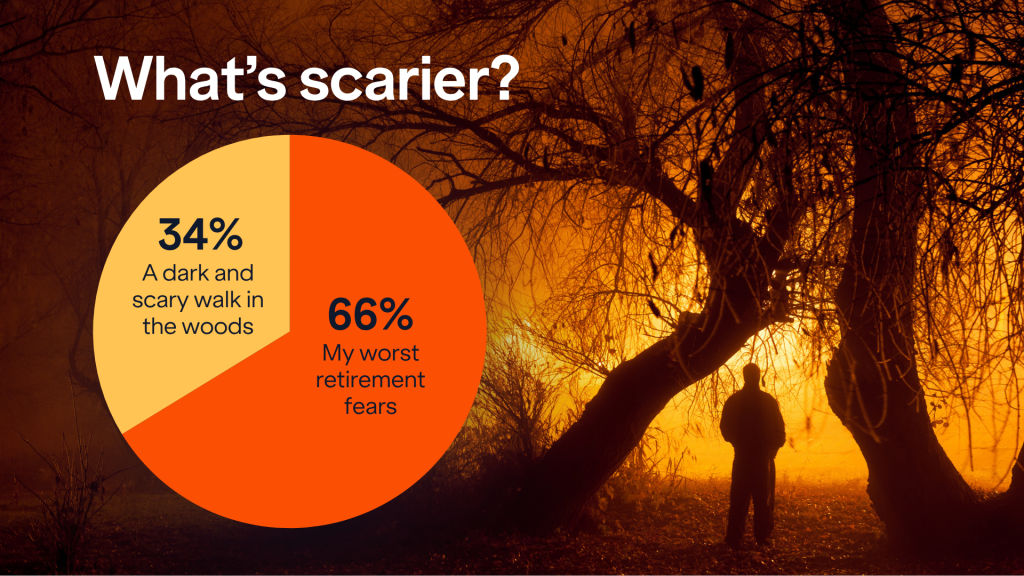

This October, we asked Boldin users a simple question: What’s scarier — your retirement fears or walking alone in the woods on a dark Halloween night?

Turns out, two-thirds (66%) said their worst retirement fears were scarier than a creepy midnight stroll (before they had a plan). Only one-third would have rathered face the unknowns lurking in the shadows of rustling trees. And, it is retirement unknowns that cause the most fear.

But when we dug deeper, we found that a written retirement plan can act as a powerful flashlight that illuminates those fears and makes them far less ominous.

Uncertainty Can Be Terrifying

Before having a written retirement plan, the biggest fear by far was running out of money or outliving savings (39%). Close behind were not being able to afford the life you want (19%) and not knowing how to plan for future unknowns (17%), events like market crashes, inflation, or natural disasters.

A smaller share worried about losing control and security (7%) or healthcare costs (6%), but taken together, these responses paint a clear picture:

For most people, uncertainty is the scariest thing of all.

Retirement Fears Are Deeply Felt

And, before creating a plan, those retirement fears were deeply felt. Over 67% said their worries surfaced regularly. More than a quarter 26.7% said they “weighed on them quite a bit,” 40.4% said that they were somewhat worried and 25.5% were a little concerned. Only 3% said they weren’t worried at all.

Finances Are the Biggest Monsters, But Non-Financial Fears Weigh Heavily Too

We asked survey respondents about whether their greatest retirement fears were related to money or general life fears like health and purpose. And, money weighs more heavily. Fifty-seven percent said that loss of financial control and security, outliving savings, healthcare costs, and other financial concerns were more significant than things like loss of purpose and declining health, which only 42% said were scarier.

Of the non-financial fears, emotional and health-related concerns dominated:

- Declining health (29%)

- Cognitive decline (22%)

- Loss of purpose (14%)

- Loneliness or loss of social connection (7%)

- Death of a spouse or loved one (11%)

What Helps Tame Financial Fears?

Beyond building a holistic retirement plan, Boldin users said these strategies help them feel more secure:

- Running “what-if” scenarios and contingency planning (66%)

- Guaranteed income streams like pensions, Social Security, or annuities (43%)

- Consistent saving and investing (34%)

- Becoming debt-free (36%)

- Professional financial guidance (26%)

In other words, clarity and preparation beat anxiety and avoidance every time.

The Magic of a Written Plan: Replace Fear with Preparation

The single most powerful finding: 96% of people with a written plan say it makes them more confident about the future.

- 68% feel much more confident

- 28% feel somewhat more confident

- Just 3% said it didn’t change their outlook

And when asked how they feel about retirement today:

- 46% feel confident — they’ve planned carefully

- 49% are somewhat confident — they’ve done some planning, but worries remain

- Only 4% still feel anxious

- 0% said they were fearful

That’s right: among Boldin users, no one said they were outright fearful about their financial future. Planning doesn’t erase uncertainty — but it replaces fear with the confidence that comes from knowing you can handle whatever comes your way.

From Fear to Freedom

A written retirement plan doesn’t just crunch numbers. It gives you control, confidence, and the ability to adapt — no matter what the world (or the market) throws at you.

So this Halloween, while others are scared of ghosts and shadows, you can rest easy knowing your financial monsters are tamed — one plan, one “what-if,” one confident step at a time. Ready to face your fears? Build your plan, run your “what-ifs,” and see what’s possible with Boldin Planner.