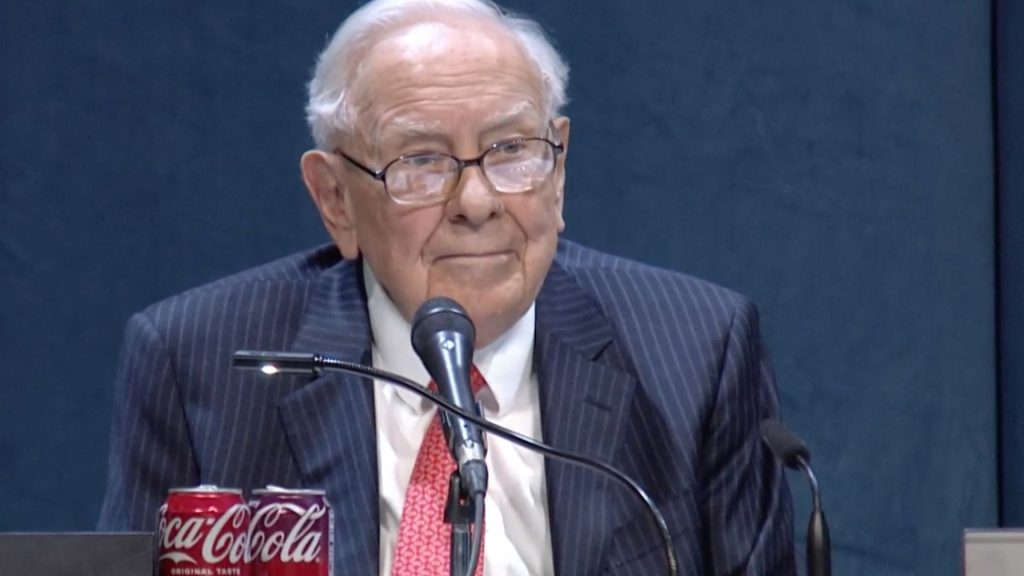

Warren Buffett laid out a plan to “step up” the pace of giving away his $149 billion estate to his children’s foundations, while still allowing for a short period that lets Berkshire Hathaway shareholders gain confidence in incoming CEO Greg Abel.

Buffett, in a Thanksgiving letter that will become an annual tradition, said he needs to accelerate the disbursement of his Berkshire stock to his three children’s foundations because of their own advanced ages and that by doing so it will “improve the probability that they will dispose of what will essentially be my entire estate before alternate trustees replace them.”

Abel, 63, is set to take over for Buffett, 95, as Berkshire CEO at the start of the new year with the “Oracle of Omaha” remaining chairman.

“I would like to keep a significant amount of ‘A’ shares until Berkshire shareholders develop the comfort with Greg that Charlie and I long enjoyed,” wrote Buffett, referring to longtime Berkshire vice chairman and his cherished business partner, Charlie Munger, who died two years ago.

“That level of confidence shouldn’t take long. My children are already 100% behind Greg as are the Berkshire directors,” said Buffett.

Buffett owns about $149 billion worth of Berkshire based on shares held at the end of the second quarter, making him far and away the largest shareholder. Most of his wealth is in the original A shares which trade for around $751,480 a share.

He said 1,800 of those Berkshire A shares were converted into 2.7 million B shares and given Monday to four family foundations: The Susan Thompson Buffett Foundation, The Sherwood Foundation, The Howard G. Buffett Foundation and the NoVo Foundation. This donation is worth more than $1.3 billion.

“The acceleration of my lifetime gifts to my children’s foundations in no way reflects any change in my views about Berkshire’s prospects,” added Buffett.

The note marks Buffett’s first major communication since announcing plans to step down as CEO, signaling the close of a six-decade run that made him a household name and one of the most successful investors in history.

“As the British would say, I’m ‘going quiet.’… sort of,” Buffett wrote in the letter.

‘I Generally Feel Good’

Abel, currently vice chairman of noninsurance operations, will take over writing Berkshire’s annual shareholder letters — a tradition that Buffett began in 1965 and that has become essential reading across Wall Street — while Buffett said he will continue this Thanksgiving message.

In one of the most personal passages of the letter, Buffett gave a rare update on his health.

“To my surprise, I generally feel good. Though I move slowly and read with increasing difficulty, I am at the office five days a week where I work with wonderful people,” he wrote. “I was late in becoming old … but once it appears, it is not to be denied.”

The Berkshire Fortress

Since taking control of Berkshire in 1965, Buffett has transformed a struggling textile mill into a $1 trillion conglomerate spanning insurance, railroads, utilities and consumer brands.

He devoted part of his letter to reaffirming Berkshire’s durability, saying it is designed to withstand nearly any economic environment.

“Berkshire has less chance of a devastating disaster than any business I know,” he said.

Berkshire held a record $381.6 billion in cash at the end of September, underscoring its unmatched balance sheet and cautious investing approach. It has also been selling equities for 12 straight quarters, reflecting Buffett’s caution in a richly valued market.

The company’s underlying businesses remain strong with operating profit jumping 34% in the third quarter. Still, Buffett acknowledged that Berkshire’s sheer scale has become both its strength and its limitation.

“In aggregate, Berkshire’s businesses have moderately better-than-average prospects, led by a few non-correlated and sizable gems. However, a decade or two from now, there will be many companies that have done better than Berkshire; our size takes its toll,” he wrote.

Berkshire‘s stock has risen roughly 10% in 2025, outpacing many defensive names but lagging the S&P 500 amid a tech-driven rally.

“Our stock price will move capriciously, occasionally falling 50% or so as has happened three times in 60 years under present management,” Buffett said. “Don’t despair; America will come back and so will Berkshire shares.”

— With reporting by Becky Quick.