WASHINGTON — Two of America’s smallest types of financial institutions are at loggerheads because one keeps buying the other.

Community bankers have for years advocated that credit unions should face heightened regulatory scrutiny, and that the largest among them should be taxed on income.

One of the biggest pressure points for community bankers is credit union acquisitions of banks, a trend they say has increased in recent years as the credit union industry and its biggest institutions get larger. Credit unions compete with banks, at least in terms of consumer deposits, so the competition between the institutions that can be similar in size isn’t surprising.

Bankers have been

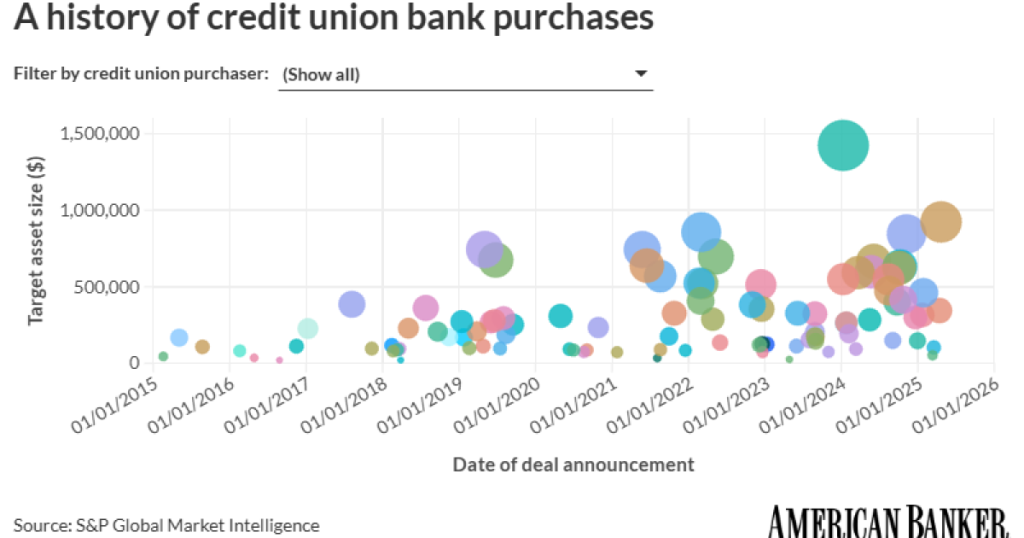

So how true is this credit union buying spree argument? In short, credit unions are indeed announcing more and more bank acquisitions.

A data analysis from American Banker outlines the scope of this trend, and the numbers tell a story of an industry in rapid transformation. The data in the analysis is pulled from S&P Global Market Intelligence, and it includes all announcements of credit union acquisitions of banks, excluding those that have been marked as terminated.

Ten years ago, credit unions acquired only a handful of small banks annually. Now they’re buying institutions worth hundreds of millions of dollars, sometimes thousands of miles from their home bases, according to the data.

In 2024 alone, credit unions announced 22 bank purchases (19 that have not now been terminated), more than in any previous year on record. Through August 2025, credit unions have already announced eight more deals to acquire banks.

This is very much a live trend. Just a few weeks ago, Avenir Financial Credit Union in Yuma, Arizona, said that it has agreed to buy Mission Bank in Kingman, Arizona. Days before that, San Francisco Federal Credit Union said it would acquire the $287 million-asset Summit Bank.

Last year Texas Dow Employees Credit Union announced its intention to purchase Sabine State Bank and Trust Company, a $1.4 billion institution that represents one of the largest credit union acquisitions on record. That deal has since been canceled, so it doesn’t show up in the American Banker visualization.

Also in 2024, Global Credit Union announced its acquisition, which has since closed, of First Financial Northwest, a more than $1.4 billion institution, the largest deal of its kind on record.

When a credit union acquires a bank, those assets are no longer taxed in the same way, or as much as they are when they belong to a bank, said Michael Emancipator, Independent Community Bankers of America regulatory counsel. ICBA has repeatedly tried to get Congress to eliminate the credit union income tax exemption for institutions larger than $1 billion.

The group got the closest they ever have to achieving that aim earlier this year in the early negotiations to the One Big Beautiful Bill Act, when credit union taxes on large institutions were considered as a pay-for. The idea fell out of the discussion relatively quickly, but it’s the first time it’s been

“The revenue from the credit union going forward, the profits from the credit union going forward, are no longer taxed,” Emancipator said. “They can take all those and build up a war chest of capital well beyond what a well run institution might want to save in capital.”

The acquisition issue is, for ICBA at least, one of the biggest examples of how some credit unions have strayed from their original missions, and one of the biggest arguments for achieving that long-held tax policy aim.

“The best example I think we can offer is when a credit union acquires a bank, especially when a credit union acquires a bank multiple states away,” Emancipator said. How is that helping the individual member of that existing credit union? If you had a choice as a member, can I get a lower rate on my loan? Or if I’m in Michigan, should my credit union buy a bank in Florida, where I’ve never visited and where I never plan to move?”

There are instances of credit unions announcing deals for banks that are far away from their existing membership base. They don’t, however, make up a bulk of the deals.

Credit unions have fought back against ICBA’s claims.

“These are transactions that are entered into by both parties willingly,” said Curt Long, America’s Credit Unions chief economist. “They’re reviewed by regulators on both sides, and on the credit union side, membership obviously has a say through its governance structure.”

The two main credit union trade groups officially merged last year, becoming a larger and stronger lobbying organization called America’s Credit Unions.

“We’re supportive of the deals,” Long said. “We think in a lot of cases, the bank that is being acquired looks at credit unions in a good light because they’re community based institutions, and traditionally they tend to keep branches open, keep employees employed and are committed to serving the existing customer base.”

Frank Gargano contributed to this report.