- Key insight: The neobank posted a Q4 net loss of $20.8 million, widening 16.2% from the previous year, despite hitting record operating income.

- What’s at stake: The capital injection comes as Varo balances the high regulatory costs of its national bank charter with the need to achieve profitability.

- Forward look: Former executives from Morgan Stanley and JPMorgan have joined Varo’s board to help guide governance and risk discipline.

Overview bullets generated by AI with editorial review

Processing Content

Varo Bank announced Monday it had secured $123.9 million in new capital, providing a boost as the de novo’s quarterly results continue to show net losses piling up even as operating income hit a record high.

The San Francisco-based neobank, which became the first consumer fintech to obtain a national bank charter in 2020, announced the Series G funding round days after releasing financial data for the fourth quarter of 2025.

Warburg Pincus led the investment round joined by new investor Coliseum Capital Management, signaling continued support from private backers despite the bank’s fluctuating financial health.

This capital injection arrives as Varo attempts to balance the high regulatory costs of its charter with the need to scale its lending business and achieve profitability.

Alongside the funding news, Varo announced significant additions to its board of directors, appointing Alice Milligan, former chief marketing officer at Morgan Stanley, and Kevin Watters, former division CEO at JPMorgan.

“This combination of new capital, Coliseum’s partnership, and experienced banking leaders joining our board, is propelling Varo into its next phase of growth,” said Gavin Michael, CEO of Varo Bank, in a press release about the fundraise.

The new directors emphasized the bank’s unique position in the market.

“Varo has built something rare: a technology-first customer experience paired with the governance and risk discipline required of a nationally chartered bank,” according to a joint statement from Milligan and Watters.

Chris Shackelton, co-founder and managing partner of Coliseum Capital Management, expressed optimism about the bank’s trajectory despite market challenges.

“We believe Varo is building a resilient and scalable platform from which to capitalize on a significant market share opportunity,” according to Shackelton.

The bank’s latest call report, which details financial performance for the fourth quarter of 2025, presents a mixed picture of Varo’s efforts to reach profitability.

Call reports do not provide the same financial information about company performance as quarterly earnings reports issued by public companies, but they do provide some details of a bank’s health.

Varo reported an adjusted operating income of $38.6 million for the quarter, a 7.7% increase from the same period a year ago and a new high for the institution.

However, the bank continues to operate in the red. Varo posted a net loss of $20.8 million in the fourth quarter, widening 16.2% from a loss of $17.9 million a year ago.

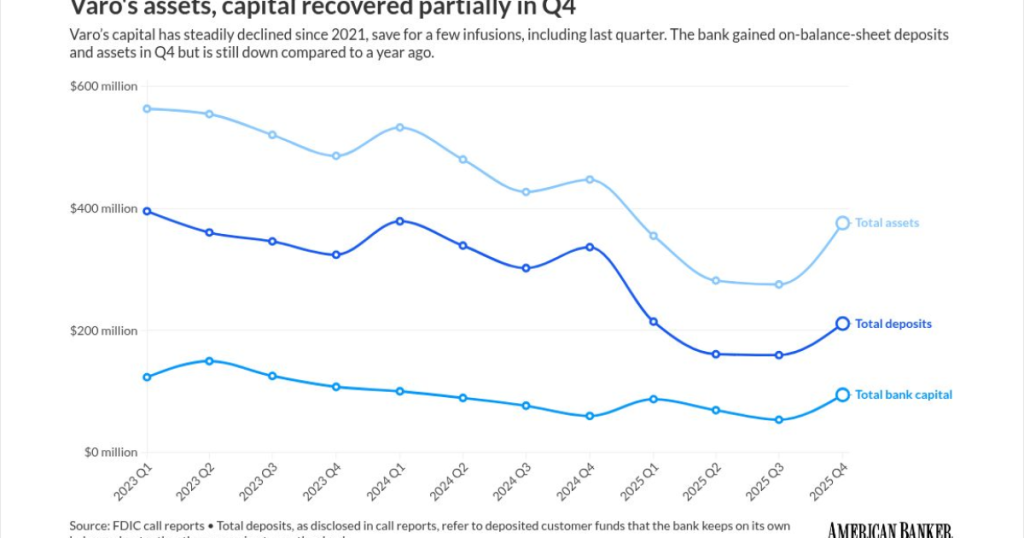

The balance sheet also reflected contraction in certain areas. Total deposits — the amount of deposited customer money that the bank keeps on its own balance sheet rather than sweeping to another bank — fell to $211.4 million, a 37.2% decline from the previous year.

Varo sweeps some deposits off its own balance sheet to partner banks to optimize interest earnings and manage capital. As of November, total deposits — swept and unswept — were at $300 million, in line with the previous year.

Since 2021, Varo’s capital has declined in all but three quarters as the company burns in pursuit of profit. Apparent capital infusions have extended this burn on a few occasions, including in the fourth quarter, when Varo’s reported total bank capital leapt up to $94.7 from $53.8 million in the third quarter.