Mortgage rates have been on a wild ride the past few years. In fact, it was still possible to obtain a 3% 30-year fixed mortgage in early 2022.

By late 2023, you may have faced an 8% mortgage rate. And today, your rate might start with a 5, 6, or a 7.

Volatility has reigned supreme as the Fed battles inflation and economic uncertainty makes it difficult to ascertain the longer-term direction of rates.

But one thing I’ve noticed is that rates tend to perform better during certain times of the year.

Namely in the winter months, which in the Northern Hemisphere include December, January, and February.

Winter Is a Historically Great Season for Mortgage Rates

Without getting overly technical here, winter runs from December 1st until the end of February.

It’s three months more or less, though if you want to get technical, there is an astronomical season and a meteorological season.

Anyway, I’ll keep it simple and focus on the months of December, January, and February. These are your core winter months, and also when it tends to be coldest.

While I don’t like being cold (as I reside in Southern California), winter isn’t all bad. In fact, there is actually a perk to winter when it comes to mortgage rates.

And possibly shopping for a home too.

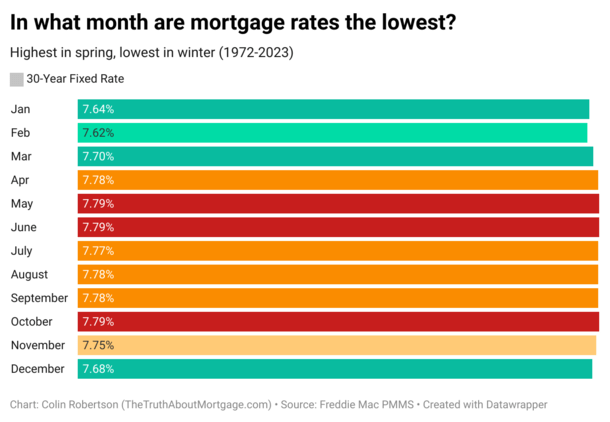

I crunched the numbers going back to 1972 and found that mortgage rates tend to be lowest in the winter months.

Using Freddie Mac’s Primary Mortgage Market Survey (PMMS), I compiled monthly averages to determine if any months stood out.

And lo and behold, February has been the best month for mortgage rates dating back 50 years.

Mortgage Rates Have Been Lowest in February on Average Going Back 50 Years

As you can see from my chart, which took a lot of time to create, the 30-year fixed has averaged 7.62% in the month of February going back to 1972, per Freddie Mac.

While that’s about one full percentage point higher than Freddie’s current weekly rate of 6.69%, it’s the best month on record.

The only better month has been January, with an average rate of 7.64%, followed by December at 7.68%.

So what does that tell us? Well, that winter is the best season for mortgage rates! In all the winter months, mortgage rates tend to be at their best, aka lowest.

To take advantage of this trend, you may want to refinance your mortgage during these months or even buy a home during these months.

While I’m not a big fan of timing the market, there are some obvious benefits that go beyond rates themselves.

There’s generally less competition if buying a home since it’s a quieter time of year, and fewer other customers if refinancing a mortgage.

This means you could snag a lower price on a home, or in the case of a refinance, get better customer service and quicker turn times.

Also, mortgage lenders tend to pass on more savings during slow periods. When they’re less busy, they need to drum up business so this might explain why rates are lower.

Spring and Summer Are the Worst Seasons for Mortgage Rates

Now we know that winter is typically the best season when it comes to mortgage rates. But what about the worst?

Once the weather starts heating up, mortgage rates tend to climb as well.

While March seems to be a decent month that straddles the end of winter and the beginning of spring, it gets worse from there.

The very worst months are May and June, and April is practically right there with them. This also happens to be when home shopping is in full swing.

So you get an unwelcome combination of the most competition from other home buyers and the highest mortgage rates (on average).

This kind of goes against buying a home in spring/early summer as sellers might be emboldened to stand firm on price. And lenders might not be willing to offer discounts or negotiate much.

Taken together, you’re looking at a possibly inflated home sales price and a higher mortgage rate.

The only real upside is that there might be more for-sale inventory to choose from, which can be a plus since it’s been slim pickings for years now.

Mortgage Rates Are Unpredictable and May Vary Regardless of the Season

One final note here. Just because mortgage rates tend to be lowest in winter doesn’t mean they always are.

The same is true of rates being higher in spring and summer. There have been and will be years when the opposite is true.

For example, the 30-year fixed began 2024 at around 6.60% and was as low as 6% in mid-September.

But in 2023, the 30-year bottomed at around 6% in February and peaked at nearly 8% in October.

So sometimes it’ll “work out” and sometimes it won’t. Pay attention to the bigger trends if you’re looking to track mortgage rates.

Right now, we appear to be moving lower as inflation cools and the economy looks shaky.

This means mortgage rates might continue to ease this month and next, and possibly hit those lows again in February 2025.

Just know that there will always be surprises (presidential inauguration anyone?), and good weeks and bad weeks along the way.