normalized and balanced market.”

For more cautious borrowers, hybrid mortgage—which split the loan between fixed and variable rates—are another option and are currently available through most major financial institutions.

“There are some people that are in the middle of that risk tolerance, and if they could put a portion in fixed and a portion and variable—and to be able to adjust it quickly—I think it would be a really good option,” Valko says.

Butler, however, disagrees.

“A hybrid mortgage means you are always half wrong about mortgage rates,” he says. “If the balance of probability clearly indicates variable is the correct short-term answer, take variable and carefully monitor the movement of fixed rates.”

Visited 1 times, 1 visit(s) today

5-year bond yield Bank of Canada bond yields Dave Larock fixed or variable fixed vs. variable IRD jared Lindzon rate outlook ron butler tracy valko variable mortgage rate variable rate mortgages variable rates

Last modified: February 11, 2025