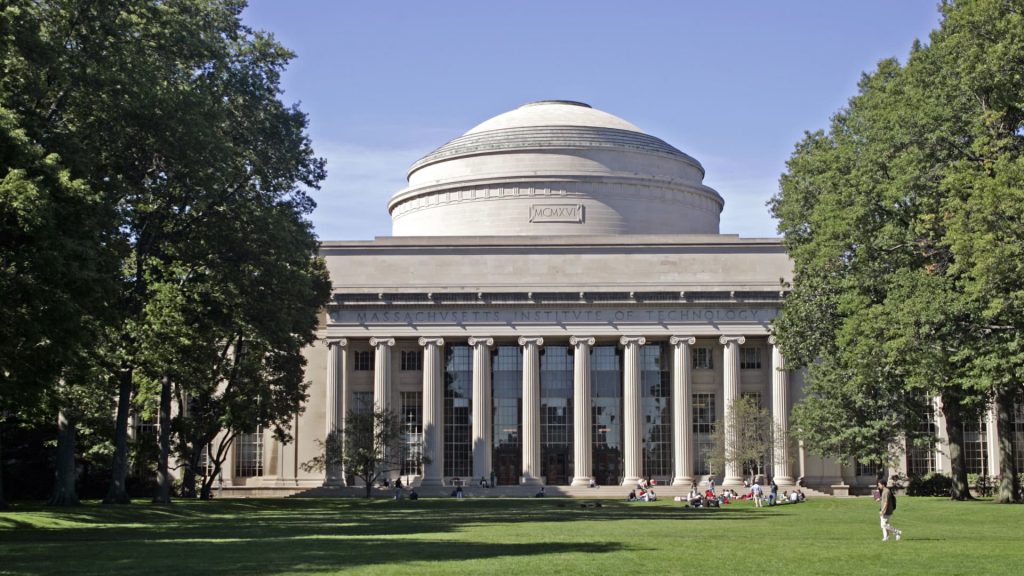

Students on campus at Massachusetts Institute of Technology in Cambridge, Massachusetts.

Education Images | Universal Images Group | Getty Images

Harvard University is no longer the ultimate “dream” school, at least among current college applicants.

This year, Massachusetts Institute of Technology secured the top spot of most desirable colleges, according to a new survey of college-bound students by The Princeton Review.

Harvard fell from No. 1 after a prolonged period of controversy, marked by antisemitism on campus and the resignation of Harvard President Claudine Gay amid allegations of plagiarism.

Despite the reshuffling, there remains a common element at the top of the rankings, according to Robert Franek, The Princeton Review’s editor-in-chief. “Each of the schools are exceptional,” he said.

However, regardless of which institution they attend, for most students, the biggest problem remains how they will pay for their degree.

Cost is a major concern

A whopping 95% of families said financial aid would be necessary to pay for college and 77% said it was “extremely” or “very” necessary, The Princeton Review found. Its 2025 College Hopes and Worries Survey polled more than 9,300 college applicants between Jan. 17 and Feb. 24.

Often, which college those students will choose hinges on the amount of financial aid offered and the breakdown across grants, scholarships, work-study opportunities and student loans.

More from Personal Finance:

How Musk’s DOGE took over the Education Department

$2.7 billion Pell Grant shortfall poses a threat for college aid

Trump’s ‘gold card’ visa opens a door for wealthy college applicants

MIT is one of the hardest schools to get into, with an acceptance rate of 4.5%. It’s also among the nation’s priciest institutions — tuition and fees, room and board and other student expenses came to more than $85,000 this year.

But MIT also offers generous aid packages for those who qualify. Last year, the median annual cost paid by an MIT undergraduate receiving financial aid was $12,938, according to the school. Among the Class of 2024, 87% graduated debt-free.

Top colleges are seeking exceptional students from all different backgrounds, according to James Lewis, co-founder of the National Society of High School Scholars, an academic honor society.

To that end, many institutions will provide scholarships or discounted tuition, in addition to other sources of merit-based aid, he said.

For qualified applicants, “if they can go after those institutions, don’t self-select out,” Lewis said.

The return on investment: a good job

In part due to the high cost of college, students are also putting more emphasis on career placement, according to Christopher Rim, president and CEO of college consulting firm Command Education.

At MIT, for example, 2024 graduates earn a starting salary of $126,438, according to the latest student survey — nearly twice the national average. The percentage of MIT graduates employed in the months immediately after graduation has edged lower in recent years, while the share enrolling in graduate school has trended higher.

“Because it’s getting harder to find a job, students are more focused on what they are going to do after college,” he said. “That’s a big thing for them.”

When asked what they consider the greatest benefit of earning a college degree, most students said it was a “potentially better job and income,” The Princeton Review found.

Fewer said it was “exposure to new ideas, places and people.”