The territory says the Yukoner First Home Program will give eligible homebuyers loans that would cover up to half of their down payments on a purchase, and repaying the loan can be deferred until the buyers’ mortgage has been refinanced or paid off.

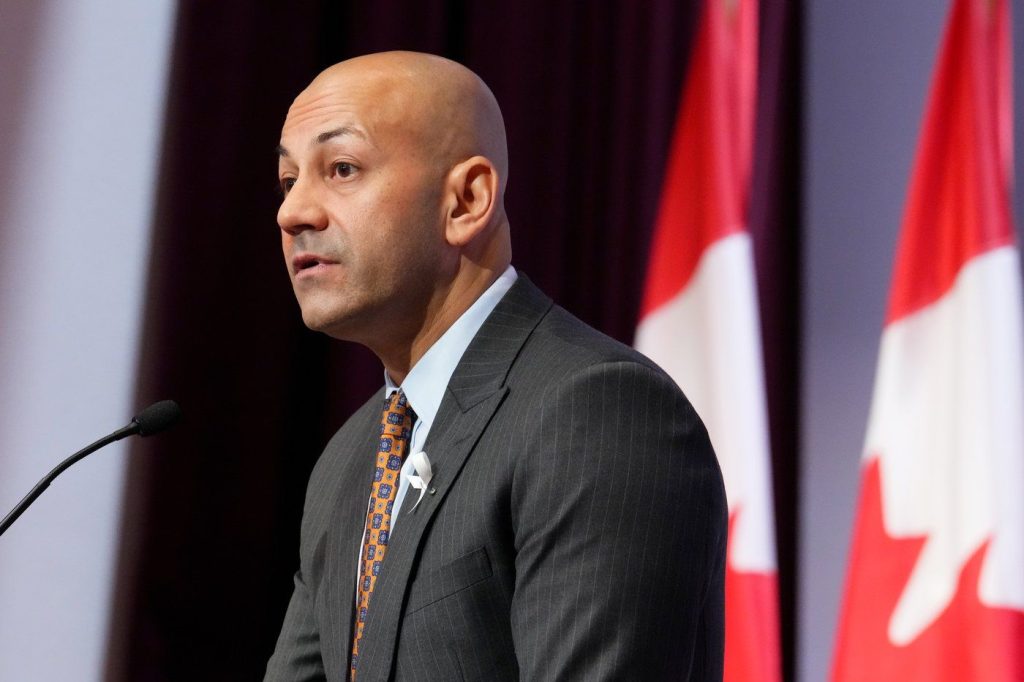

Premier Ranj Pillai says in a statement that the program is meant to cover a gap between a first-time homebuyer’s savings and the barrier created by a high down-payment amount, especially when buyers may also be paying rent on their current home.

In order for an applicant to be eligible for the loan, they must be a first-time buyer with a mortgage pre-approval from a lender and have enough money to cover at least half of the down payment as well as closing costs.

There are also limitations for the type of properties eligible for the loan, including having a purchase price no higher than the maximum average sale price in Whitehorse for that property’s residential type.

The loan can also be no higher than five per cent of the home’s purchase price, and the property must remain their principal residence for the duration of the mortgage.

“We know it can be tough to save for a down payment while paying rent,” Pillai says in a statement. “That’s why our government is proud to offer this new support for first-time homebuyers.

“This program will help more Yukoners take the important step into home ownership, building stronger communities and a more resilient economy for people who want to live, work and build a future here in the Yukon.”

The Yukon government says the loan’s interest rate is fixed at 2.5% and compounds annually.

The territory has budgeted $1 million for the loan program, and it says a review will be conducted after one year to determine if Yukon’s first-time homebuyers had their needs met by the new initiative.

Visited 58 times, 58 visit(s) today

down payment assistance down payments Editor’s pick first-time home buyer incentive first-time homebuyers government programs Ranj Pillai The Canadian Press yukon Yukoner First Home Program

Last modified: April 24, 2025