It’s been a pretty solid week or two for mortgage rates.

The 30-year fixed, which unexpectedly breached the key 7% psychological threshold in mid-April, is back closer to 6.75%.

It’s still a lot closer to 7% than 6%, but after the worsening trade war sent rates flying, they’ve since calmed down a bit.

The problem is when you zoom out, the good days haven’t offset the bad days.

We’re in a worse place than where we started, similar to the stock market, which recovered some but not all of its losses.

Mortgage Rates Are Higher Than They Used to Be

One of the core “problems” with mortgage rates is that they go up faster than they go down.

The old adage is elevator up, stairs down. Lenders are happy to raise them for any given reason (or no reason at all), but hesitant to lower them, even if a good reason exists.

For stocks, it’s the opposite. Stairs up, elevator down. In other words, your portfolio value can plummet in a day, but take weeks to climb back up.

Such is life I suppose, but it’s pretty relevant today with what we’ve seen of mortgage rates lately.

While things have calmed down lately, the 30-year fixed is still higher than it used to be as recently as March.

For much of that month, the 30-year fixed was in the 6.70% range. For much of April, it has been hovering near 7% (or above).

Now we’re slowly (keyword) moving back to those lower levels, which is the point I’m trying to make.

Our so-called progress is merely a return to the very recent past, when things were better.

A tidy way to sum it up is one step forward, two steps back.

Bessent Says Mortgage Rates Are Lower

During a press briefing today at the White House, Treasury Secretary Scott Bessent spoke about President Trump’s first 100 days in offer.

He touched on prices and progress, saying, “Since January 20th, uh, interest rates, mortgage rates, are down.”

And added that, “We’re expecting the, uh, further decreases.”

He’s correct in that assertion, though if we’re honest, the 30-year fixed has only improved by about 0.25% since that time.

On a $400,000 loan, that’s a difference of roughly $67 per month. Hardly a lot to get excited about.

In addition, one could make the argument (I already did) that mortgage rates were lower before Trump entered office.

Look, it’s no secret that both Bessent and Trump have been focused on getting mortgage rates down.

Trump campaigned on it, and once Bessent came into the picture, he too has echoed that stance.

But lower mortgage rates have proved elusive, perhaps because of tariffs and a larger trade war, which have fueled uncertainty and big market selloffs, including bond selloffs.

There’s even been fears of foreign countries selling our mortgage-backed securities (MBS), which would lead to increased supply and higher rates.

But yes, this past week has been a nice reprieve, and perhaps things could get even better.

Unfortunately, the way these things tend to go, it might be yet another head fake, and another two steps back sometime soon.

So if you’re mortgage rate shopping, be ready for it. And don’t be surprised if/when it happens.

Mortgage Rates Went Up 37 Basis Points, Then Down 26 Basis Points

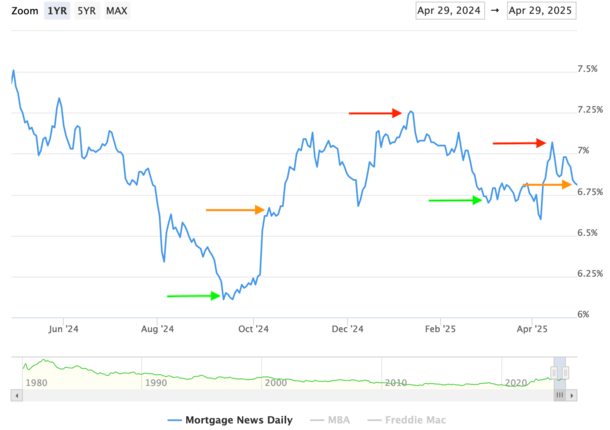

A simple way to look at it is by checking out this chart from Mortgage New Daily.

In March, the 30-year fixed was 6.70%. It had been steadily falling since the inauguration in late January, albeit by a relatively small amount.

Then the trade war rhetoric ratcheted up and rates went up with it. As noted, things seemed to cool down and rates came back down.

But all told, rates went up more than they went down. So we wound up in a worse place than where we started.

If you want to get even more critical, you could argue we are well above levels seen pre-election.

The green arrow last September was when mortgage rates were nearing 6%. Then they jumped on a strong jobs report in October, the orange arrow.

Then they kept climbing once Trump became the frontrunner to win the election, as many expected his policies to be inflationary in nature.

So sure, rates are lower today than the inauguration, but not by much. About a quarter of a percent.

And if you zoom out, they’re higher than they were pre-election. Unclear how much progress we’ve really made here.

Perhaps the one silver lining is they’re about 0.625% lower than they were a year ago, which arguably should boost home sales this spring.

But with all the uncertainty, that remains to be seen.

(photo: Quinn Comendant)