Editor’s Note: Director of Trading Anthony Summers has the week off from writing The Value Meter so he can focus on some exciting new ideas we’re researching here at the Club.

I’m sharing today’s article, which Anthony wrote for the December issue of The Oxford Income Letter, because it relates to The Value Meter’s focus on blocking out the noise and focusing on fundamentals. In today’s markets, that’s arguably more difficult – but also more relevant – than ever.

If you have any stock requests for Anthony to evaluate in a future edition of The Value Meter, please drop them in the comments section below.

– James Ogletree, Senior Managing Editor

Markets today often feel like they’re speaking a new language. Not the one most of us learned. Not the one where a stock moved because the business changed or where volatility reflected something grounded in reality. We’re operating in a louder, more chaotic environment – one where the swings are sharper and the signals harder to trust.

Here’s the uncomfortable truth: Markets aren’t growing more efficient with time. They’re drifting further from the companies they’re supposed to measure.

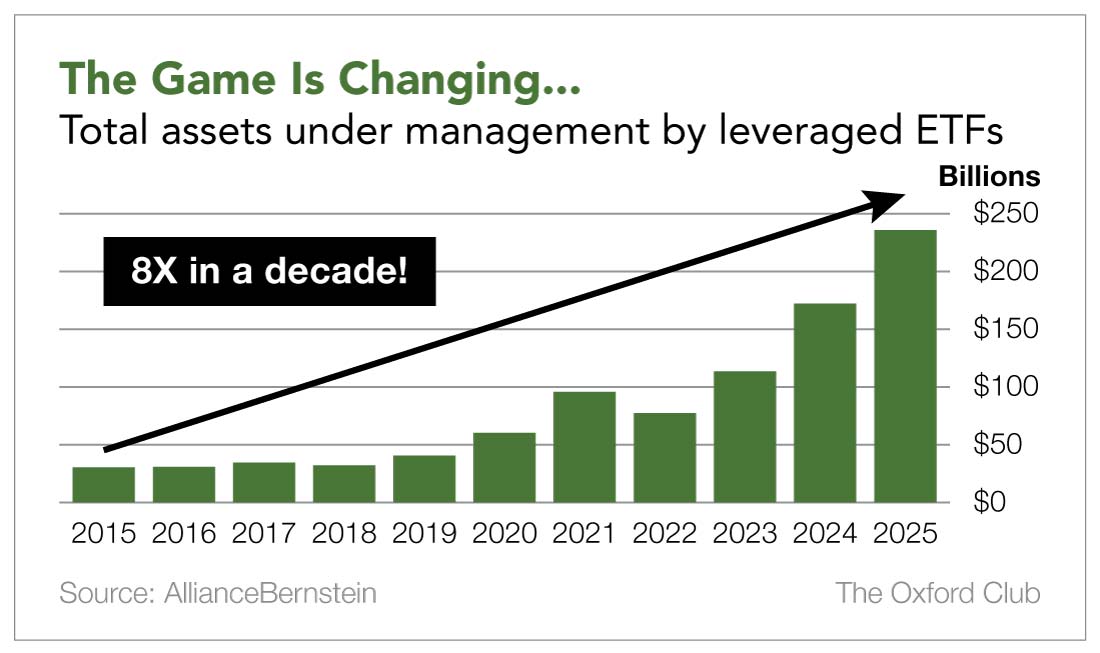

The data makes this hard to ignore. Over the past decade, leveraged ETFs – funds that aim to amplify the returns of a benchmark index – have ballooned from roughly $30 billion in assets in 2015 to nearly $240 billion in 2025.

At first glance, that jump might look like a quirky industry trend. But it represents something far more important: a massive increase in capital tied to investment products that react mechanically rather than analytically.

When markets rise, these funds must buy. When markets fall, they must sell. Their daily rebalancing – often concentrated in the final minutes of trading – forces bursts of activity that move prices with no regard for earnings quality, margins, balance sheet strength, or any of the fundamentals investors are taught to care about.

On top of that, the surge in zero-day options has accelerated this disconnect. Dealers hedge in real time, sometimes second by second, producing flows powerful enough to shift the direction of billion- and even trillion-dollar stocks – and sometimes entire indexes.

The machinery of it all now moves faster than meaning. Prices no longer wait for a story because, too often, they are the story.

This has pushed many investors to lean even more heavily on diversification as a defense. Diversification is important, but when it comes to diversifying across sectors, it doesn’t work the way people assume. Companies’ sector labels simply don’t match how they actually make money today.

For example, Microsoft and Alphabet sit in different sectors even though both compete across cloud infrastructure, AI, online advertising, and enterprise productivity. Meanwhile, a fiber-optic network operator in New Zealand is grouped in the same sector as Alphabet despite the two sharing almost no economic drivers.

In short, the map of the market hasn’t kept pace with the terrain. Yet portfolios continue to follow it out of habit and convention.

Global value chains complicate this even further. A single fire at a Renesas semiconductor plant in Japan once halted Ford’s production lines around the world.

Risks no longer stay neatly inside industries or regions. They move through suppliers, customers, transport networks, software dependencies, and geopolitical chokepoints. That means your investments can appear diversified while still hinging on the same fragile point of failure.

Many investors feel this shift even if they can’t always name it. They see a company beat earnings and watch the stock fall anyway. They see solid businesses dragged around by noise that has nothing to do with management execution or long-term prospects.

As markets continue drifting toward noise, I find myself returning to the only parts of a business that don’t get swept up in the chaos: the fundamentals. Real earnings and real customers. Real costs and real cash flow.

Over the years, the more the noise has grown, the more I’ve realized that a less efficient market isn’t something to fear. It’s something to work with. Opportunity still exists, but it rewards a different posture – one built on slowing down, reading more carefully, paying attention to incentives, and understanding the forces underneath price action.

The longer I observe this shifting landscape, the more convinced I am that real analysis doesn’t become obsolete in a noisy market – it becomes essential.

In a world moved by mechanics instead of meaning, disciplined investors aren’t at a disadvantage.

They’re the only ones still playing the real game.