One year after

But there’s been enough interest in the product that

This year alone, account openings are up 60% versus 2023, said Ryan MacDonald, head of growth financial products in

“Some of that growth is driven by the fee waiver,” he said. “And some of it is driven by our efforts to get out into low- and moderate-income communities and into branches serving communities, and make sure there’s awareness of the [account] so customers can take advantage of it.”

Chase Secure Banking is part of a growing lineup of low-cost checking accounts that are certified by the Cities for Financial Empowerment Fund and known as “Bank On” accounts. Nationwide, 474 such products are available at banks and credit unions, up from just four in 2016, the CFE Fund said.

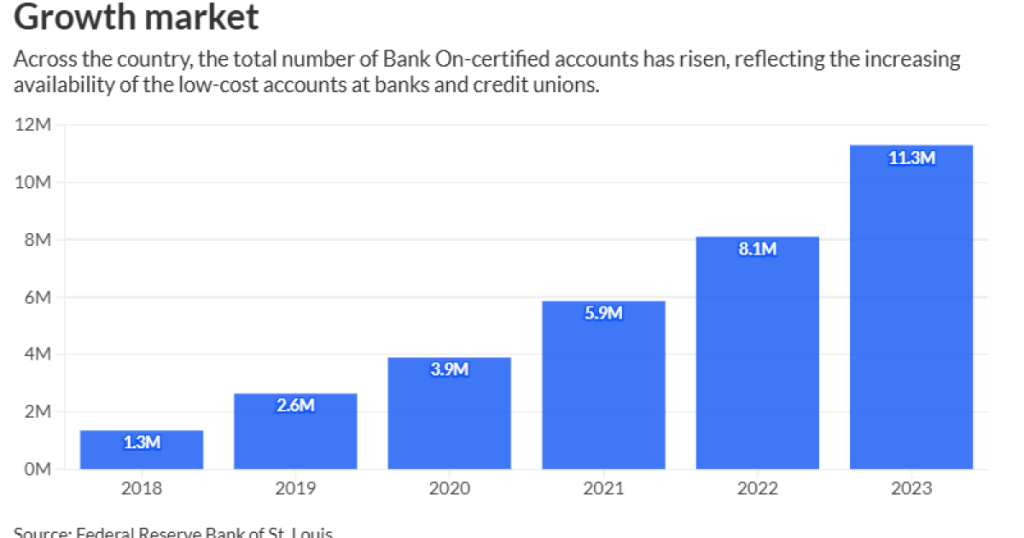

The accounts continue to become more popular. In 2023, there were nearly 11.3 million Bank On-certified accounts in operation, up from 8.1 million in 2022, according to a data hub maintained by the Federal Reserve Bank of St. Louis. Of the nearly 11.3 million accounts, 85% were opened by customers who were new to the bank or credit union, the data shows.

Eight years after the accounts were first rolled out, they appear to be helping to bring more people into the mainstream financial system. Industry experts and bankers say the increasing availability of Bank On accounts has been contributing to a decline in the percentage of unbanked households across the United States. That percentage

In 2011, the nationwide percentage of unbanked households was 8.2%, the highest level since the FDIC began conducting the biennial survey in 2009. Last year, it was 4.2%, the FDIC said.

“We do believe this option for low-cost accounts … is part of a solution set that contributes to the unbanked rate,” said Montrice Yakimov, the FDIC’s acting associate director of community affairs, a role that manages the agency’s economic inclusion and financial education programs.

The Bank On movement grew out of a one-year pilot project that the FDIC ran in 2011. The effort was a case study on the feasibility of

To get Bank On certification, an account must adhere to a set of standards, such as keeping the monthly fee to $5 or less, providing free bill pay and mobile banking service, ditching minimum balance requirements and refraining from imposing overdraft fees and certain other charges.

The number of financial institutions that offer Bank On-certified accounts rose steadily between 2016 and 2020. Then between 2020 and 2021, the number of account offerings available in the marketplace jumped from 53 to 190.The next year, it climbed again to 337, and by 2022 there were 438 such accounts being offered, the CFE Fund said.

The increase reflects three factors — consumers’ need to access federal stimulus payments distributed during the pandemic, which drove many unbanked and underbanked individuals to open low-cost checking accounts; mounting pressure by regulators and lawmakers on banks to reform their overdraft policies to become more consumer-friendly; and banks’ focus on developing partnerships with community organizations that work with unbanked and underbanked individuals.

“The Bank On movement has really blossomed, particularly over the past four years … in terms of the supply and availability of accounts as well as the way we’re connecting people to those accounts,” said David Rothstein, a senior principal at the CFE Fund. “They’re very popular.”

The American Bankers Association has called on all banks to create Bank On-certified accounts as a way to reduce the number of unbanked households and expand access to the financial system, Sarah Grano, a spokesperson for the trade group, said in an email. The ABA is also warning that a Federal Reserve

The Fed has not yet taken action on the proposal.

The SafeBalance product now represents nearly two-thirds of all new consumer banking accounts that are opened at

Part of the product’s success stems from the bank making sure that employees are trained in the product and know how to speak to the needs of the unbanked, Stephens said. It’s also about partnering with nonprofit organizations that are trusted by unbanked individuals, she said.

“We know that while you may not trust a financial institution, you may trust different nonprofits, especially nonprofits you receive services from,” Stephens said. “We saw people come in and cash a check and come in again, but still be hesitant about opening a bank account.”

“So we knew we needed more than one play in our playbook … to reach that audience,” she said.

“Out of the gate, it did really, really well,” he said. “We’re in the millions now with that account.”

A handful of banks and credit unions offer two Bank On-certified accounts. The list includes

As of October, the Bank On accounts represented about 6% of

Chris Powell, head of deposits and customer engagement at

He said the accounts are “core components” of the bank’s offerings and one of several reasons that the unbanked population has declined. Overall, the industry has “made a number of changes from an innovation perspective that have leaned into the needs of the customers,” including the elimination of overdraft fees and providing early access to paychecks, he said.

While Bank On accounts are helping to expand banking access, there is still lots of work to do.

The FDIC’s survey results show that the unbanked rates among some minority groups remain stubbornly higher than among white households. In 2023, the percentages of Black households, Latino households and American Indian or Alaska Native householders that were unbanked were 10.6%, 9.5% and 12.2%, respectively. The unbanked rate for white households that year was 1.2%.

The CFE Fund is focused on making improvements by targeting the “hardest to reach” populations, including people who are aging out of foster care, those with criminal justice histories and immigrants who don’t have proper identification or don’t trust banks, Rothstein said.

“I think our lofty goal, of course, is that this becomes a very vanilla product … that every financial institution offers in some capacity to their clientele,” he said.