Adobe Stock

At

Whether it’s the apocalyptic images of whole neighborhoods razed by wildfires in Los Angeles (or hurricane-battered cities like Houston and Tampa before that); the economic dislocations caused by American tariffs on our largest trade partners and further inflation; or the intense uncertainty surrounding the emergence of generative AI, perpetual crisis seems to be the new normal. And the finance community — while flush and in the mood for dealmaking — is trapped in a reactive stance, unable to take a more proactive, thoughtful and strategic approach that anticipates the ways in which our world is transforming.

What would that approach look like?

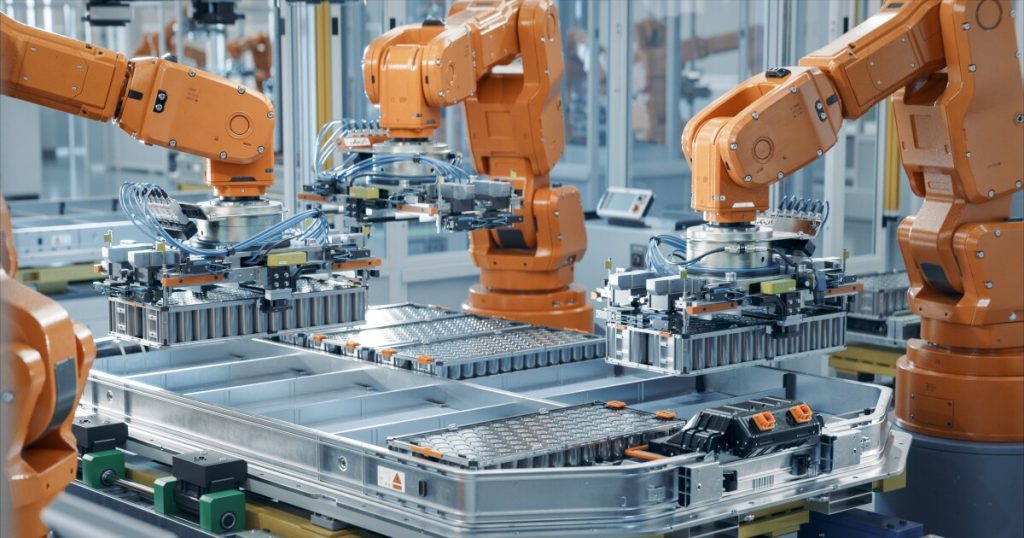

First, it would acknowledge the need for significant industrialization: lithium processing facilities, modular nuclear reactors, biomanufacturing plants, compute capacity and novel electrical assembly operations. For far too long, Wall Street’s capital has flowed primarily to digital and consumer-focused assets, while heavy industry — increasingly indispensable to economic security — has struggled to attract the scale of financing required to thrive in the new, globally hypercompetitive era that’s now upon us.

Second, it would recognize that the benefits of these investments — though they will take years to materialize — are essential to whether we continue to win, and that to meet the moment, Wall Street needs to quickly align itself with this long-term vision.

Third, a better approach can help realize a new industrial asset class: the bio-manufacturing plants, the networks of data centers we desperately need, and the specialty manufacturing for tool and die making. But only if we figure out how to finance them.

If capital markets fail to support new industrial projects — from new semiconductor foundries to clean energy infrastructure — the U.S. risks falling behind, ceding industrial and technological leadership to foreign competitors. Our ambitions will only be realized if private investment, public policy and industry innovation work in tandem, and work fast.

History reminds us of what’s at stake if we don’t adapt and how entire nations have fallen behind in worst-case scenarios.

Germany’s shift to renewable energy starting in the early 2000s was not immediately matched by its financial sector, which was slow to finance renewable projects. It took years before banks and investors fully backed the transition, leaving much of the early capital needs to government subsidies. Similarly, despite the rapid adoption of mobile payments worldwide in the 2010s, many Indian banks were initially slow to invest in digital infrastructure. This misstep allowed third-party tech players like Paytm to dominate the market while major banks had to play catch-up.

But history has also shown that when markets adjust to emerging challenges, those ready to think creatively and embrace change stand to gain the most.

To remain resilient, the United States needs to pivot to new models of blended finance to invest in new industrial infrastructure. Established financial players, alongside venture firms, family offices and institutional investors have a vital role to play in marshaling resources for this new era. We can meet this challenge by providing targeted products that address the needs of this “missing middle” — those ventures too large for venture capital alone but not yet suited to traditional public markets.

We’ve done it before. Finance can be an adaptive industry. Consider the rise and dominance of investment banking in the 1980s, spurred by deregulation, relaxed antitrust laws and lower taxes. Or Wall Street shifting to accommodate the rise of personal technology in the 1990s. Similarly, the growth of the internet and new methods of electronic trading demolished barriers to entry and spawned thousands of lucrative hedge funds.

In facing another industrial revolution, we would do well to remember the lessons of an earlier success, beginning in the 1870s. With European powers asserting new imperial dominance abroad, the U.S. faced pressure to strengthen its economic foundations at home. This competitive landscape spurred the American government and private sector to adopt innovative financing models, particularly in building the transcontinental railroads that became the backbone of economic growth and innovation. Blended financing that combined equity, private debt and public investment enabled these massive infrastructure projects to materialize, creating a resilient economy capable of holding its own amid turbulent geopolitical shifts.

If the private sector, policymakers and investors fail to evolve now, the promise of this new era will remain elusive. A commitment to reshaping American manufacturing with a focus on innovation and productivity could hold the key, but only if we recognize the urgency and act accordingly. As we enter a new age as a nation, America is faced with a choice: Either continue with the status quo that only reacts to the latest dislocation or adapt by adopting an economic model that unlocks a new industrial revolution.