Well, it sounds like the new Mesa Homeowners Card got the attention of one of its competitors.

Bilt is best known for its credit card that allows its members to earn points on rent, but soon homeowners will be able to earn points on mortgage payments too.

We heard rumblings of this possibility a while back, but it never materialized, possibly because the numbers just didn’t pencil.

Now it seems like some good old fashioned competition may have proven to be the mother of innovation.

And if you’ve been paying attention, Mesa, which is planning the same thing, just so happened to be built by some former Bilt employees, among others.

Bilt MasterCard Will Reward Homeowners in 2025

In its Letter to Bilt Members released today, Bilt Rewards CEO Ankur Jain said, “We’ll announce the first phase of plans in the mortgage space, creating a whole new category of value for homeowners.”

This includes the ability to earn points on mortgage payments, and points when refinancing a mortgage, likely a referral style program.

As I always say with those referral programs, don’t use the lender unless the total cost is lower than other options, even if you can earn points!

Anyway, the fact that you’ll be able to use a credit card to pay the mortgage is the biggie here, at least for me.

It’s been very difficult to pull off, and even when it is permissible, there are often hefty fees that negate the benefit of using plastic.

I’ve long thought that the math just doesn’t work and that mortgage lenders and loan servicers aren’t too keen about their customers charging the mortgage. And who can blame them?

But the public has been pretty vocal about wanting points/cash back on virtually all purchases they make, especially large transactions that have big earnings potential.

So apparently Bilt will soon allow you to pay the mortgage with a credit card. Just stay tuned on that official launch date.

Competition Heats Up for Homeowners in the Credit Card Space

Lately, it seems credit card issuers have grown increasingly interested in homeowners.

It makes sense as they probably have a lot of expenses (other than the mortgage) and could be solid customers.

As noted, a new competitor (Mesa) entered the fray recently with its Mesa Homeowners Card that earns one point per dollar spent on monthly mortgage payments.

It’s currently waitlisted, but may have been the inspiration for Bilt to make the announcement in their letter today.

Especially since some of the Mesa team includes former Bilt employees.

For the record, Bilt was floating this idea in early 2024 as well but nothing came of it all year.

Perhaps they are still working out the economics of it, as it could be costly to allow mortgage payments on their network when no others card issuers permit it without fees.

I also wonder if there’d be an annual fee on the card or if it would require cardholders to spend X amount on other purchases as well.

At the moment, the Bilt Mastercard offers 1X on rent but you need to use the card at least five times each statement period to actually earn points.

This could well be a requirement for mortgage payments too. Obviously it has to make sense to all parties involved.

Bilt Rewards Now Offers Points on Home Purchases Too

Back in late November, Bilt announced that it launched the industry’s first program to earn points on home purchases.

What they meant by that is Bilt Members will now be able to earn Bilt points when purchasing a home through an eXp Realty agent.

So it’s essentially a real estate agent referral program where you earn one Bilt point for every $2 in property price if you link up with one of their preferred agents.

On a $400,000 home purchase we’re talking 200,000 Bilt Points, which are redeemable for all types of stuff like shopping, fitness classes, and travel.

In fact, you can transfer the points to frequent flyer programs and hotel loyalty programs at a 1:1 ratio to maximize the value.

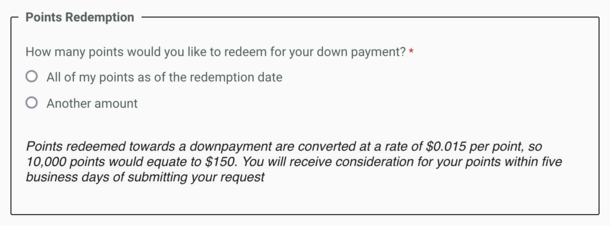

Perhaps even more interesting, you can redeem Bilt points for a down payment on a home, and the value is an even better 1.5 cents per point.

This works out to $1,500 towards your down payment if you have 100,000 Bilt points. Pretty cool.

Lastly, you can apply points toward rent as well, though the redemption value is a lesser 0.55 cents per point, or $55 for every 10,000 points.

In other words, it might be better to save those points and use them on a down payment for a new home and kiss rent goodbye!

Read on: Should I rent or buy a home?