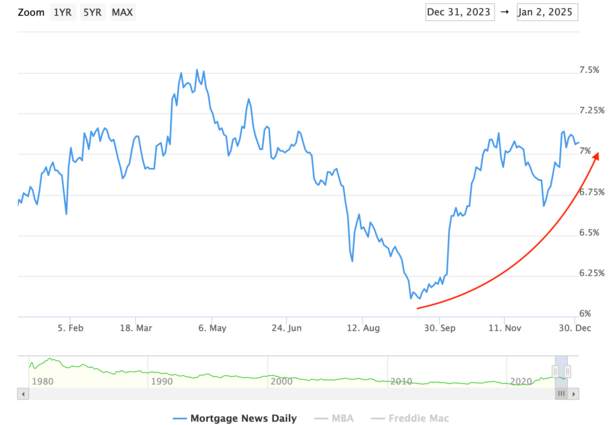

What a difference a year makes. Toward the end of 2023, mortgage rates fell nearly 150 basis points to ring in the New Year.

Meanwhile, mortgage rates jumped about 100 basis points to close out 2024. Ouch!

In other words, things were looking bright heading into 2024, and feel a bit bleak by comparison going into 2025.

Despite that, the 30-year fixed isn’t all that different than it was a year ago.

Rates were actually about neck-and-neck until they diverged in mid-to-late December.

Mortgage Rate Sentiment Has Worsened

At last glance, the 30-year fixed averaged about 7.07%, per Mortgage News Daily, and 6.91%, per Freddie Mac.

According to Freddie, it’s the worst average going back to July, meaning it’s been a rough stretch for the 30-year fixed.

Whether that points to some relief soon is another question, but it’s certainly a stark contrast to late 2023 and early 2024.

A year ago, the 30-year fixed was finally starting to show signs that it had topped out and that the worst was behind us.

After all, the 30-year fixed climbed just above 8% in October 2023 and had fallen to around 6.625% by the end of the year.

So things were looking up as we rang in 2024, largely because the Fed had indicated it was ready to pivot.

It wasn’t going to hike its own fed funds rate anymore, and chances of a rate cut were now on the table.

That held true, though it took about nine months for the Fed to finally act on that rate cut.

And lo and behold, the 30-year fixed began ascending once the Fed finally did cut, which got everyone confused in a hurry.

Today, prospective home buyers are facing a mortgage rate that is about one percentage point higher than it was just three months ago.

Will Mortgage Rates Get Better or Worse by Spring?

If we look back on early 2024, mortgage rates actually rebounded higher after experiencing that big move down to the mid-6s from 8%.

Perhaps it was too much of a good thing and simply not sustainable. At the time, we were still grappling with inflation and there were a lot of head fakes.

The 30-year fixed wound up back around 7.50% in April, putting a damper on the traditionally strong spring housing market.

When all was said and done (we’re still counting), 2024 might go down as the bottom for home sales this cycle.

All that talk about home buyers rushing back in didn’t materialize. There was a theory buyers would strike early to “beat the rush,” but that rush never came. Instead they were told to wait again.

Now the million-dollar question; will things be different in 2025? Will the home buyers rush back in this year?

That might hinge on what mortgage rates do this spring. One could argue that they’re due for an improvement given the dramatic rise to close out 2024.

The 30-year fixed was around 6% in September and rose to 7% because of renewed inflation concerns and a stronger-than-expected jobs report.

But history still says mortgage rates tend to fall for a while post-Fed pivot. And thus far they remain above levels pre-pivot.

Can Home Buyers Wait Any Longer?

So we know mortgage rates will play a role here, as they always do. But another thing to consider in 2025 is home buyer patience.

Many who wanted to buy a home last year may have held off after rates experienced an unexpected uptick.

It was a bit of a gut punch after it appeared rates were finally in the clear and headed back down to more palatable levels.

For these folks, plans were set back yet another year, though life must go on. And the more time that goes by, the more everyone gets used to these higher mortgage rates.

Human psychology is at play and a rate that starts with 6% or even 7% isn’t a big scary rate anymore.

We’re all used to it by now. And we’ve all seen worse, with rates in the 8% range in late 2023 as noted.

The problem though is that affordability remains abysmal historically. Rates are one piece of the problem, but not all.

There is also a high asking price to contend with, along with costly property taxes and rising homeowners insurance premiums.

Taken together, the total housing payment (PITI) simply might not pencil, as much as someone wants to be a homeowner today.

So either home sellers are going to need to get more serious and drop their asking prices, or we’ll need some mortgage rate relief as we head into spring.

Otherwise it’s going to be another dismal year for the housing market, at least in terms of sales volume.

Read on: 2025 Mortgage Rate Predictions: Where Do They Go From Here?